Non-charitable purpose (NCP) trusts are one of the most overlooked vehicles for estate-planning purposes. These trusts can provide a helpful supplement to a grantor’s estate planning to protect, in perpetuity, assets near and dear to the family.

Trusts are, generally, required to have human beneficiaries, with the exception of charitable trusts and NCP trusts.1 Usually, without any beneficiaries, there’s no one to enforce the trust. However, all charitable trusts have a purpose that’s often enforced by a state attorney general. Many offshore,2 as well as domestic,3 trust jurisdictions have enacted legislation providing for enforcement and other key provisions, thus validating NCP trusts. Many of the domestic NCP trust statutes have developed quite extensively over the last few years so as to provide a great onshore option for settlors desiring to avoid all the negatives associated with a U.S. citizen establishing an offshore trust.4

Common Purposes

Some of the common purposes for establishing an NCP trust are:

•Pet care (including offspring);5

•Maintenance of grave sites (honorary trusts). Also, support of religious gravesite ceremonies;

•Maintenance of family property (for example, antiques, cars, jewelry and memorabilia);

•Maintenance of an art collection;

•Maintenance of family homes (residence and vacation);

•Long-term maintenance of building, property or land;

•Maintenance of business interests;

•Royalties;

•Digital asset protection;

•To provide for a philanthropic purpose not qualifying for a charitable deduction; and

•Maintenance of private family trust companies.6

Not every state allows the establishment of NCP trusts; however, many states have some form of statute.7 Many states with NCP trust statutes only allow for pet trusts and/or honorary trusts.8 Other states (Delaware, New Hampshire, South Dakota and Wyoming) allow NCP trusts for most broad lawful purposes,9 in addition to providing for pets and honorary purposes.

Key Features

The key features of an NCP trust are:10

1. Statement of a valid purpose (the purpose can’t be against public policy and must be reasonable and attainable);

2. No requirement to appoint any beneficiaries;

3. Capable of being enforced by an enforcer and/or trust protector;

4. Appointment of a trust protector who can reform or modify the trust;

5. Appointment of a trustee in a trust situs with an appropriate NCP trust statute properly administering the trust for the desired purpose; and

6. A duration or term (generally, the range is a 21 year to unlimited/perpetual duration); varies based on state statute and trust situs.

Enforcer’s Responsibility

The responsibility of the enforcer of an NCP trust is to ensure that the trust’s purpose is carried out and that the trustee performs its duties. The enforcer generally has authority to seek court action, if necessary. It doesn’t usually have powers to change trust situs, add or delete beneficiaries or reform or modify the trust. Those powers are often reserved for the trust protector.11

Trust Protector’s Role

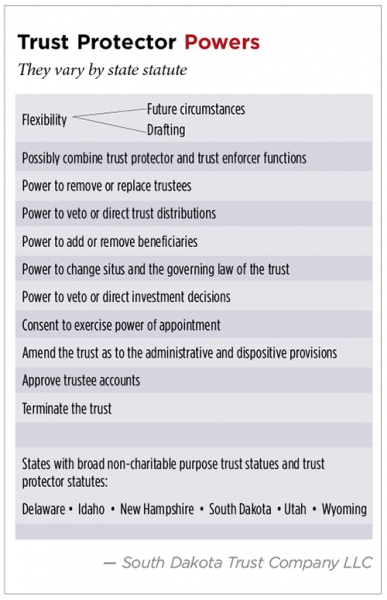

A trust protector’s role in an NCP trust is extremely important due to the possible future need to modify the trust over the term of the purpose.12 Most of the boutique trust states also have trust protector statutes.13 It may be necessary to modify the trust when the purpose has ended, at which point the trust may convert to a beneficiary trust. Another possibility is to combine both a trust protector and an enforcer as one position within the trust.14 Additional trust protector powers outlined in the statutes may also be helpful, for example, powers to change trust situs or add beneficiaries so distributions can be made once the purpose has ended.15 (See “Trust Protector Powers,” this page.)

