BlackRock, the world's largest asset manager, has a message for financial advisors: You're overweight equities and need to "get properly diversified."

Last year, advisors across segments shared nearly 10,000 models with BlackRock to get a free assessment of them by the firm's Aladdin risk management platform. The company's Portfolio Solutions group then analyzed the results and published some of its findings—and suggestions.

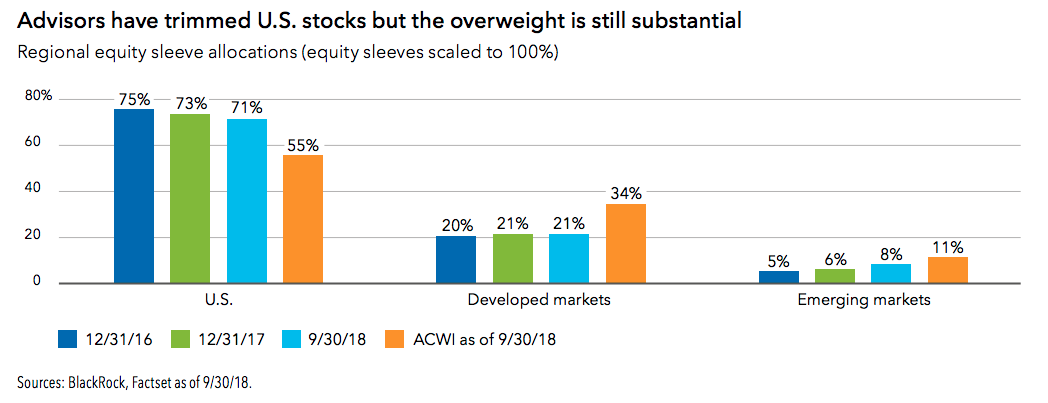

Despite a slowing U.S. economy, increased volatility, and a menagerie of trade and political risks, "Advisors have been consistently overweight U.S. equities (and U.S. Dollar), underweight U.S. Treasurys and shorter-duration in fixed income for many years," according to the latest Advisor Insights Guide by the Portfolio Solutions group. It also found that "advisor portfolios weren’t well positioned for them coming into 2018" and there was no real evidence of significant changes in portfolios, although by year-end advisor demeanor began shifting, the report said.

In response to its observations, the group suggests that portfolios in "pro-growth posture" should be more diversified heading into 2019. In turn, the report suggests that advisors consider adding duration and alternative investments.

But the report was careful not to incite a panic about markets, which overall remain strong.

"If you are bearish, then make the portfolio more conservative. But if you are uncertain, then don’t make big bets in either a bullish or bearish direction. Uncertainty should lead your portfolio back to your strategic asset allocation—not to cash," Brett Mossman, a managing director and head of BlackRock Portfolio Solutions, and Patrick Nolan, a director and portfolio strategist, wrote in the report.