By Natasha Doff

(Bloomberg) --The chief investment officer of State Street Global Advisors is sounding the alarm bell on short volatility trades.

The billions of dollars backing bets that volatility in the stock market will keep sinking lower is “storing up trouble” for the future, according to Richard Lacaille, CIO of the $2.4 trillion asset manager. Investors will scramble to cover their short positions in the event of a rapid reversal, he said.

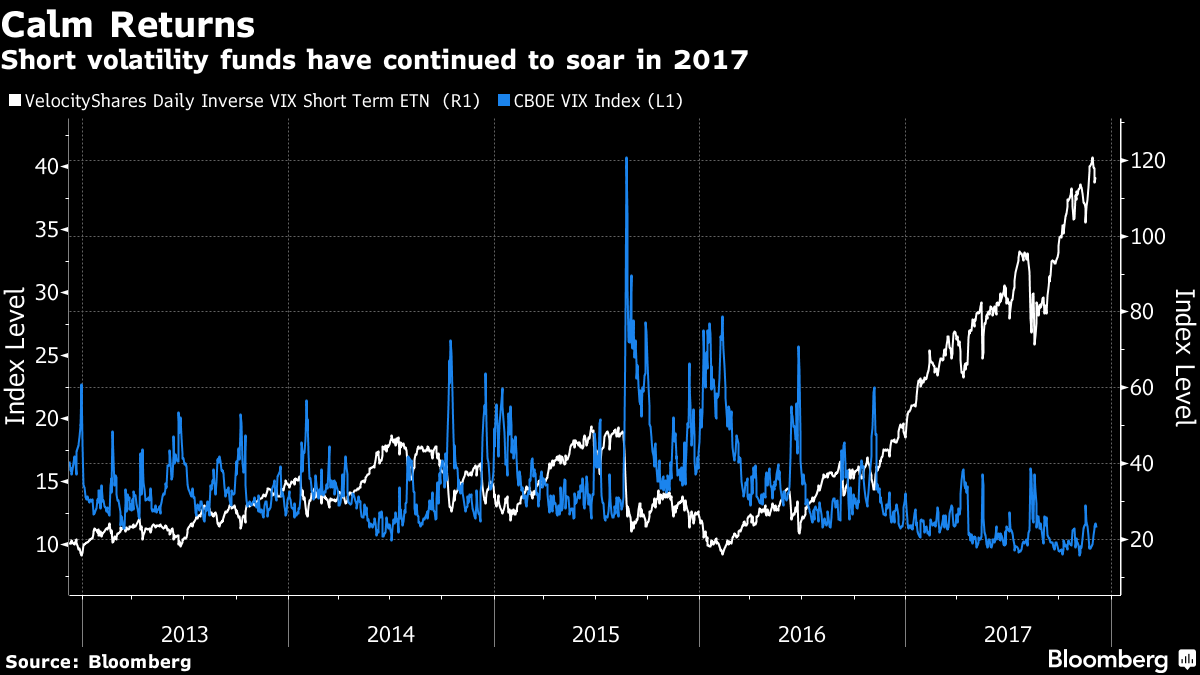

Even as the CBOE Volatility Index has plunged to its lowest level on record this year, investors have continued to pile money into exchange-traded products that short the gauge. With $2.6 billion in assets, short volatility exchange-traded funds are backed by the most cash on record, according to data compiled by Bloomberg.

“We all know that the VIX is at very low levels, but if you want to buy emergency-type insurance, that has remained relatively expensive,” Lacaille said in an interview with Bloomberg TV on Tuesday. “That’s a signal that investors may be concerned about a really left-tail event.”

It would take a “series of choppy moves” in U.S. stocks with an underlying narrative that something is changing for the worse in global markets to properly unwind the trade, Lacaille said. Only then will the full extent and volume of short trading become evident, he said.

To contact the reporter on this story: Natasha Doff in Moscow at [email protected] To contact the editors responsible for this story: Samuel Potter at [email protected] Cormac Mullen, Todd White