By Claire Boston, Katherine Chiglinsky and Sid Verma

(Bloomberg) --Company pensions are nearing a tipping point that’s poised to send them on a buying spree in the U.S. corporate bond market.

The retirement plans, helped by gains in stocks, are edging closer to digging themselves out of a hole they’ve been in for more than a decade, a shift that is cutting their demand for risky assets like equities and stoking their interest in more stable investments like company debt.

Companies on average have about 82 percent of the funding they expect to require for retirees’ pensions, compared with around 75 percent in the middle of last year, according to strategists at Morgan Stanley. Once pensions are around 80 percent funded, they tend to increase their bond holdings and cut their stock investments to lock in gains, Morgan Stanley analysts led by Adam Richmond wrote in a report on Friday. They funnel much of that money toward high-grade corporate debt, especially longer-dated bonds, to help fund their decades-long obligations.

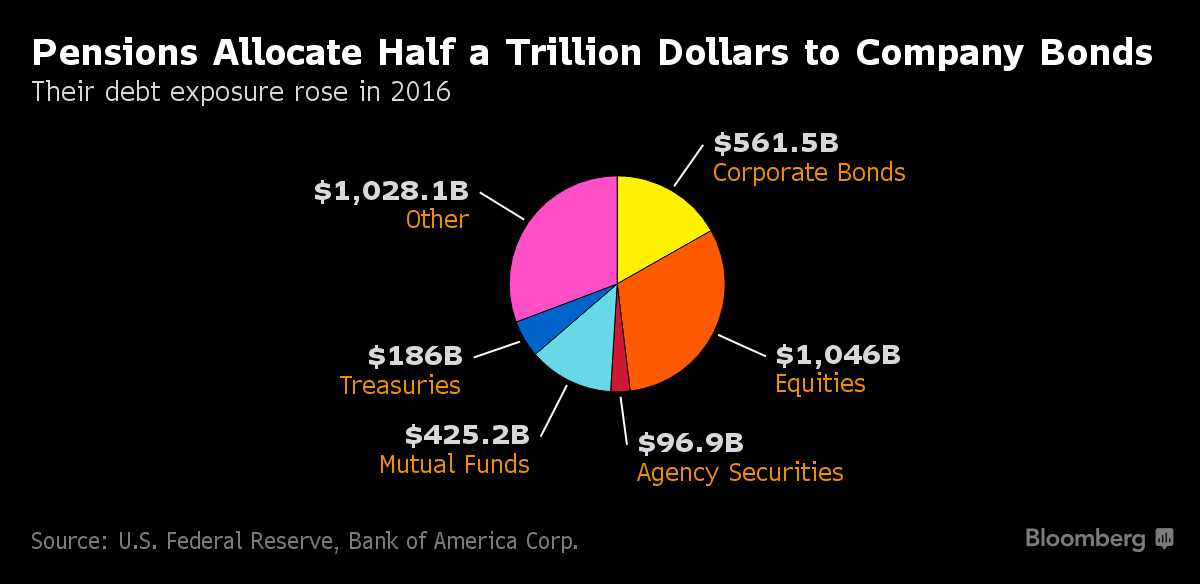

That trend is already happening and could now intensify, according to Morgan Stanley analysts. U.S. company pension funds own more than $1.8 trillion of assets, and even small changes to their allocations can lift already-high prices for bonds, and weigh on stocks.

‘Sweet Spot’

The biggest gainers may be corporate bonds maturing in around 30 years. Longer-term corporate bonds have risen 1.9 percent this year, including interest payments, compared with around 1.6 percent for the broader investment-grade universe, according to Bloomberg Barclays indexes.

“Pension funds’ sweet spot is out at the long end of the curve,” said Vincent Murray, who heads U.S. fixed income syndicate at Mizuho Securities USA in New York. Investors in some deals he’s worked on this year have placed orders for five times as much 30-year debt as was for sale, he said. “We’ve seen good demand.”

U.S. companies had overfunded pensions for most of the 1990s, but at the turn of the millennium lapsed into perennial underfunding as interest rates fell and stocks crashed. That trend may be reversing thanks in part to the surging U.S. equity market, which is up nearly 6 percent this year including dividends. Rising bond yields help as well, by lifting potential income from fixed-income investments and decreasing the accounting value of future obligations.

Some companies are also putting more money into their pension plans as the U.S. government charges more to backstop plans with big deficits. 3M Co., United Parcel Service Inc. and Honeywell International Inc. and others increased their allocations to corporate bonds last year, according to a report from Goldman Sachs Group Inc.’s asset management unit.

With smaller deficits, many pensions automatically pile into less volatile securities to reduce the chances of their losing ground again. The pension plans at 50 of the biggest U.S. publicly traded companies have been boosting their allocations to bonds and reducing their stock holdings for at least two years, according to Goldman Sachs Asset Management. These pensions held 44 percent of their assets in bonds last year compared with 35 percent in equities.

The investment shifts may end up helping companies in another way: by reducing their borrowing costs, as demand from pension funds cuts their yields. That’s a big deal in a year when the Federal Reserve is widely seen by market participants as likely to continue raising rates.

Bond prices have climbed recently amid steady demand from investors, who poured $2.71 billion into funds that buy investment-grade debt last week, according to data provider Lipper. Yields have held near historical lows, with the average Friday at 3.3 percent.

If equity markets keep gaining, pensions will probably cut even more risk and add corporate bonds, said Owais Rana, who heads a group that advises pensions at asset management firm Conning in Hartford, Connecticut. Non-public pension funds, including companies’, held around $562 billion of corporate bonds at the end of 2016, up from $551 billion a year earlier, according to U.S. Federal Reserve data.

“There’s going to be an improvement in funding levels if all the economic theories that we’re thinking about will come to fruition,” Rana said.

But even if stocks don’t rally much from here, some pensions may have other reasons to cut their equity allocations, including reducing the fluctuations in their returns and grabbing scarce long-duration, high-rated corporate bonds while they can, said Michael Moran, chief pension strategist at GSAM.

For long-term corporate bonds, it’s unlikely that new-issue supply will be able to meet demand in the near term. Until supply catches up, yields -- particularly on 30-year debt -- will likely sink, according to Hans Mikkelsen, head of high-grade credit strategy at Bank of America Corp.

“Pensions have a natural bias toward buying long-duration bonds,” Mikkelsen said. “The initial move is going to be lower long-term yields, and selling equities.”

To contact the reporters on this story: Claire Boston in New York at [email protected] ;Katherine Chiglinsky in New York at [email protected] ;Sid Verma in London at [email protected] To contact the editors responsible for this story: Nikolaj Gammeltoft at [email protected] ;Dan Kraut at [email protected] ;Samuel Potter at [email protected] Dan Wilchins