It’s been a wild ride in the bond market since the People’s Bank of China decided to weaken the yuan renminbi. To be more accurate, bonds have actually been on the rise for the past month amid concerns of a slowdown in the Chinese economy. It’s just that last week’s devaluation put a capstone, some would say, on safe haven buying of US Treasury debt. At least in the near term.

What motivates such thoughts?

Cycles, that’s what. Sometimes markets go up and sometimes they go down. At a certain point, uptrends and downtrends become exhausted and reverse, even if it’s just to regroup before continuing.

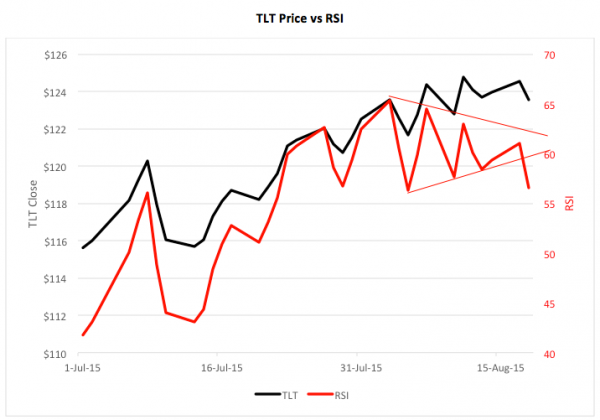

From that perspective, you could say it’s time for bonds to roll over. You can see this being signaled in the recent price action of the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT), an index tracker that’s been around since 2002. Since July, TLT’s share price has climbed nearly seven percent to the $123-$124 level.

Over that period, the ETF’s Relative Strength Index (RSI) reading pretty much mimicked its price. RSI measures the speed and degree of price movements, oscillating between 0 and 100. In early August, RSI started diverging from TLT, meaning the ETF’s new price highs weren’t matched by the oscillator.

RSI’s wedge pattern was broken to the downside on August 18. This wasn’t the strongest of bearish signals, though. It would be more compelling if RSI had risen to overbought territory at the 70 level before breaking down.

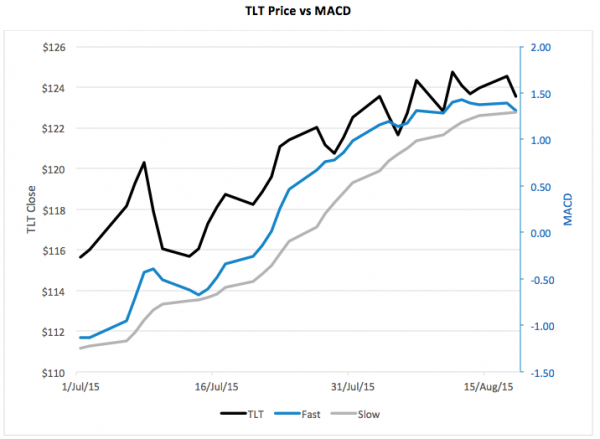

You could dismiss the signal if it wasn’t for developments in the Moving Average Convergence Divergence (MACD) indicator. MACD is momentum indicator based on wobbles in fast and slow moving averages. Crossovers of the fast average over or under the slower average serve as potential buy or sell signals. As of the 18th, the fast signal line had closed in on the slow line. It didn’t cross below it, it just got closer than it’s ever been since July. You could say MACD is poised to turn bearish.

All this, it should be noted, is taking place in a low-volume environment. There’s not a whole lot of conviction on either side of the bond trade nowadays. Still, if you’re looking for a selling spot, one seems to be just ahead.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.