Index-based ETFs change more often than you think. In mid-December, the $550 billion automobile manufacturer Tesla will be added to the market-cap weighted S&P 500 Index and represent a likely 1.5% position in SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (IVV) and Vanguard S&P 500 ETF (VOO). Combined, these ETFs manage approximately $540 billion in assets and while annual turnover is just 3%, the impact for ETFs is notable. It is not yet known what stock TSLA is replacing, but it will likely come from the smallest in the S&P 500 Index, while the ETFs will trim exposure to others, including mega-caps Johnson & Johnson and Procter & Gamble, to make room in the portfolio.

Smart-beta ETFs incur higher turnover than market-cap weighted to stay true to their mandates. Unlike SPY, which makes few changes at seemingly random times, ETFs focused on lower volatility, quality and other smart-beta investment styles will be reconstituted on a set schedule during the year as the broader stock universe is re-run through screens pre-determined by the index provider. For example, Invesco S&P 500 Low Volatility ETF (SPLV) is reconstituted on a quarterly basis, most recently in late November, to own the approximately 100 least volatile stocks in the S&P 500 Index. SPLV has an annualized turnover of 49%, though unlike some mutual funds with a similar percentage of portfolio, the ETF is not expecting to pass along any capital gains in 2020.

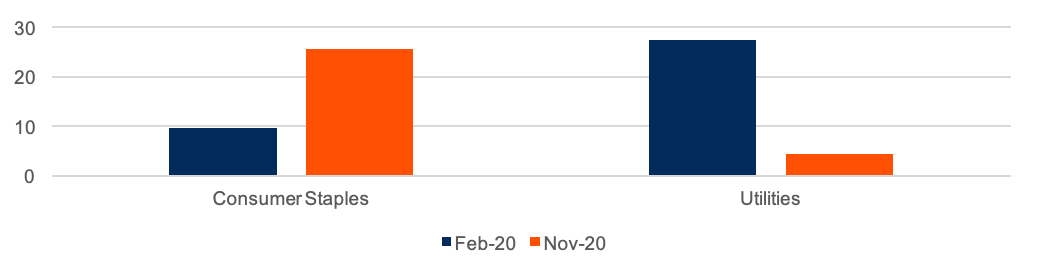

During the latest portfolio changes, SPLV modestly increased exposure to Consumer Staples (up to 26% of assets, from 24%) and reduced exposure to Utilities (4%, from 6%). However, the weightings in these sectors are sharply different than they were in February 2020, as shown in Chart 1.

Chart 1: Select Sector Weightings for SPLV (% of assets)

CFRA’s First Bridge ETF Database. As of November 23, 2020.

Following the February rebalancing of the SPLV, Utilities comprised 27% of assets and had by far the highest sector exposure , while Consumer Staples was 9.7% of the portfolio. SPLV is simply built by assessing what stocks in the broader index were historically the least volatile, without constraining representation. But adjusting on a quarterly basis, the portfolio currently consists of stocks that incurred the lowest recent volatility.

Eight stocks joined SPLV in November replacing more volatile securities. Phillip Morris International joined with fellow S&P 500 sector constituents General Mills, Kimberly Clark and Walmart in SPLV last month. Other names that were added to this smart-beta ETF included Ball, McDonalds and Waters.

These companies were some of the replacements for utilities Consolidated Edison and Public Service Enterprise Group. Currently there are just five utilities in SPLV, with Alliant Energy and American Electric Power among them. While Health Care is the second largest sector for SPLV (25% of assets), there were deletions last month here as Incyte and Quest Diagnostics were removed.

iShares Edge MSCI Min Vol USA (USMV) offers a different approach to lower risk investing. Although the ETFs sound the same and over the long run provide similar downside protection for equity investors, USMV and SPLV are constructed differently and hold many distinct securities. USMV is more diversified across the sectors than SPLV as it has bands preventing deviation by more than 500 basis points. USMV generally holds the least volatile stocks within a sector, while also incorporating optimizing tools to project the riskiness of the securities. USMV is reconstituted semi-annually, not quarterly, most recently at the end of November.

