S&P 500 constituents continued to pass along higher dividends to shareholders in the first half of the year – even as buybacks, another strategy corporations use to return equity to shareholders, slipped. Given the broad representation of these higher payers in cyclical and defensive sectors, dividend-yielding ETFs are worth a closer look given their diversification benefits.

In the first half of 2019, there were 195 dividend increases made by S&P 500 companies and just five decreases. This follows 356 and 380 increases in 2017 and 2018, according to Howard Silverblatt, an index analyst at S&P Dow Jones Indices.In the second quarter of 2019, the median dividend increase was 8.0%, slightly ahead of the 7.9% in the first quarter of this year, but behind the 10.0% growth in 2018.

In June, health care company Medtronic raised its quarterly dividend 8% to $0.74 per share. CFRA forecasts earnings per share (EPS) to increase to $5.49 and $6.00 in FY 2020 (Apr.) and FY 2021, which allows ample financial flexibility. MDT has paid a dividend since 1977 and is a member of the S&P 500 Dividend Aristocrats, a group of companies that have raised their dividends for more than 25 consecutive years.

In the first half of 2019, 30 of the 57 S&P 500 Dividend Aristocrats raised their dividends, while none decreased or suspended the dividend. Once companies have established a strong record of dividend increases, investors come to expect them.

Target is a fellow S&P 500 Dividend Aristocrat that increased its dividend in June, though at a lower growth rate (3.1%). The consumer discretionary company now pays a $2.64 per share annual dividend to its shareholders, continuing a string of returning cash to shareholders dating back to 1965.

In May, consumer staples company Clorox hiked its dividend 10% to $4.24 per share, extending its annual dividend-increasing record since 1968. CFRA forecasts the household products company to generate EPS of $6.30 in 2019 and $6.69 in2020.

In February, T Rowe Price boosted its dividend 8.6% to $3.04 per share. CFRA expects the Financials sector company to generate EPS of $7.40 in 2019 and $7.95 in 2020 and views the stock as attractive.

February was also when CenturyLink slashed its dividend by more than half to $1.00 per share, despite paying dividends since 1974. The sharp reduction by the Communications Services firm was a reminder that dividends, unlike diamonds, are not forever.

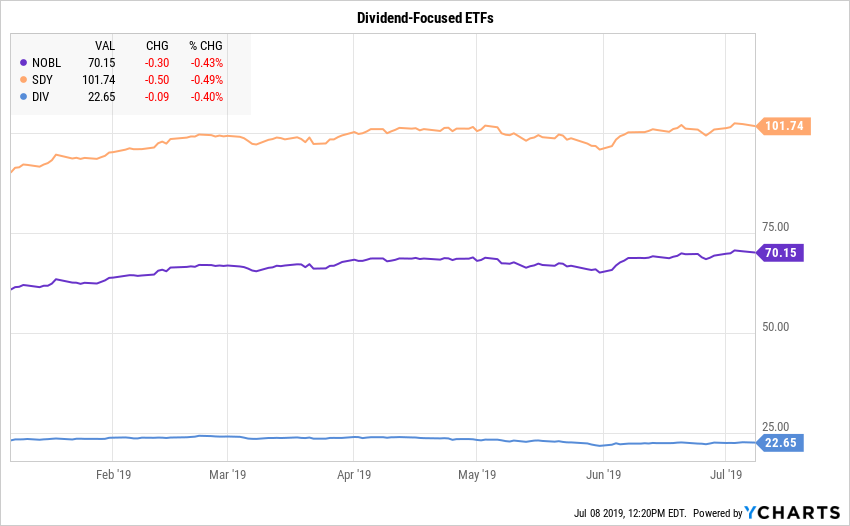

At the end of June 2019, there were $184 billion invested in divident-focused ETFs, aided by $4.8 billion of net inflows in the second quarter.

CLX, MDT, TGT and TROW are all part of the $5 billion ProShares S&P 500 Dividend Aristocrats Index ETF (NOBL). Consumer Staples (23% of assets) and Industrials (21%) are the largest sectors in the ETF, but Financials (13%), Health Care (11%), Materials (11%) and Consumer Discretionary (10%) are also well represented. CFRA’s positive rating on NOBL stems from its low risk considerations and modest costs, including its 0.35% expense ratio and tight bid/ask spread.

The $19 billion SPDR S&P Dividend ETF (SDY) holds some of the same stocks as NOBL but also includes small- and mid-cap companies that are part of the S&P 1500 Index and that have raised their dividends for 20 consecutive years. These include MDU Resources and Telephone & Data Systems. At the sector level, low-risk SDY has less exposure to Industrials (17%) and Health Care (7%) than NOBL, but more to Utilities (10% vs. 2%) and Communications Services (5% vs. 2%).

While NOBL and SDY focus on companies that have a long record of dividend increases, Global X Super Dividend US (DIV) invests in the 50 highest-dividend-yielding securities in the U.S. These include Amerigas Partners and Coty. While DIV’s 7.4% dividend yield is much higher than its peers, CFRA finds the ETF to incur additional earnings and dividend consistency risk.

This thematic research was originally published on MarketScope Advisor https://www.cfraresearch.com/marketscope-advisor/ CFRA looks to continually improve the quality and delivery of our research. To ensure that you continue to receive this and other relevant content from CFRA, please submit your contact details here.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.