By Dean Cook

The race to “zero” fees and the rapid rise of passive investing have made ETFs the vehicle of choice for many financial advisors. Now, with fees seemingly at all-time lows, advisors find themselves looking for the next competitive edge to differentiate themselves from the rest of the industry. The question becomes, “How can they add value to client portfolio management?”

Developments in portfolio management technology have brought about the newest, most high-touch form of investing known as direct indexing. This create-your-own index strategy puts advisors back in the driver’s seat, which may add immediate value for the client.

Direct indexing may offer a range of benefits to advisors, including the ability to build their own custom indices instead of relying on existing ETFs to meet clients’ needs. Because investors own the equities directly, they may achieve potentially far greater tax efficiency and customization than with traditional ‘40 Act funds. As the wealth management industry strives for ever-greater client customization, direct indexing is sure to be a vital aspect that becomes a clear distinguishing factor.

Optimization through Tax Efficiency

To understand the potential tax benefits available through direct indexing, consider the following scenario based on a growing advisory firm. An advisor takes on a large volume of new clients, liquidates the legacy positions and reinvests the new assets into their preferred model of diversified ETFs and mutual funds. The client then receives a large tax bill based on the capital gains in their portfolio and calls the advisor to complain. Sound familiar?

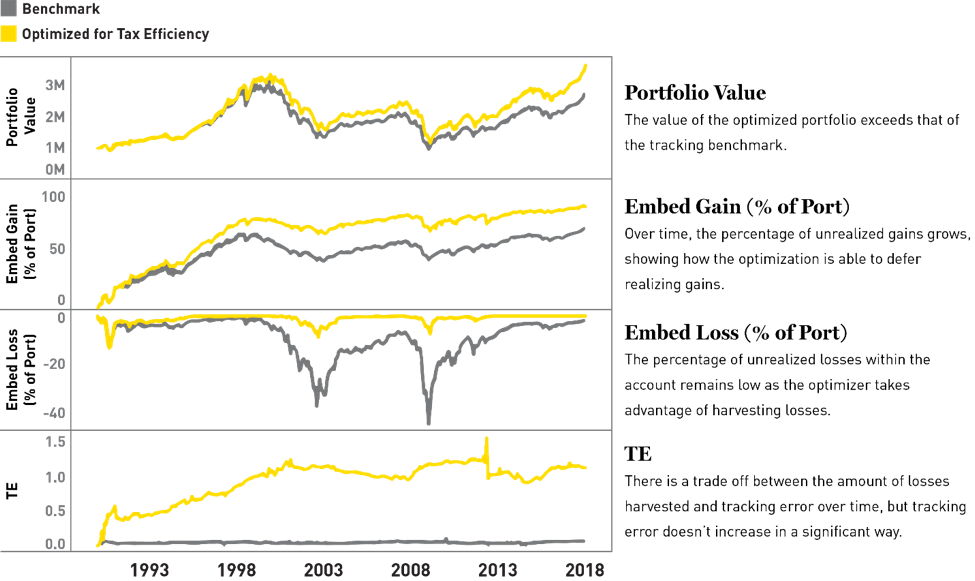

In the direct indexing scenario, an advisor can use technology to onboard the same new clients into separately managed accounts with built-in tax-loss harvesting methods that invest directly in a custom index’s underlying securities. This optimized method may generate tax alpha through tax-loss harvesting, creating additional returns by capturing losses or deferring gains when appropriate based on individual investor needs.

With the technology at hand, assets can also be reinvested in a similar position to maintain a low tracking error with automated rebalancing software. These small, tax-efficient moves can create legitimate savings – providing a new way to potentially outperform ETFs after taxes and keep clients happy.

Customization on the Individual Level

The ETF was a game changer for advisors looking to offer their clients low-cost access to indexes, but it never was able to truly offer any real level of portfolio customization. The reality, is that ETFs could never accomplish what direct indexing can. Advisors boast about their “customization” capabilities, but they can’t scratch the surface of the tailored approach direct indexing provides.

Because an advisor can choose the underlying securities, he or she can screen for specific client preferences that go well beyond a basket of thematic ETFs. For example, an advisor can create a portfolio composed of companies in the S&P 500 with a diversified board, exclude vice stocks and weight in favor of X, Y and Z companies. There is almost no limit to the customization possibilities of direct indexing. Screening for environmental, social and governance factors can become a reality, rather than just a supposed capability that lacks real action.

The customization doesn’t stop at ESG, because it can also be utilized in situations of unique risk profiles, specific financial goals or diversification away from stock concentration. When all is said and done, an advisor will have custom portfolios for each client and a clear understanding of exactly what they are invested in. The icing on the cake? Thanks to technology, this customization is adjustable throughout the life of the portfolio.

Position your advisory firm out in front of the vanilla, cookie-cutter asset management companies – a must in a world where financial advisory firms are clamoring to offer the best portfolio services.

Direct Indexing is Here

Direct indexing is the next wave of portfolio management and could completely alter the way an advisor competes for and services clients. This new technology provides a way to differentiate a firm in a passive, low-fee world. Ask your technology provider if they have the direct indexing tools to take your investment management to the next level.

The key factors, tax-loss harvesting and enhanced customization, work at the individual level to give advisors more control and options with time-saving technology. This efficient and cost-effective strategy means clients receive next-level service without any additional burden to the advisor. Because of technological advancements, direct indexing can be quickly incorporated, learned and executed. The next wave of high-touch portfolio management is here. It’s time to start using it, and stand out.

Dean Cook is the president of FTJ FundChoice, a leading TAMP provider with over $14 billion in assets under management. Dean oversees the development and implementation of strategic initiatives designed to assist advisors who use FTJ FundChoice products and services.