So, you wanna be a commodity bear? Well, there’s certainly good reason. This year, the equal-weighted Thomson Reuters-CRB Commodity Index has fallen 7.5 percent. Other commodity benchmarks, more heavily skewed to the energy sector, have slumped even more. The Bloomberg Commodity index, mirrored by the iPath Bloomberg Commodity Index Total Return ETN (NYSE Arca: DJP), for example, has slipped 13.2 percent. More dramatically, the iShares GSCI Commodity-Indexed Trust (NYSE Arca: GSG) and the PowerShares DB Commodity Index ETF (NYSE Arca: DBC) have skidded 27.2 percent and 23.4 percent, respectively.

Shorting the commodity sector has been made easy by the introduction of inverse exchange-traded products. Investors can choose between vanilla and leveraged exposure amid three broad-based ETPs:

PowerShares DB Commodity Short ETN (NYSE Arca: DDP) – Based on a total return version of the Deutsche Bank Liquid Commodity Index (DBLCI), this ETN provides inverse (1x) exposure to the daily weighted performance of wheat, corn, crude oil, heating oil, gold and aluminum. The underlying index is heavily tilted to energy (30.5 percent crude oil, 18.3 percent heating oil).

PowerShares DB Commodity Double Short ETN (NYSE Arca: DEE) – DEE is designed to deliver twice (2x) the daily inverse performance of the DBLCI.

ProShares UltraShort Bloomberg Commodity ETF (NYSE Arca: CMD) – CMD offers 2x inverse exposure to an index (formerly known as the Dow Jones-UBC Commodity Index), a benchmark of 22 physical commodities, weighed most heavily (31.7 percent) to energy.

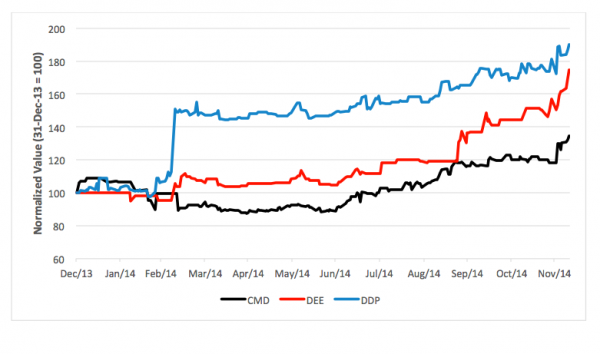

On the face of the offerings, you’d think the leveraged products (CMD and DEE) would have produced the biggest gains during the current commodity slump. You’d be wrong, though. Actually, the unlevered DDP note, with a 90.1 percent year-to-date gain, is the category champ. DEE has been playing catch-up and now claims a 74.8 percent return. CMD lags with a 34.5 percent advance.

The reason for the disparate returns? Volatility. Remember these ETPs promise to deliver multiples of their underlying indices’ daily returns. But here, volatility’s greater in the unlevered DPP note. About 150 percent greater, in fact, than the double inverse products.

The lesson to be learned? Check under the hood before buying your exposures.

Brad Zigler is former head of marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.