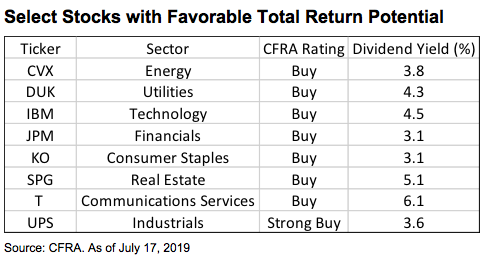

With the yield on the 10-year Treasury bond hovering around 2%, investors continue to search for higher income streams, including income from equities. CFRA has Strong Buy or Buy recommendations on 94 U.S. stocks that sport a dividend yield of 3% or higher. Given the sector diversity found on the list, high-dividend ETFs could be appealing part of a client's income-producing portfolio.

The $4.8 billion of net inflows in the second quarter received by dividend ETFs was higher than any other smart beta style and more than $600 million of new money has poured in so far this month. CFRA previously published a thematic research article titled “S&P 500 Dividend Growth in the First Half” that highlighted ETFs that invest in companies with long records of raising dividends. In this follow-up, we’re focusing on funds that are constructed based on their yield, which provides a lower-risk approach. If the market volatility picks up, due to shifts in earnings or other trends, these ETFs will likely provide further downside support due to their exposure to stocks with favorable potential total return traits.

According to Lindsey Bell, Investment Strategist at CFRA, second-half 2019 earnings growth estimates have been reduced since early June, but likely have further to go. As of July 17, third- and fourth-quarter EPS projections for the S&P 500 index declined approximately 160 basis points, but Bell thinks these do not fully reflect the slowing global economic concerns due to trade tensions and tariffs.

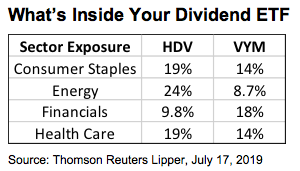

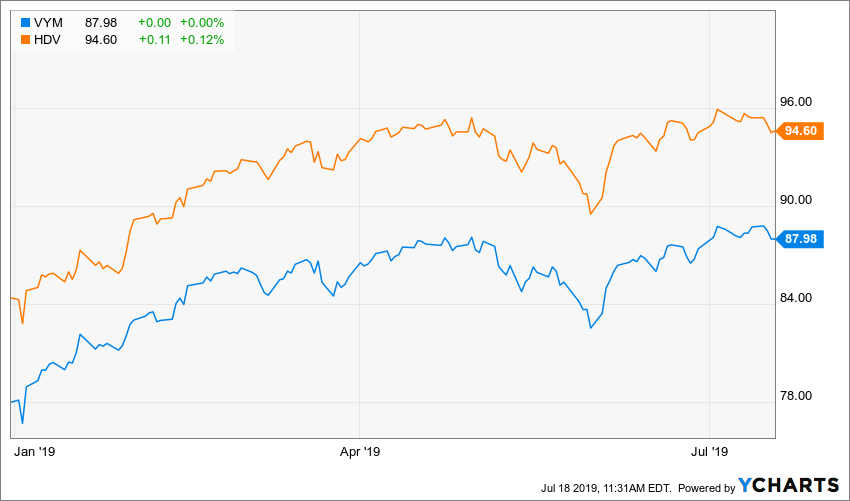

Vanguard High Dividend Yield (VYM) is a $25 billion ETF constructed based on a company’s forecasted annual dividends but is market-cap weighted. From a sector basis, the ETF is dominated by Financials (18% of assets), Consumer Staples (14%) and Health Care (14%). VYM’s top-10 holdings comprise 27% of recent assets, with six of them CFRA Strong Buy or Buy recommendations. These include JPMorgan Chase, Merck and Procter & Gamble. The ETF sports an appealing 3.1% yield and incurs a modest 0.06% expense ratio.

iShares Core High Dividend (HDV) is a $7.4 billion dividend fund. HDV has a 3.3% dividend yield and is also relatively cheap with a 0.08% expense ratio. However, our research showcases that the portfolio is different than VYM’s due in part to the addition of screens for financial health and a weighting based on dividends.

HDV’s top-10 holdings comprise 59% of recent assets, with Exxon Mobil and Johnson & Johnson, the two largest representing 17% together. While those are CFRA Hold recommendations, Chevron and Coca-Cola are examples of some of the CFRA Buy recommendations investors will find inside. At the sector level, Energy (24%), Consumer Staples (19%) and Health Care (19%) were the largest, with just 9.8% in Financials, considerably lower than VYM.

Though CFRA does not believe investors should choose an ETF based on its past performance, we note that VYM’s 9.8% three-year annualized total return as of July 16, ahead of HDV’s 7.9%, is a reminder that holdings drive returns. Our ratings employ holdings-level analysis and fund attributes including expense ratio and trading costs.

Join Lindsey Bell and I on July 23 for an upcoming webinar for CFRA’s latest views on the economy, earnings season and the markets. A discussion of some of CFRA’s favored stocks and smart-beta ETFs will also be discussed. https://go.cfraresearch.com/Summertime-Blues

To learn more about CFRA visit https://www.cfraresearch.com/marketscope-advisor/

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.