(Bloomberg) -- Private credit is going places that big banks wouldn’t dare.

In the race to win debt deals that fund leveraged buyouts, direct-lending firms are in discussions to deploy one of the more unusual tools of finance: allowing a company to pay interest by taking on additional debt.

It’s a rare structure for a big new buyout deal, which are normally financed by banks arranging high-yield bonds and leveraged loans and sold to institutional investors. For those watching the rapid growth of private credit, in which investment firms bypass banks by arranging loans directly, it highlights the degree to which the industry is able to combine heft and flexibility to upend how multibillion-dollar deals are traditionally put together.

Read more: As Wall Street Chokes on Bad Buyout Loans, Rivals Seize Opening

The payment-in-kind option for part of the loan, known as a PIK feature, is an arrangement being considered by private credit lenders including Apollo Global Management Inc., Blackstone Inc. and Oaktree Capital Management. The group is in competition with banks for the $5.5 billion debt backing the takeover of health-care technology firm Cotiviti Inc.

While it’s possible the PIK option won’t happen for this deal, their ability to quickly offer more appealing options, in this case a very borrower-friendly concession, is partly why private credit has been so successful in taking business away from Wall Street heavyweights.

To get caught up on the world of distressed credit, see The Brink newsletter

Banks, on the other hand, are in a weaker position. They have been saddled with deals they underwrote before credit markets tumbled last year. That’s left them struggling to offload the debt to institutional investors that became more bearish and made it more challenging to compete with terms being offered by private lenders.

US leveraged loan prices plunged to about 92 cents on the dollar last year, from near par at the start of 2022. Those prices started to rebound this year, and if that were to continue, it would ultimately allow banks to once again regain a competitive edge.

But for now, what was once their winning tactic — the ability to corral lots of investors in the market and put their balance sheet at risk — is now their disadvantage.

What to watch in the days ahead:

- Dealers surveyed by Bloomberg News are expecting around $35 billion of US investment-grade corporate bond sales in the coming week.

- In Europe, an overwhelming majority of those surveyed expect at least €25 billion of bond offerings, with sales planned by the European Union and BTP Italia, the government bond indexed to the Italian inflation rate and conceived for retail investors.

- Embattled conglomerate Adani Group is extending its worldwide roadshow as management seeks to reassure fixed-income investors that the company’s finances are under control. It will hold meetings March 7-15 in Dubai, London and the US.

- China’s annual national congress gathering kicks off Sunday. The 2023 growth forecast will be released then, coming at a time top officials are said to be pleasantly surprised by the post-Covid-Zero recovery. Potential further policy support for real estate is being closely watched, along with what President Xi Jinping said would be “deepening structural reform” in the financial sector.

- For an in-depth look at the data and events around the world that could impact market sentiment this week, see this on the Bloomberg terminal and choose a region.

Elsewhere:

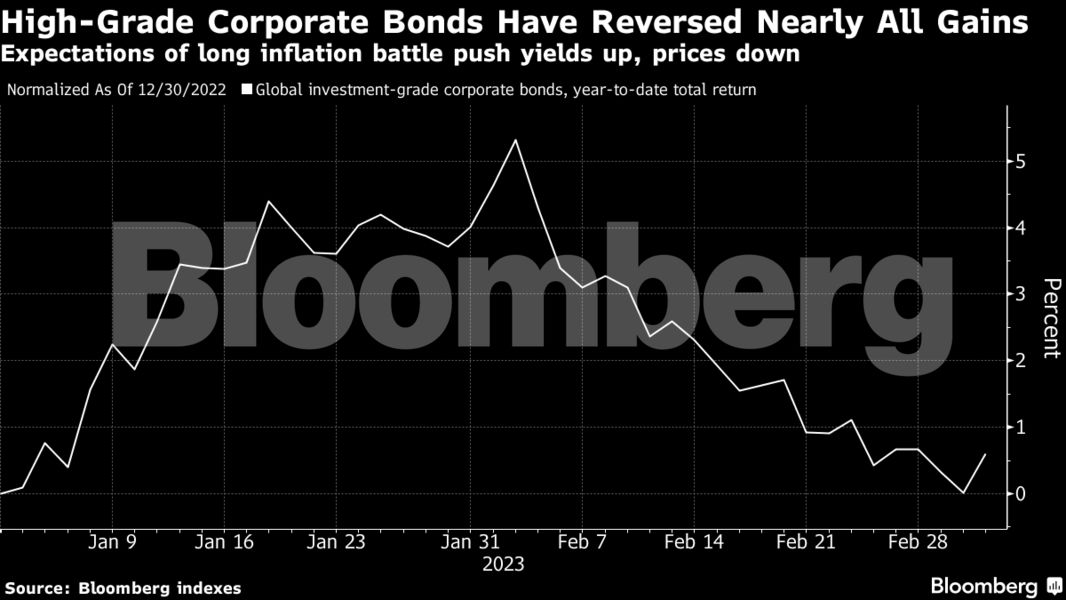

- Investment-grade corporate bonds have erased almost all of their 2023 gains as stubborn inflation data lead traders to reverse course on the timing of rate cuts by central banks. The total return for the debt globally is now just 0.6% since the start of the year following the worst February on record, according to Bloomberg indexes. It’s a remarkable turnaround for high-grade bonds, after a record jump in January.

- China Evergrande Group, has yet to reach an agreement with major creditors on a restructuring framework crucial to avoiding potential court-ordered asset liquidation, Alice Huang and Jackie Cai reported. For more on Evergrande’s restructuring efforts, see the latest Credit Edge podcast.

- China Fortune Land Development Co., the first of China’s big builders to default, is said to plan its first onshore-bond payments in a year under its domestic restructuring framework. And a unit of Shimao Group Holdings Ltd. wants until 2027 to pay off some yuan notes.

- Serone Capital Management has become the latest European hedge fund to liquidate a series of leveraged loans once destined to become a collateralized loan obligation under the management of PGIM Fixed Income. With diminishing chances of bundling the debt into CLOs profitably, at least in some cases, hedge funds are responding to a partial recovery in loan prices by selling off older warehouse lines of credit.

- Ares Management Corp. is planning to launch a private credit fund targeting wealthy individual investors in Europe, hoping to get a slice of an increasingly sought-after pool of capital in the alternative debt markets.

- Sotheby’s is pitching investors a first of its kind: a securitization of personal loans to the wealthy secured by their art collections, Carmen Arroyo and Charles Williams report. Discussions about the offering remain at the early stages but Sotheby’s expects to bring the asset-backed security to the market later in the year.

Five stories you may have missed:

- American Airlines Goes All-In on a $15 Billion Debt-Cutting Plan

- Bed Bath & Beyond’s Tanking Stock Puts Hedge Fund Rescue at Risk

- Japan Is Rare Leader in Asian Dollar Bond Sales Amid Surge

- Oaktree Says It Can Profit From Coming Private Credit Shake-Up

- DeSantis, Florida GOP Dismantle ESG Bond Ratings: Muni-Wise

--With assistance from Kevin Kingsbury, Yuling Yang, Bruce Douglas, Alice Huang, Jackie Cai, Carmen Arroyo, Charles Williams, Tasos Vossos, Josyana Joshua and Finbarr Flynn.

© 2023 Bloomberg L.P.