Advisors, take note. IRA rollovers are picking up steam in the U.S., creating an opportunity to expand your share of Baby Boomer assets. Cogent Research plans to release a report next week showing that wealthy investors in the county are holding more assets in IRA accounts than in employer-sponsored 401(k) and 403(b) plans. It’s the first time that IRAs have outpaced workplace retirement plans since Cogent began tracking allocations in 2006.

Recession is part of the reason, Cogent says; investors who have lost jobs are rolling over their 401(k)s into IRAs while they look for new employment, or they’re simply opting to retire earlier. Actually, the study found that ownership of both kinds of retirement plans is down from 2006 levels, although the drop-off in employer plans is sharper than that in IRAs. Many employers have discontinued contributions to retirement plans since the financial collapse, making them less attractive to investors. Among the 4,000 affluent Americans who were surveyed by Cogent last fall, the proportion of total assets held in their IRAs rose from 26 percent in 2006 to 31 percent in 2009; employer plan assets fell from 34 percent of the total to 25 percent in that period. Meanwhile, overall IRA account ownership among those surveyed fell from 87 percent to 82 percent, while employer plan ownership declined more sharply: from 77 percent to 59 percent. The survey covered investors with more than $100,000 in investable assets, excluding real estate.

IRA assets have surpassed those in workplace plans in part because of the wave of Baby Boomers marching into retirement and transferring their savings into IRAs in the process. Cogent expects the rollover momentum will continue. Their survey found that 45 percent of investors who had assets in employer retirement programs planned to roll them into an IRA, up from 39 percent in 2008. Some will take advantage of rules allowing easier conversion of IRAs into Roth IRAs over the next two years, so they can benefit from tax-free withdrawals from such accounts.

Meredith Lloyd Rice, Cogent’s senior research director and author of the study, says advisors need to speak more closely with clients about potential job changes and/or upcoming retirement plans. “I think it’s an opportunity to consolidate assets,” she says. “One thing we’ve seen with investors as they age is that they are looking to simplify the accounts.” But the growth of IRA assets also reflects uptick in asset transfers into IRAs by so-called “second wave” Baby Boomers, ages 45 to 53, who are leaving jobs and starting their own companies.

Getting a client out of a 401(k) and into an IRA often provides advisors with options they didn’t have before, says Melissa Nassar, head of sales and distribution for Vanguard Financial Advisor Services. Employer-sponsored plans may have investment options that are more limited than an IRA plan. Often the client is heavily invested in the stock of the company where he works; that’s an undesirable allocation because it links the client’s prospects too closely to his employer’s, she says.

An advisor can restructure a portfolio more broadly under an IRA, using exchange-traded funds and a range of other assets that weren’t available before, and perhaps convert to Roths. Income eligibility limits for Roth conversion were eliminated on Jan. 1 this year; before then, investors with modified adjusted gross incomes of $100,000 or more were barred from a Roth conversion. “The advisor gets to have a whole new conversation with the client. It’s not just about asset allocation anymore,” Nassar says. “It’s about wealth creation plus wealth preservation … They get an opportunity to pick the investments, and also to do tax optimization. It’s a very good thing for the advisor.”

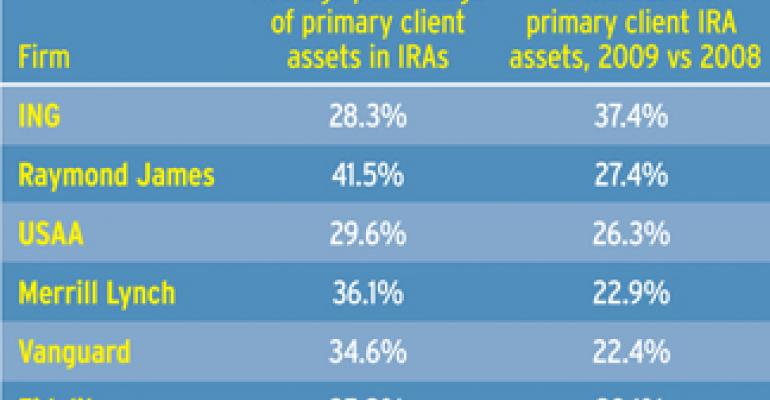

Cogent said that over the past year, the proportion of primary client assets held in IRA accounts increased by an average of 15 percent at 19 investment firms. Nine firms held one-third or more of their primary clients’ assets in IRAs: Ameriprise, Charles Schwab, Edward Jones, Fidelity, LPL, Merrill Lynch, Raymond James, UBS, and Vanguard.