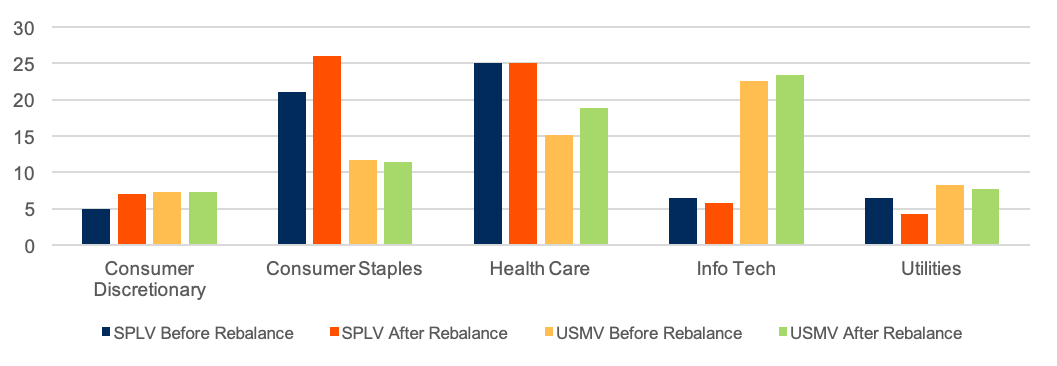

While USMV tends to have more exposure to defensive sectors than the broader U.S. equity market, it also has more exposure to growth-oriented sectors, such as Information Technology than SPLV. Following the changes made this week, this trend has continued, as shown in Chart 2.

Chart 2: Sector Exposure of Popular Lower Volatility ETFs (% of assets)

CFRA’s First Bridge ETF Database. November 30, 2020.

Information Technology (23% of assets) was the largest sector for USMV, following a fractional increase before the rebalance. In contrast, SPLV has just 5.8% in the sector, down from 6.5% just before it was adjusted. Meanwhile, USMV’s 11% stake in Consumer Staples was less than half the 26% for SPLV. Health Care was a hefty weighting for both ETFs, but USMV had 19%, less than SPLV’s 25%. Meanwhile, USMV had more Utilities exposure (7.7% vs 4.3%) than SPLV.

This week, USMV added Activision Blizzard and Electronic Arts to help boost the weighting to 9.2% of assets, up from 6.9%. They joined fellow attractively valued Communications Services companies Disney and T-Mobile US. Meanwhile, the removal of Exxon Mobil left USMV with just two small positions in the Energy sector. USMV had a recent turnover rate of 23%, which also reflects that stocks, such as Coca-Cola, were trimmed in November.

Keeping track of international equity smart-beta ETFs is doubly complicated. While investors in U.S. focused smart-beta ETFs want to be mindful of the sector exposures their funds provide, those owning an international equity focused fund need to also keep in mind that country weights can shift. WisdomTree International Quality Dividend Growth ETF (IQDG) combines two fundamental approaches—quality and dividend growth—which makes its annual reconstitution particularly interesting.

In November, the index behind IQDG significantly shifted toward Australia (an increase of nearly 700 basis points) and away from Spain (a decrease of more than 400 basis points). At the sector level, Materials jumped by more than 800 basis points to 20%, while Consumer Staples fell by approximately 450 basis points to 10%. BHP Group and Rio Tinto were added, while British American Tobacco and Diageo are examples of stocks that were removed. IQDG recently had a 39% turnover rate.

Conclusion

CFRA’s ETF star ratings combine holdings-level analysis with fund attributes. While we believe an ETF’s costs and performance record are worth understanding, we incorporate risk and reward analytics for each fund holding as we contend that future performance is driven in part by what is inside. IQDG, SPLV, and USMV earn favorable ratings based on their risk and reward potential in addition to a review of costs. Even as investors increasingly use index-based ETFs to support long-term goals, we think it is important to regularly review how a fund is positioned to realize the exposure it currently provides. Index-based ETFs can and do change throughout the year.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.