If you look over the sector landscape for the best performance in April, energy exchange trade funds should immediately stand out. The $17.4 billion Energy Select Sector SPDR (NYSE Arca: XLE) gained a not-too-shabby 11.7 percent last month but it was the outsized performance of three smaller energy portfolios that grabbed me by my lapels.

Like STP, the famous gasoline additive, there’s something extra—or at least different—in these three portfolios that boosted their performance in April.

We know STP is made from jet fuel but what’s the juice in these ETFs that made them outdo the bigger funds?

First things first. Which funds are we talking about? Just these:

- The PowerShares DWA Energy Momentum Portfolio (Nasdaq: PXI), as its moniker implies, follows a momentum-based strategy in its 42-stock portfolio. Here, momentum means the fund’s index methodology looks for stocks with relative strength measured against the Nasdaq universe. This portfolio has a decided small-cap tilt. In April, PXI gained 15.5 percent.

- Smaller-cap stock performance is also writ large in the PowerShares S&P 500 Equal Energy Portfolio (NYSE Arca: RYE), a 31-issue index tracker that climbed 14 percent last month. At last look, RYE had $253 million in assets under management.

- Not one to be left alone, the First Trust Energy AlphaDEX Fund (NYSE Arca: FXN) also plays up smaller stocks through its quantitatively tiered weighting scheme. This $91 million portfolio owns 46 issues and appreciated 13.9 percent in April.

Even with this cursory introduction, you should be able to see the performance booster in these three funds. Or, rather, you can see what’s not. It’s not market-cap weighting. All three ETFs use alternative weighting schemes that allow smaller stocks, such as drilling and exploration outfits, greater expression.

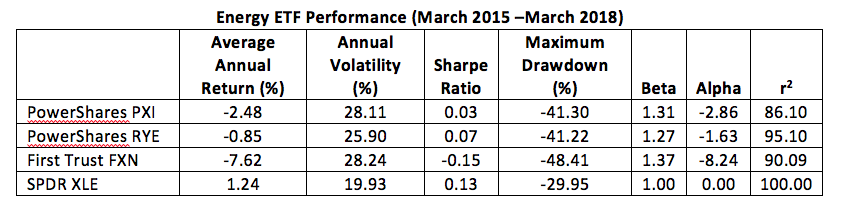

That worked last month, but what about the longer term? If we trace back three years, the alternatively weighted ETFs all fared poorly against the cap-weighted XLE portfolio.

Of course, the energy sector was less exuberant back then, wasn’t it? So maybe our performance additive only works when there’s a market tailwind. One thing’s certain from the table above: These ETFs are volatile.

Bottom line? If you’re looking for leveraged performance in the energy sector without actually using leverage, consider the alternatively weighted ETFs, but be prepared to bail from them if the sector begins to flag. And be prepared for a bumpy ride.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.