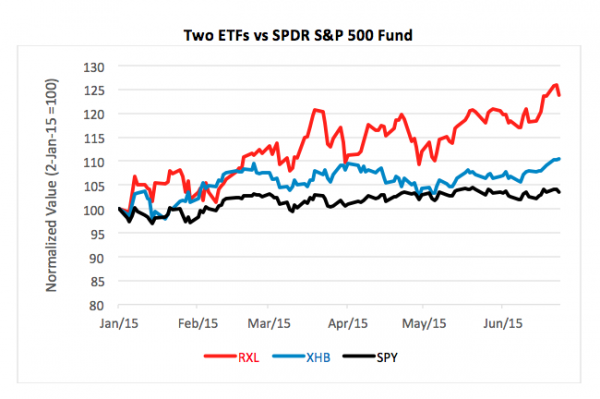

If I was looking for an ETF with the strongest technical pattern and good fundamentals (and I am, always), I’d be facing a dilemma now. Two funds look extremely attractive. So, if you’re looking for a portfolio overweight, bend an ear.

First, there’s the SPDR S&P Homebuilders ETF (NYSE Arca: XHB), a product that got some real play this week after the release of some very positive housing data.

XHB tracks the performance of three dozen stocks carved out of the S&P Total Markets Index. Equally weighted, these include constructors such as D.R. Horton, Inc. (NYSE: DHI) and Toll Brothers (NYSE: TOL) together with makers of HVAC components, windows, carpets and other products such as Lennox International, Inc. (NYSE: LII), Owens Corning (NYSE: OC) and Mohawk Industries, Inc. (NYSE: MHK).

XHB recently broke to the upside of a symmetrical triangle and is now churning above support at the $37 level. Technically, the fund’s setting up a run towards $55. Fundamentally, the fund’s propelled by greater demand as evidenced by this week’s housing starts data and a slip in inventory levels. Fears of impending interest rate hikes are also driving buyers into the market.

On the other side of the ledger is the ProShares Ultra Health Care ETF (NYSE Arca: RXL) which has jumped through the resistance line of a three-month ascending triangle.

RXL aims to deliver 200 percent of the daily return in the Dow Jones U.S. Health Care Index, a capitalization-weighted benchmark comprised of health care, pharma, insurance and biotech stocks such as Johnson & Johnson (NYSE:JNJ), Pfizer Inc. (NYSE: PFE), UnitedHealth Group Inc. (NYSE:UNH) and Medtronic plc. (NYSE:MDT).

Healthcare stocks have been outgunning the broader market for some time now as investors bet on the Affordable Care Act’s effect. What’s good for Obamacare, apparently, is good for JNJ. And now, the Supreme Court stamped its imprimatur on Obamacare, further validating investors’ wager.

Now working the $77 level, signs point to RXL reaching $101.

So, what’s it to be, a potential 49 percent gain in XHB or maybe a 29 percent uptick for RXL? To answer this, you may want to consider your risk tolerance. Year to date, you get a 1.76 Sharpe ratio with RXL versus 1.21 with XHB. Meaning? RXL, being leveraged, may be more volatile than XHB but the healthcare fund more than compensates with a two-fold return.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.