You’ve heard of herd immunity by now, right? Most advisors have. Or so it seems as they flood into the Treasury market in hopes of inoculating their clients’ portfolios from the current financial tumult. Amid this rush, it’s worth asking how much of a Treasury dosage is healthy. And of what tenure?

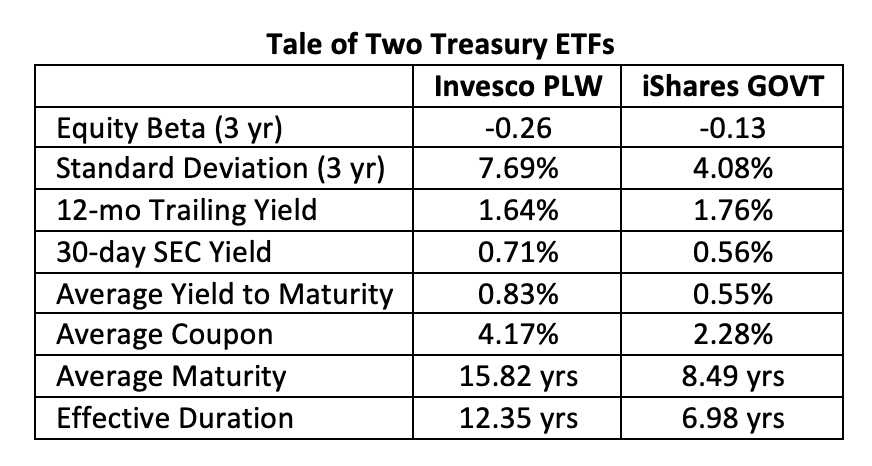

For many, the choice is daunting. There are myriad slices of the Treasury yield curve that can be accessed through exchange traded funds. Each ETF presents a unique risk/reward profile, leaving advisors to ponder the interplay of duration and convexity allocations, among other metrics. Luckily, there’s one-stop shopping available for the derivative-impaired. Two ETFs offer broad exposure to the entire Treasury spectrum, one market-weighted, the other equal-weighted. Though they ostensibly cover the same range of bonds and notes, each fund has its own distinct characteristics.

With its low volatility, you’d think the $16.7 billion iShares U.S. Treasury Bond ETF (Cboe BZX: GOVT) would be the perfect yin to stocks’ yang. GOVT tracks the ICE U.S. Treasury Core Bond Index, a market-weighted assortment of government securities with a remaining maturity of one year or more. Market-weighting sensitizes the portfolio, particularly to shorter maturities.

The Invesco 1-30 Laddered Treasury ETF (Nasdaq: PLW) takes a different tack. By weighting each year of the 30-year curve equally, the fund tilts heavily toward durations on the long end. Despite being older than GOVT, PLW has amassed only $172.8 million in assets. The fund tracks the Ryan/Nasdaq 1-30 Year Treasury Laddered Index.

Over the past week, investors and advisors have shown a decided taste for the equal-weighted Invesco fund. The inflow rate into PLW was 24 times that of GOVT as of Friday. It’s perhaps PLW’s characteristics that account for the attraction. PLW’s negative beta is twice that of GOVT and fits hand in glove with the Invesco fund’s longer duration. Seemingly, investors and advisors are looking for more bang for their bond bucks.