If an NCP trust is established to maintain a family asset and the family uses that asset and indirectly benefits from the trust, the family likely wouldn’t be considered beneficiaries and, consequently, wouldn’t have any enforcement rights. This role would be the enforcer’s and/or trust protector’s. The family members may also be designated as remainder persons within the trust when the purpose of the trust has ended. The trust protector also generally has the power to add beneficiaries when the purpose has ended. These provisions won’t taint an NCP trust sitused in a jurisdiction with a supporting statute.16

Term and Duration

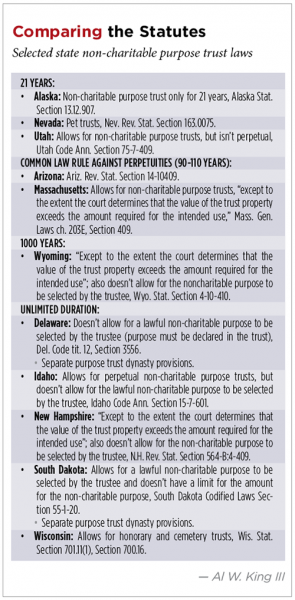

The NCP trust term and duration is another very important consideration in selecting a trust situs. Most states typically limit the duration of an NCP trust to a term of 21 years.17 Alternatively, some states allow for longer terms, and a few states allow for a dynasty NCP trust (that is, the purpose trust has no restriction or a very long-term restriction as to length of time it can be in existence) with either a long-term or an unlimited duration rule against perpetuities (RAP) statute.18 Consequently, the grantor’s intent to provide trust funds for the specific purpose can be carried out for as a long as desired. Delaware and South Dakota are unique in that they not only have unlimited duration RAP statutes for beneficiary trusts, but also they’re the only two states that have separate unlimited duration RAP statutes for NCP trusts.19 Many advisors maintain that a separate RAP statute is needed for NCP trusts due to their uniqueness as trusts without beneficiaries.20

As previously mentioned, when evaluating the term and duration considerations of an NCP trust, it’s important that the term of the trust last long enough to accomplish the purpose. For example, many states have 21-year pet purpose trust statutes to care for a pet; consequently, the trust will end after 21 years.21 This term generally works for a dog or cat, but the average lives of many species are beyond 21 years. For example, horses live 25 to 30 years, macaws live 35 to 60 years and tortoises live about 100 years.22 Consequently, if the trust is required to end after 21 years, the purpose to care for the animal during its lifetime can’t be served. Thus, you need to choose a trust situs allowing for a longer term. Some states have statutes based on the life of the pet and others have extended the 21-year statute to the actual life of the pet, if longer than the 21 years.23 However, if the client is interested in freezing a pet (cryogenic suspension), then he should choose a long term or an unlimited NCP trust statute in the appropriate trust situs, allowing adequate time to find a cure for what caused the pet to die and bring the pet back to life.24 This consideration also applies to humans who are interested in cryogenic suspension, because if their trust isn’t there when they thaw out, it could pose a problem.25 Both the Uniform Trust Code and the Uniform Probate Code allow for a 21-year NCP trust, which may not be long enough to serve the settlor’s desired purpose.26 A few jurisdictions allow NCP trusts for terms longer than 21 years, and at least 10 states allow for dynasty NCP trusts.27 Additionally, the statutes differ in dynasty NCP jurisdictions. Delaware, New Hampshire, South Dakota and Wyoming have more expansive NCP trust statutes providing for broader purposes, as previously discussed.28 Additionally, these jurisdictions have many other powerful trust, asset protection and income tax statutes to support their top-rated purpose trust statutes.29 Alaska and Nevada both have more limited versions of NCP trust statutes (Alaska, 21 years and Nevada, only pets).30

NCP trusts are usually completed gift dynasty trusts excluded from the estate31 and drafted either as grantor or non-grantor trusts.32 Another option is for the NCP trust to be revocable during the grantor’s lifetime.33 A revocable NCP trust could have dynasty provisions awaiting a pour over from the grantor’s will or another trust. This flexibility can be invaluable. (See “Comparing the Statutes,” p. 14.)

Endnotes

1. Charles E. Rounds, Jr. and Charles E. Rounds, III, Loring and Rounds: A Trustee’s Handbook Section 9.27 (2015); Alexander A. Bove, Jr., “Rise of the Purpose Trust,” Trusts & Estates (August 2005), at p. 18; Alexander A. Bove, Jr., “The Purpose of Purpose Trusts,” Probate & Property (May/June 2004); Alexander A. Bove, Jr., “Trusts Without Beneficiaries: Planning With Purpose Trusts,” Boston Bar Association (Oct. 21, 2014).

2. Some of the more popular offshore non-charitable purpose (NCP) trust jurisdictions are: Bahamas, Bermuda, British Virgin Islands, Cayman Islands, Isle of Man, Jersey, Liechtenstein and Nevis.

