By Lee Miller and Wei Lu

(Bloomberg) --Is the U.S. stock rally great? Great again? Or merely middling?

Bloomberg’s World Equity Markets Risk-Return Analysis evaluated more than 50 national benchmarks and ranked their 2017 performance relative to the Standard & Poor’s 500 Index, using criteria including total return, risk and correlation.

The S&P 500’s 22 percent total return last year was its highest since 2013, a result President Donald Trump said validates his policies. Still, investors would have gotten better total returns in 21 other markets, with Argentina, Turkey, Vietnam and Nigeria leading the world -- each delivering more than 50 percent. Japan’s Nikkei 225 Stock Average was close to parity with its U.S. peer. Only three markets in the analysis declined: Pakistan, Oman and sanction-squeezed Qatar.

“Strategists expect global equities to rise further in 2018,” Citi Research said in its Jan. 25 global asset-allocation report. “Absolute equity valuations are starting to look stretched, but they should remain underpinned by a reasonable equity-risk premium.” Citi analysts are overweight emerging markets and continental Europe for 2018, while “U.S. valuations look expensive against other markets, but that has been the case for some time.”

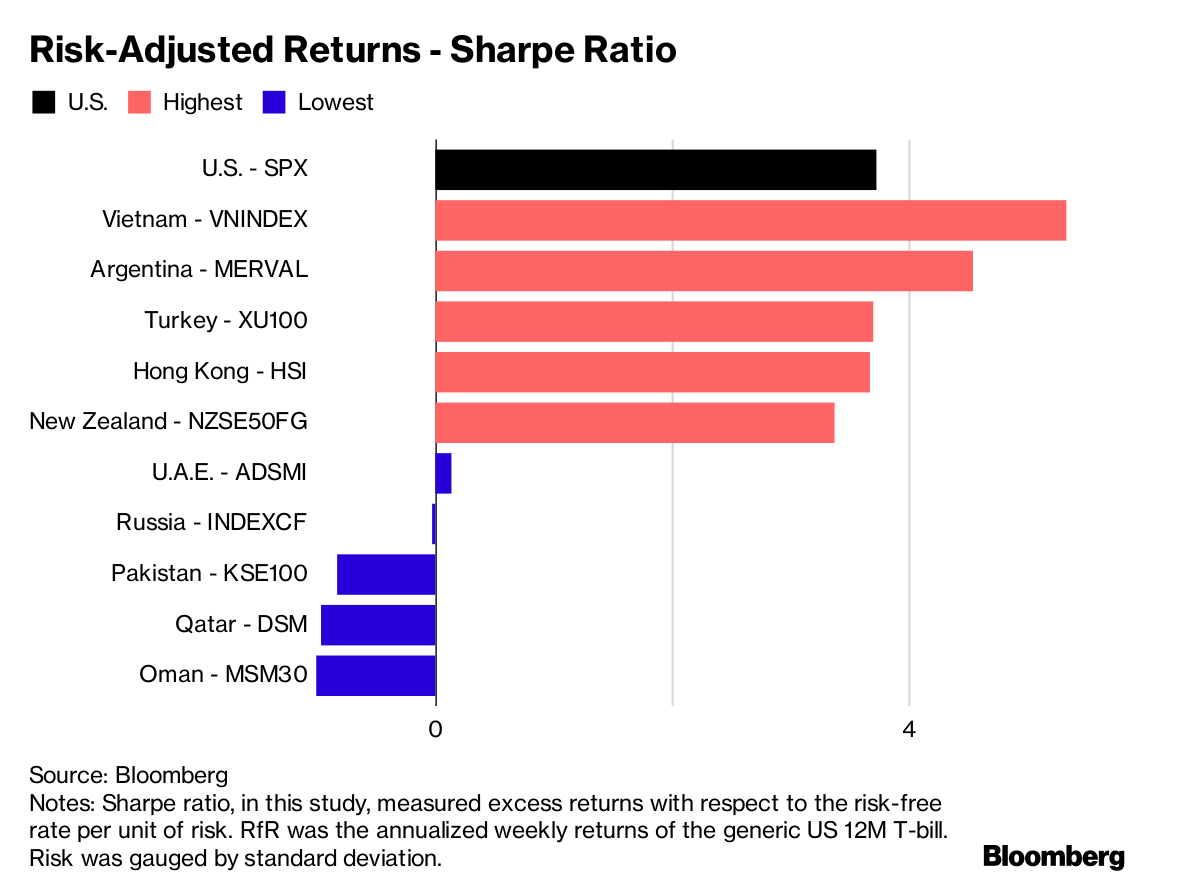

The American benchmark did stand out on a risk-adjusted basis. Only Argentina and Vietnam outperformed the U.S., with Sharpe ratios higher than 3.7. The ratio tallies stock returns relative to Treasuries and volatility. Thanks to a collapse in volatility last year, investors’ risk-adjusted returns from the S&P 500 were among the highest in half a century.

Mexico’s equity market seemed least affected by U.S. share moves, according to data compiled by Bloomberg. The Mexbol Index’s correlation coefficient with the S&P 500 was close to zero -- meaning there was little relationship between the indexes. Investors in Mexico may have suffered as a result, as returns lagged their U.S. peers’ by half, giving back only 10.4 percent. One reason could be Mexico’s own presidential election, which is scheduled for July 1.

The nearest proxies to S&P 500 moves last year were once-warring neighbors Israel and Egypt. Their equity benchmarks had the highest correlations with the U.S. gauge, meaning their price movements were most synchronized with those of American stocks. Markets with the highest negative correlations -- rising when the U.S. dove and vice versa -- were Indonesia, Kenya, Colombia and China.

“The stock market has smashed one record after another, gaining $8 trillion in value,” Trump said in his State of the Union address on Jan. 30. “That is great news for Americans’ 401k, retirement, pension and college-savings accounts.”

Several other countries also elected new leaders last year, and the performance of their benchmarks was mixed.

Trump beat French counterpart Emmanuel Macron, who took office in May: The CAC 40 Index had full-year total return of 13 percent. But Moon Jae-in, who became South Korea’s president the same month, edged past him with total return of 24 percent. Pakistan Prime Minister Shahid Khaqan Abbasi took office in August; his nation’s equities delivered a negative annual return of 14 percent. And in New Zealand, where Jacinda Ardern became prime minister in October, stocks returned 22.3 percent.

To contact the reporters on this story: Lee Miller in Bangkok at [email protected] ;Wei Lu in New York at [email protected] To contact the editors responsible for this story: Alex Tanzi at [email protected] Melinda Grenier