Is EVERYBODY at the beach? You’d think so by looking at the equity market. Lately, stocks have been churning to make up ground lost since the February break. And, while no new highs have been set by the widely followed benchmarks, some secondary indicators have summited and are now heading lower. Not that a lot of folks have noticed that.

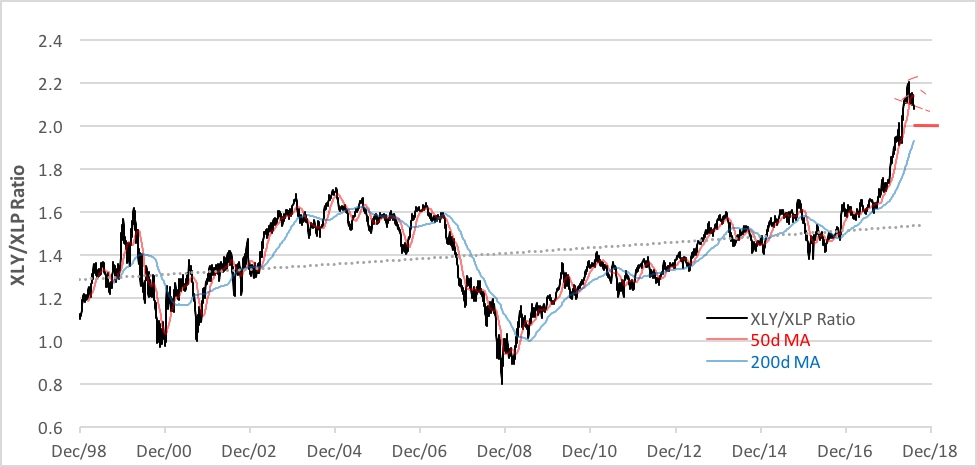

Back in May, we fretted over the seeming overreach of an investor confidence metric, the XLY/XLP ratio. Now, as we enter into August, the ratio’s heeled over, breaking below the neckline of a head-and-shoulders top formation.

What’s that mean? Just this: The shine of discretionary consumer goods has been dulled. Consumer staples—the more defensive issues—are leading now. Or losing less. Put more simply, investors now anticipate that consumers are likely to rein in their spending on durable and luxury goods. That’s a predicate for recession. At the very least, the ratio’s recent gains are due for some consolidation; retracement is long overdue. Take a look at the chart below to get a sense of the indicator’s near-vertical trajectory which led to today’s topping action.

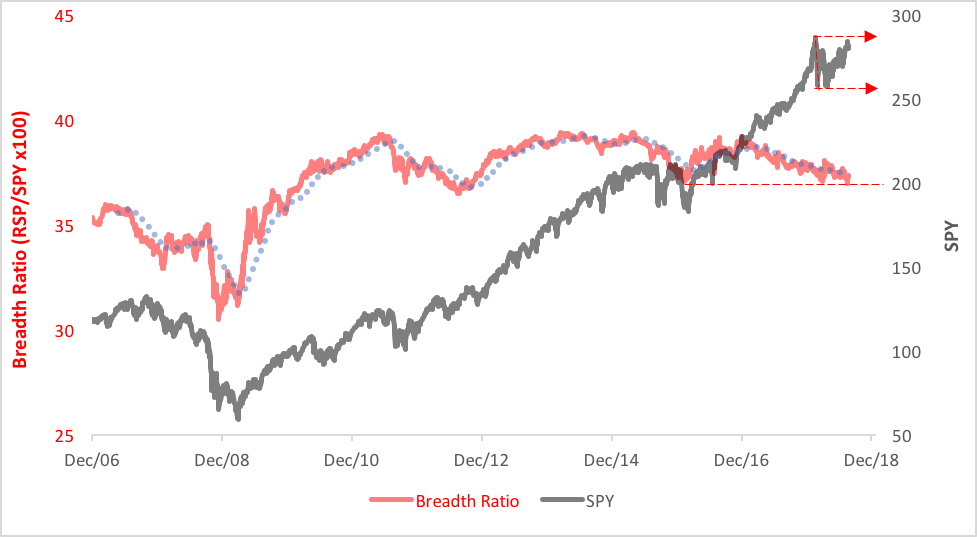

If this was just some routine summertime congestion, we wouldn’t be too concerned. What we’re seeing, however, is waning vigor in the market-leading large stocks. That’s worrisome. Our breadth ratio has been slipping and is now challenging the lows set in January 2016. Evidence of that can be seen in the chart below which contrasts the breadth ratio to the market-tracking SPDR S&P 500 ETF (NYSE Arca: SPY). Declining breadth typically accompanies or precedes bearish market phases.

In this environment, equity investors ought to be prepared for another volatility spike. Migration of some stock exposure to a low-volatility product might be a prudent tactic. We examined some large cap options in our Feb. 27 article including the Fidelity Low Volatility Factor ETF (NYSE Arca: FDLO), the SPDR SSgA U.S. Large Cap Low Volatility Index ETF (NYSE Arca: LGLV) and the Invesco S&P 500 Low Volatility ETF (NYSE Arca: SPLV). This year, FDLO’s methodology has proved most fruitful on an absolute and risk-adjusted return basis, though it’s not a pure low volatility tactic.

Now may be a good time for beachgoers to duck indoors for the consideration of a little portfolio reallocation while they await yet another one of those umbrella-festooned refreshments.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.