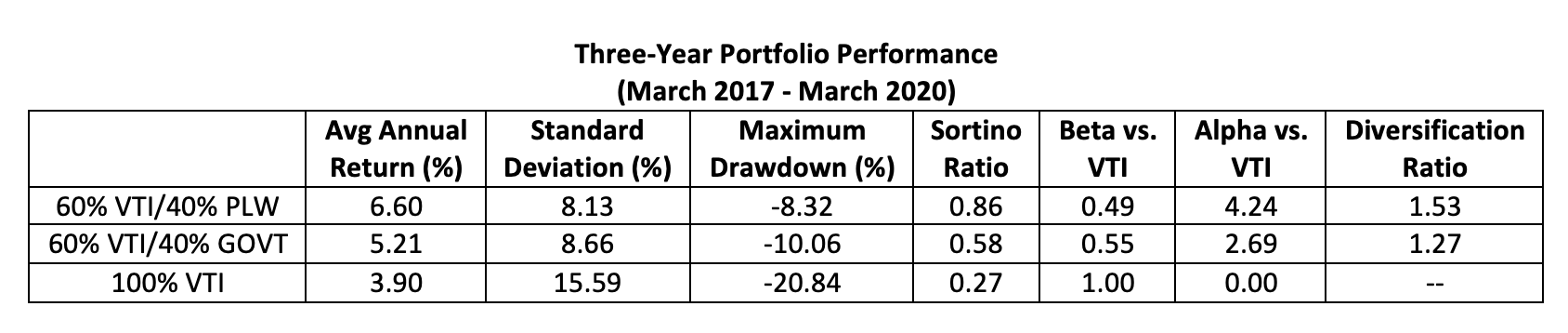

The stats above offer clues to the diversification benefit that can be expected of the ETFs. Constructing two classic 60/40 portfolios, each pairing total stock market exposure with one of our two ETFs, reveals just how loud each fund’s bang really is.

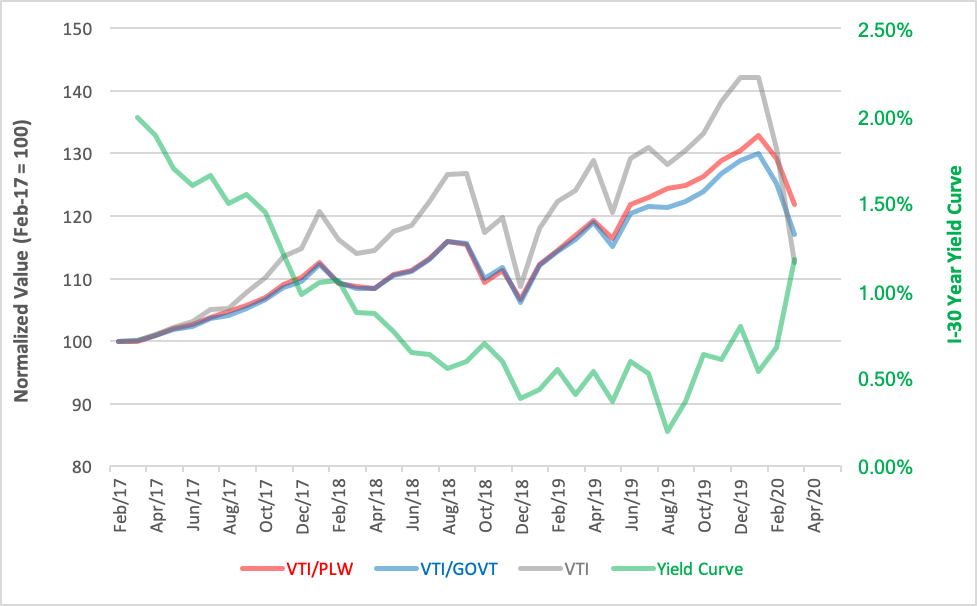

Taken alone, PLW may be the more volatile take on the Treasury yield curve, but it’s been the “right” kind of volatility to compensate for stock market gyrations represented by the Vanguard Total Stock Market ETF (NYSE Arca: VTI). By any measure, the portfolio built around the PLW fund has outperformed the GOVT-based asset mix. In general, the flattening of the yield curve benefited both portfolios but more so the one using the equal-weighted product. The PLW fund’s greater sensitivity to the long bond especially boosted its performance in the second half of 2019. All told, PLW offers 20% greater diversification than GOVT.

The question for portfolio builders going forward, of course, is whether this outperformance is likely to continue. Duration’s a double-edged sword. If yields on the right end of the curve are pushed up dramatically, PLW is likely to fare worse than GOVT. Advisors choosing PLW over GOVT to balance their portfolios will necessarily be speculating on the differential rate risk.

Brad Zigler is WealthManagement’s alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.