People are making a lot of noise about the bond market’s retreat after the July 20 range break.

What I hear is that it’s largely about speculation over the Bank of Japan’s upcoming meeting and the active discussion therein. This relates to Japan undershooting inflation targets and what the BoJ can and can’t do to spur it (presumably lower for longer) without doing harm. Included in that is the idea of raising their target on 10-Year Japanese Government Bond yields. You might argue that raising rates is rather unstimulative, but then easy policy hasn’t worked and has hurt banks.

It’s all speculation, and that speculation follows the price action I think more than leading it. This is to say, I suppose that Treasurys needed an excuse for the weakness on July 20, and so on a summer Friday when we had no data or Fedspeak, it was the thing people grasped because they had nothing much else to go on.

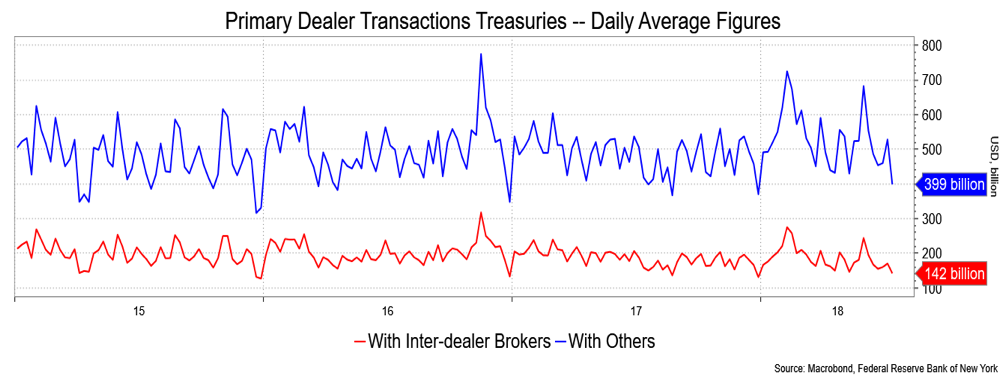

I’ll give an alternative. Positions were simply all leaning the same way, flattening curve plays, and with 10-Year Treasurys going sideways for a remarkable number of weeks (the range trading started on June 25), complacency set in until someone said, “ring the register” and on an illiquid summer Friday, bingo, we broke the range and pretty much hit the technical objectives of a broken sideways channel. I don’t think it’s more than that. Toss in some setup for supply and decidedly light trading volume (see chart below) and you have a rather technical story.

At the risk of sounding like an old, know-it-all, curmudgeon, I’ve been at this for a long time and I have a sense of when excuses come before the price action. I did a Google search on the matter—BoJ Speculation —and got over 250,000 results. That may not seem like a lot, but those came for just three days, which tells you how much the market was focused on it, and while I didn’t read all of them, I got enough of a sampling to say there was nothing concrete other than the debate is likely to go on. Maybe it’s a one-hit wonder, as the market didn’t extend very much the damage done on that July 20. Surely that says something.

I suppose that the wait for GDP also came into play as a reason to unwind trades, as 4 percent handle speculation was rife. Again, whatever the speculation was, the fact is many realized Q2 was getting ahead of tariffs, here and abroad, and boosted growth more than is likely to be repeated in the coming quarters. Then, of course, there’s the trade stuff, with an apparent truce and talk of lower to zero tariffs after President Trump’s meeting with President Juncker of the European Commission. I go with ECB President Draghi on this one, “it’s too early to assess the actual content.” In the meantime, we hear from a lot of companies (GM, Ford, Fiat and even Coke) that there’s a toll being taken.

Anyway, we’ve got some potential support coming with month-end extensions, then a wait for the BoJ and Non-Farm Payrolls and supply next week with larger auctions for 3s, 10s and 30s. The short-term technicals are oversold; I peg near-term support in 10s up near 2.98-3 percent. If the impending data is firm, well surely that reinvigorates flattening interest as it enhances Fed hiking prospects. I think we’ve seen the unwinds of flatteners for now and should err on the side of more sideways action into upcoming events. I’m a bit cautions over the subdued trading volumes and the potential for liquidity to exaggerate the action.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.