By Justina Lee

(Bloomberg) --Investors seeking refuge in two corners of the equity market touted for their resilience in the grip of sell-offs may be living on borrowed time.

Sure, low-volatility stocks are living up to their label of late, on track for the best quarter of outperformance since 2011. Meanwhile, a Russell Value index has beaten growth for four straight weeks, the longest streak in almost two years, as $2 trillion was wiped off the U.S. market.

But money managers playing defense are now in a quandary, as volatility and a long-in-the-tooth U.S. expansion vex tried and tested strategies.

Stocks that boast cheap valuations, and those with muted price swings are at the mercy from an aging business cycle saddled with a multitude of threats from interest-rate hikes to market crowding, warn investors.

“When you have higher rates for very good reason with an acceleration of GDP growth -- this is the best scenario to invest in value stocks,” said Cyrille Collet, Paris-based head of quantitative investing at CPR Asset Management, an Amundi SA unit that oversees 46 billion euros ($52 billion). “But now it’s more complicated because a lot of people believe the acceleration of GDP growth is behind us.”

Risky Business

After the dot-com bubble peaked in 2000, value beat growth in the U.S. for nearly seven straight years. But cheaper shares don’t always outperform in equity downturns -- during the global financial crisis they trailed growth stocks. Meanwhile, value and minimum volatility might do better during sell-offs simply by falling less than competing strategies.

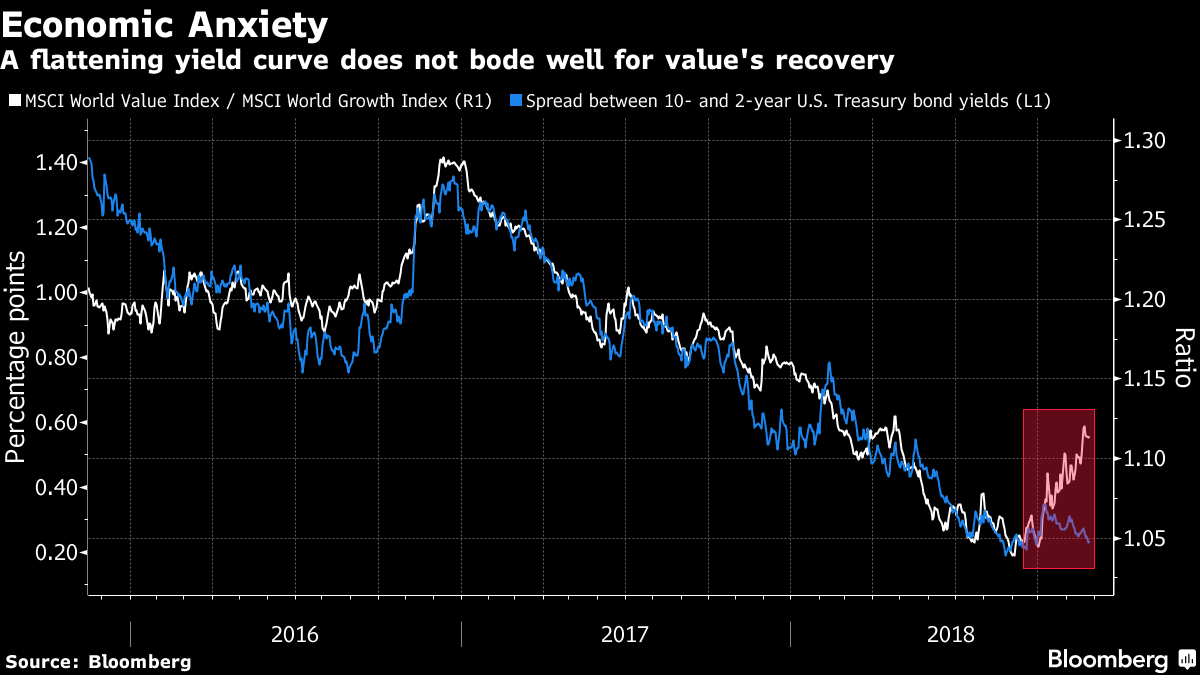

Right now, headwinds are besieging the cyclical sectors like materials and financials that typically make up the value universe. As signaled by the flattening Treasury yield curve, U.S. economic momentum is projected to slow while inflation expectations are falling.

“For value to work sustainably, you need to see much more of an inflationary environment,” said Johan Swahn, a fund manager at Nordea Asset Management in Stockholm.

Many value sectors like industrials are particularly vulnerable to unresolved trade tensions while in Europe, the heavily weighted financial sector is exposed to political risks such as Brexit, CPR Asset’s Collet added.

Those hoping low vol offers an enduring shelter as the U.S. bull market flags also need nerves of steel. While the S&P 500 Low Volatility Index has dropped about 1 percent this quarter, compared with 8 percent for the benchmark, these shares are threatened by rising rates, thanks to their outsized exposure to bond proxies like utilities and high-dividend payers.

“Some of that historical outperformance of low vol can be attributed to those stocks behaving more like bonds,” said Maarten Smit at APG Asset Management, which set up a low-vol strategy in 2012 and invests 485 billion euros in total for Dutch pension funds. “It’s going be very interesting going forward what the performance of low vol will be in a rising rates environment.”

That’s not stopping money from pouring in: A U.K. exchange-traded fund that tracks steadier equities worldwide is set to draw record inflows this month. As herding and valuation risks grow, low vol’s rising popularity is another threat to its defensive allure during bouts of risk aversion -- as disruptions in 2016 laid bare.

In any equity drawdown, “the main adjustment will be realized by valuation -- so if you agree with that, low vol is too expensive to benefit,” Collet said.

--With assistance from Luke Kawa.To contact the reporter on this story: Justina Lee in London at [email protected] To contact the editors responsible for this story: Blaise Robinson at [email protected] Sid Verma, Samuel Potter