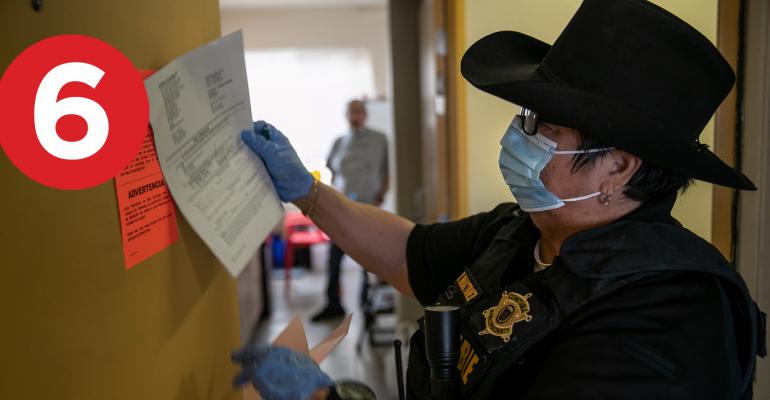

- As Rents Rise, So Do Pressures on People at Risk of Evictions “Tenants and advocates have dreaded a wave of evictions that was predicted to follow the end of the federal ban on evictions during the pandemic. Yet in many areas nationwide, eviction filings have increased only moderately since the Supreme Court ruled President Biden’s extension of the eviction moratorium unconstitutional. Evictions remain well below prepandemic averages, according to the Eviction Lab at Princeton University. But those numbers do not capture evictions, like Mr. Jones’s, that were filed during the pandemic but are only now being executed — right as rents surge far beyond prepandemic prices and the budgets of many renters.” (The New York Times)

- Homebuilder Sentiment Bounces Back Despite Ongoing Supply Chain Problems “The nation’s homebuilders aren’t seeing any relief from supply chain issues that have slowed construction recently, but high buyer demand appears to be making up for it. Builder confidence in the single-family home construction market rose 4 points to 80 in October on the National Association of Home Builders/Wells Fargo Housing Market Index.” (CNBC)

- Hudson’s Bay Company Successfully Restructures $846M CMBS Retail Loan “Positive retail news hasn’t exactly been plentiful over the past few years. But, Hudson’s Bay Company (HBC) has a happy ending to share. The retail business group just emerged victorious from its 18-month effort to modify and remedy a defaulted commercial mortgage-backed securities (CMBS) loan, Commercial Observer can first report. On Sept. 30, HBC, together with joint venture partner Simon Property Group, finalized a restructuring for an $846.2 million defaulted CMBS loan backed by 24 Lord & Taylor stores plus 10 Saks Fifth Avenue stores.” (Commercial Observer)

- These Markets Are Expected To Be the Hottest for Real Estate in 2022 “Large cities, which previously dominated the list of the country’s top real estate markets, are losing their appeal as people discover they can work from anywhere, spend less, and escape dense crowds. And that has unleashed a flood of demand for smaller metro areas. In fact, the two top cities in PWC’s 2022 Emerging Trends in Real Estate report have populations of less than 2.5 million. Former stalwarts, such as Los Angeles, San Francisco, and Washington, D.C., meanwhile all failed to make the Top 10.” (Fortune)

- Zoom and HP Are Working with a Prefab Workspace Maker on a $17,000 Office Pod for Video Calls—See Inside the Room for Zoom “New York-based prefab office pod maker Room is working with Zoom and HP to create the Room for Zoom. Room for Zoom is a soundproof office pod designed for video conferencing. The modular almost $17,000 workspace can be assembled within a few hours.” (Insider)

- Returning Workers Confront Creepy Time Capsules of Pre-Pandemic Life “Though millions of workers remain fully remote, those who are returning to office life say it can be like stumbling into a bizarre corporate Pompeii. Wall calendars are still set to 2020. Desktop computers reveal browser tabs open to news pages about a novel coronavirus that could keep people home for several weeks. Vending machines and desk drawers house snacks that are long expired—but might technically still be safe to eat.” (The Wall Street Journal)

0 comments

Hide comments