The latest volatility in the S&P 500 Index has been driven in part by the ongoing and often escalating trade tensions between the U.S. and China. But not all sectors or companies in the widely followed benchmark are similarly exposed to foreign markets. Research recently published by S&P Dow Jones Indices provides great insight that can help investors in sector ETFs make better informed decisions whether they believe the tensions are easing, and foreign market exposure will be a tailwind, or the risks might persist into 2020 creating headwinds.

The S&P 500 Index holds only U.S.-listed companies and is the benchmark behind the two largest ETFs, SPDR S&P 500 (SPY) and iShares Core S&P 500 (IVV), used by many investors as a core U.S. equity holding. Yet many of these large-cap companies have multinational operations, producing and/or selling products and services in various non-U.S. regions. According to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, the percentage of S&P 500 sales from foreign countries was 43% in 2018. This was down from 44% in 2017 and 48% in 2008, while trending lower for more than a decade.

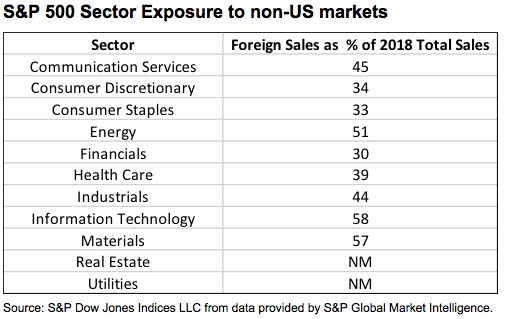

In many cases, companies do not break out what regions or countries these foreign sales stem from, creating a roadblock for more in-depth analysis. But Silverblatt notes that Asia (8.2%) and Europe (8.2%) were the two most represented continents, followed by Africa (3.8%). However, there’s a notable distinction between the 11 GICS sectors in their foreign exposure.

On one end are the relatively small S&P 500 Real Estate and Utilities sectors, tracked by Real Estate Select Sector SPDR (XLRE) and Utilities Select Sector SPDR (XLU), which have primarily domestic operations and insufficient foreign sales data, according to S&P Dow Jones. At the other end are Information Technology (58% in 2018, up from 57% in 2017), Materials (57%, up from 53%) and Energy (51%, down from 54%).

Technology Select Sector SPDR (XLK), Materials Select Sector SPDR (XLB) and Energy Select Sector SPDR (XLE) provide investment vehicles that track these non-U.S.-centric S&P 500 sectors. These are market-cap-weighted ETFs holding the heftiest stakes in the largest companies within a sector. In many cases, the largest companies have significantly high exposure to foreign sales.

For example, Exxon Mobil was the largest holding in XLE and recently represented a 23% weighting. The integrated oil & gas company derived 65% of 2018 sales from foreign revenues. Canada and Europe were two of the company’s largest regional markets.

Meanwhile, Apple was the second-largest holding in XLK, at 17% of assets. The technology hardware, storage & peripherals company generated 58% of 2018 sales from outside the U.S., with Europe and Asia the largest.

Within the Materials sector, Dupont de Nemours was the third-largest holding in XLB at 8% of recent assets. Africa was the largest region for the specialty chemicals company, which had incurred 65% of its 2018 sales from foreign markets.

While the Sector SPDR ETFs are the biggest and most frequently traded sector ETFs, investors can also gain exposure to the S&P 500 sectors with an equal-weighted suite offered by Invesco. For example, XOM was only a 3.5% weighting in Invesco S&P 500 Equal Weight Energy (RYE), while fellow ETF constituent Valero Energy was a slightly higher 3.8% position. The oil & gas refining & marketing company derived just 31% of sales from foreign markets, highlighting that not all stocks in a sector generate sales equally.

This thematic research was originally published on MarketScope Advisor https://www.cfraresearch.com/marketscope-advisor/ CFRA looks to continually improve the quality and delivery of our research. To ensure that you continue to receive this and other relevant content from CFRA, please submit your contact details here.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.