In an increasingly complex and competitive post-recession environment, CEOs of family businesses are making strides to plan for an uncertain future, navigating the interplay between innovation and technology and grappling with barriers to growth. With family-controlled businesses accounting for 35 percent of Fortune 500 companies,1 they’re a huge driver of the U.S. economy. Therefore, their ability to thrive within the current business landscape and expand operations becomes even more important for their own organizations’ sustainability, as well as that of our country.

Sticky Baton Syndrome

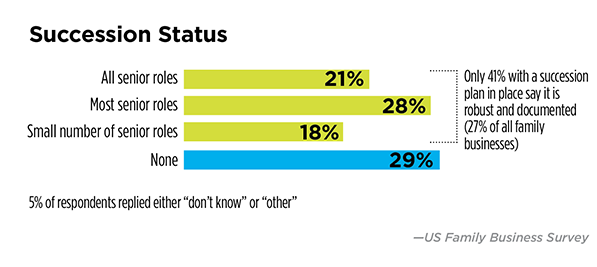

There comes a time in the lifecycle of every family-owned business when the delicate matter of succession planning must be addressed. However, PwC’s 2015 US Family Business Survey revealed that the vast majority of family businesses (73 percent) don’t have a robust and documented succession plan in place, and that makes for an uncertain future (see “Succession Status”). In addition, many senior business owners are increasingly hesitant to relinquish control to their successors, given that 40 percent admit that it will be difficult to fully let go when the next generation takes over. This dynamic causes critical issues for many family-owned business and impedes their ability to successfully hand over the reins to the next generation.

One explanation for current leaders’ reluctance to hand over authority is the widening age gap between generations. An heir-apparent to the current family business leader could easily be in his mid-20s when succession time comes. Unsurprisingly, this younger generation often hasn’t gained enough wisdom or experience to take full control. This leads to what we call the “sticky baton syndrome,” in which the older generation hands off management in theory, while retaining control of what really matters, in practice. This situation deprives potential successors from crucial hands-on involvement and may ultimately leave them unprepared to oversee the business.

Successful Succession & Innovation

What should a family business leader do to successfully relinquish control? Effective succession ideally includes a flexible long-term plan with rotations for the heir-apparent in senior management positions across the business, a thorough skills assessment and opportunities for work experience outside the family company. This crucial strategy will not only transfer valuable skills, but also will help successors gain credibility and trust among key stakeholders.

But that’s not enough. To achieve effective growth and thrive in today’s market, U.S. family-owned companies must adapt faster, innovate earlier and become more professional in how they run their operations. In addition, they need to make difficult decisions while contending with business challenges and pressures ranging from recruitment and retention, to resource scarcity, risk management and regulation.

For example, nearly three-quarters of our survey respondents acknowledge the need for digital adaptation within their family businesses. Moreover, a third of these leaders say that recruiting technologically savvy employees is at the top of their digital transition agenda. As a result, leaders’ ability to leverage their businesses’ innovative potential becomes even more important for their own sustainability and for that of the overall economy.

Barriers to Growth

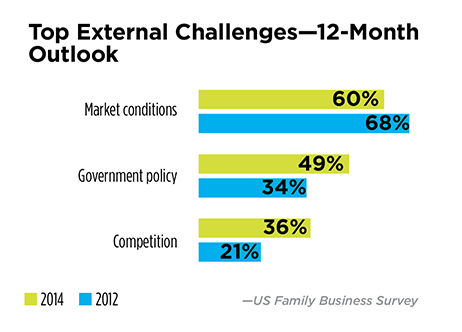

Challenges of all sorts abound for family-owned businesses, regardless of size or industry. When we asked our respondents to talk to us about the external challenges they expect to face in the next 12 months, market conditions, government policy and competition were their top three concerns (see “Top External Challenges—12-Month Outlook”).

Sixty percent of the family businesses we surveyed cited market conditions as a top challenge for them in the coming year. As for the impact that regulation, legislation and public spending are likely to have on their businesses in the next year, we saw a notable uptick in the number of companies flagging this as an issue: 49 percent today versus 34 percent in 2012. This shift may reflect the fact that since our last survey, Congress enacted anticipated tax-law changes and healthcare legislation, with family businesses still acclimating to the ongoing impact of those events. Finally, we see a growing focus on competition. Over a third (36 percent) of respondents in the 2014 survey regard their competitors as a major cause for concern (compared with 21 percent in 2012).

Ultimately, the US Family Business Survey shows that for family businesses in the 21st century, retaining the founders’ entrepreneurial drive and imagination is every bit as important as resiliency. We’ve consistently seen that staying power isn’t enough if family businesses want to thrive rather than just survive. To succeed, they must do what the majority of them say is their strong suit: self-reinvent. Family business leaders who rethink their strategies through adaptation such as proper succession planning will be the ones who anticipate change and get out in front of it or, better yet, drive change themselves.

Endnote

1. Conway Center for Family Business, Family Business Facts, Figures and Fun, http://www.familybusinesscenter.com/resources/family-business-facts/