By Lu Wang

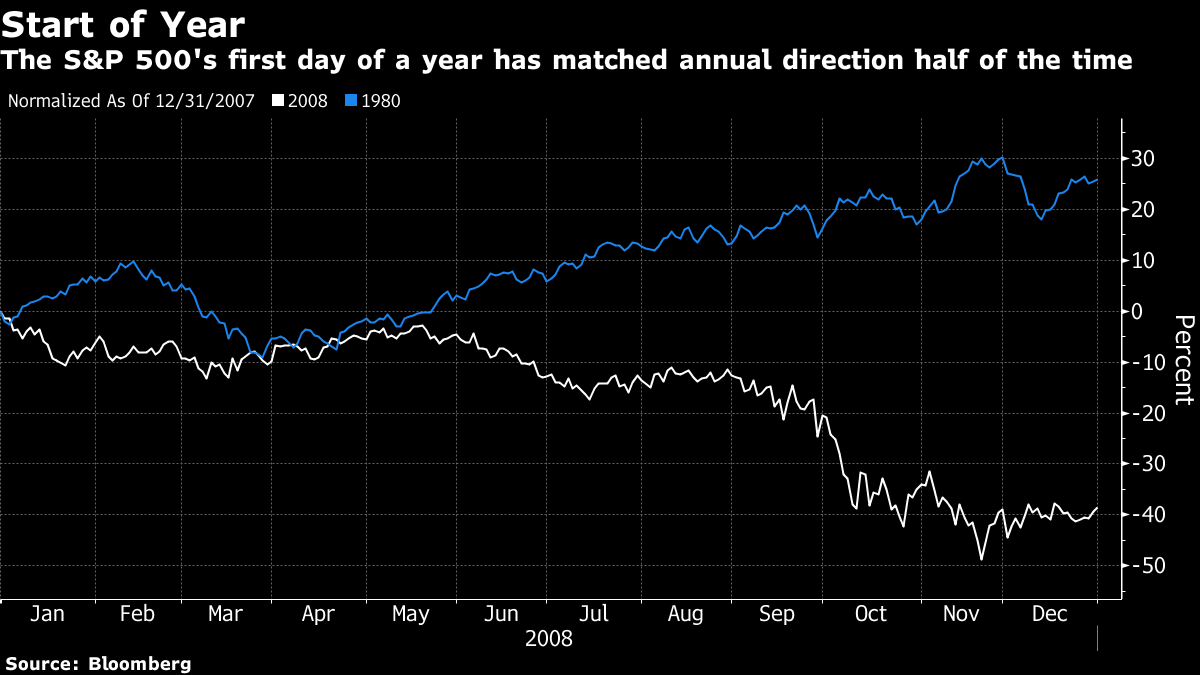

(Bloomberg) --It’s tempting to assume that as today goes, so goes the year. But history shows that using the year’s first day of stock trading as a premise for an annual view of the market is baseless.

Down 1.6 percent just after trading opened, the S&P 500 Index was briefly threatening its worst start since 2001 before the decline was erased. Since 1928, gains or losses in any year’s inaugural session have matched the annual direction of U.S. stocks only about half of the time, data compiled by Bloomberg shows.

Last year marked stocks’ first appreciable annual decline since 2008 as economic data from China added to concerns over a global economic slowdown. The S&P 500 fell to the brink of a bear market last month amid lingering U.S.-China trade tensions and continued monetary tightening from the Federal Reserve.

“It sets the tone for the feeling for the market, but as an investor, you have to be prepared to change and try not to extrapolate,” said Robert Pavlik, the chief investment strategist at SlateStone Wealth. “It can change on a dime.”

The inclination to see the first few trading sessions of the year as a harbinger may trace to 2008, when stocks tumbled 1.4 percent, 2.5 percent and 1.8 percent on the first, third and fifth days. The S&P 500 went on to fall 38 percent over the next 12 months, the worst annual retreat since 1937.

But one year does not a strategy make. The S&P 500 greeted 1932 and 2001 with a plunge of 6.9 percent and 2.8 percent, respectively, and extended declines for the following 12 months. However, the next biggest drops, ranging from 1.6 percent to 2 percent in 1949, 1980, and 1983, all came at the start of up years.

To contact the reporter on this story: Lu Wang in New York at [email protected] To contact the editors responsible for this story: Courtney Dentch at [email protected] Chris Nagi, Brendan Walsh