Saving for college is at an all-time high, but parents are the ones planning to pay for a large portion of their children’s higher education costs.

About 69 percent of families are saving for college, up from the 64 percent of those who reported doing so in 2014. And two-thirds of parents say they are planning to pay a "large portion" of their kids’ college costs, according to a recent survey by Fidelity Investments of almost 2,500 parents nationwide with children aged 18 and younger. That’s up from the 57 percent who said they were planning to do so in 2012.

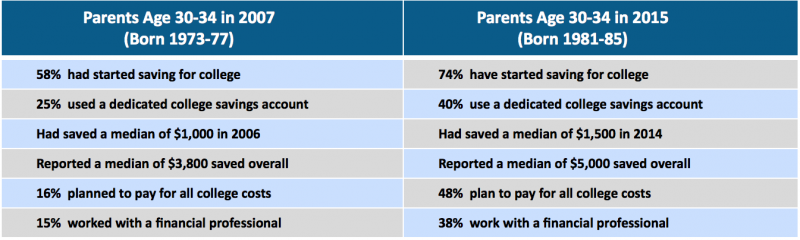

Among millennials, the urge to help out is even stronger, with almost half (46 percent) reporting they plan to completely pay for all college costs. Seven out of 10 millennial parents (those born between 1981 and 1997) are actively saving for their children’s college and reported individually saving a median of $5,000 saved so far.

“Millennials have weathered challenging economic conditions for much of their adulthood. Many have channeled that experience into setting college savings goals early, and taking steps to make savings a regular habit,” Keith Bernhardt, vice president of retirement and college products at Fidelity, said in a statement.

But despite the good intentions, U.S. parents are currently on track to fund just 27 percent of their children’s college costs, according to Fidelity’s report. Additionally, 56 percent of millennials are still paying back their own college loans and about half feel they are not on target with their college savings goals.

And while it's important to minimize the debt burden brought on by higher education, that's only the case if it doesn't jeopardize parents' financial well-being, says Austin, Texas-based advisor Elliott Weir.

When facing a funding decision between college and retirement, Weir says he takes the airlines’ example of passengers securing their own oxygen mask first before helping others. “Loans, work, financial aid and grants can help pay for college but kids cannot take out loans to support their parents in retirement,” he says.

Weir recommends his clients look into 529 plans. “From a pure college funding need, low-cost 529 plans are hard to beat. However, Roth IRAs, cash value life insurance, and other savings vehicles can help serve multiple client priorities as well,” he adds.