3. Some of the more popular domestic NCP trust jurisdictions allowing for broad and flexible non-charitable purposes are: Delaware, New Hampshire, South Dakota, Utah and Wyoming.

4. Foreign Account Tax Compliance Act, codified 26 U.S.C. Sections 1471- 1474; Foreign Bank and Financial Accounts, FinCEN Form 114; IRS Form 3520; Form 8938. Possible increased Internal Revenue Code scrutiny.

5. Many states only allow for NCP trusts for pets, and no other purpose is allowed. See 1993 Amendment to Uniform Probate Code (UPC) Sec- tion 2-907(b). Also see Uniform Trust Code (UTC) Section 409, which limits non-charitable purpose trusts to 21 years.

6. A private family trust company (PFTC) is typically a family-owned limited liability company that qualifies with a state division of banking and serves as a trustee and administers the family’s trusts. A purpose trust may be used to maintain the PFTC. Popular states to establish PFTCs are: Nevada, New Hampshire, South Dakota and Wyoming.

7. Every jurisdiction, except Louisiana and Minnesota, allows for some type of NCP trust.

8. An honorary trust may include NCP trusts for the maintenance and care of a grave, tomb or cemetery plot.

9. See Del. Code tit. 12, Section 3556, N.H. Rev. Stat. Section 564-B:4-409, South Dakota Codified Laws Section 55-1-20, Wyo. Stat. Section 4-10-410.

10. See supra note 1.

11. See supra note 1.

12. Alexander A. Bove, Jr. Trust Protectors: A Practice Manual With Forms, Sec- tion 10.5, p. 136-137 (2014).

13. States such as Alaska, Delaware, Idaho, Nevada, New Hampshire, South Dakota, Utah, Wisconsin and Wyoming have trust protector statutes.

14. See supra notes 1 and 12.

15. See supra notes 1 and 12; South Dakota Codified Laws Section 55-1B-6, South Dakota had the first domestic trust protector statute in 1997.

16. See Bove, supra note 1.

17. UPC Section 2-907(b); UTC Section 409.

18. Dynasty trust (long-term or unlimited): Delaware, Hawaii, Idaho, Kentucky, Maine, New Hampshire, South Dakota and Wisconsin; 1,000 years: Wyoming. Also, please note Arizona and Massachusetts have 90-year limits (generation-skipping transfer).

19. Del. Code tit. 25, Section 503(a), South Dakota Codified Laws Section 55-1-20.

20. Adam J. Hirsch, “Trusts for Purposes,” 26 Fla. St. U. L. Rev. 913 (1999).

21. Approximately 46 jurisdictions have 21-year pet trust statutes. Some are the longer of 21 years or the life of the pet. See N.Y. Est. Powers & Trusts Law Section 7-8.1; N.Y. Code Section 7-8.1: Honorary Trust for Pets; Utah 75-2-1001; Cal. Prob. Code 15212 and Colo. Rev. Stat. Ann. 15-11-901. Maine Revised Statutes Annotated Title 18-B; and Hawaii Section 560:7-501.

22. See Katherine Blocksdorf, How Long Do Horses Live?, http://horses.about.com/od/understandinghorses/qt/horseage.htm; Beauty of Birds.com, Blue & Gold Macaws, http://beautyofbirds.com/blueandgoldmacaw.html#lifespan; Vetstreet, 7 Animals with Incredibly Long Life Spans, http://www.vetstreet.com/our-pet-experts/7-animals-with-incredibly-long-life-spans.

23. Hawaii, Nevada, New Jersey, New York and Utah.

24. Al W. King III, “Freezers—Our Future Coffins?” Trusts & Estates (August 2002), at p. 8.

25. Ibid.

26. UPC Section 2-907(a) and UTC Section 409.

27. See supra note 18.

28. South Dakota Codified Laws Section 55-1-20, Del. Code tit. 12, Section 3556, N.H. Rev. Stat. Section 564-B:4-409, Wyo. Stat. Section 4-10-410.

29. Daniel G. Worthington and Mark Merric, “Which Situs is Best in 2014?” Trusts & Estates (January 2014), at p. 53.

30. Alaska Stat. Section 13.12.907, Nev. Rev. Stat. Section 163.0075.

31. See supra note 1.

32. See supra note 1, Revenue Ruling 76-486, and Bove supra note 1.

33. Restatement (Third) of Trusts Section 47.