The coronavirus pandemic is creating tremendous turmoil in the higher-ed world. No one knows if colleges will reopen in the fall, or if they’ll reopen and then have to close again.

Without the normal freshmen recruitment efforts in the spring, college administrators have no idea what their admission yields will be for the freshman class of 2020.

Parents, with decimated 529 college accounts and other investments from the stock market plunge, don’t know how they are going to cover the ever rising cost of college.

A variety of surveys of college-bound freshmen suggests a significant minority of students are going to delay attending college, select a school closer to home or in some other way change their plans.

During this time of crisis, another unsettling question has come to the fore: Will some colleges close? The answer almost certainly will be “yes.”

In December, Moody’s Investors Service estimated that one in five small private colleges face “fundamental stress” due to declining revenues, rising expenses and little pricing power when it comes to tuition. The risks of closures are generally worse for colleges in the Midwest and Northeast, where there are fewer teenagers.

In mid-March, Moody’s updated its higher-ed analysis and observed that, due to the coronavirus, there would be a contraction in operating margins for most colleges, and the update noted that just over 30% of public universities and nearly 30% of private ones were already operating on deficits, and these schools will experience even more challenges.

During a webinar in late March sponsored by The Chronicle of Higher Education, 1,600 college administrators and staffers listened to the president of The Ohio State University and a higher-ed professor at the University of North Carolina at Chapel Hill discuss that this new era for colleges will be worse than the Great Recession of 2007-2009.

So what should families do with this information?

1. Delay putting a deposit down as long as possible.

Families of college-bound freshmen should strongly consider postponing putting down a deposit for the upcoming school year. Many colleges are pushing their official deposit date back due to the uncertainty.

Traditionally, many schools imposed a May 1 deposit date. Some schools have moved their deadline to June 1 or later.

You can see which colleges have extended their deposit deadlines by heading to the website of Admissions Community Cultivating Equity & Peace Today (ACCEPT), which advocates for racial equity in college admissions. The organization says it provides daily updates of the colleges delaying deposit deadlines.

As a practical matter, many colleges in recent years have quietly continued recruiting high school seniors and accepting deposits into August. They’ve done this because so many of them have trouble filling their freshman class.

2. Regardless of whether a child is a rising high school senior or younger, parents need to evaluate the financial strength of their relevant colleges.

Here is a question that I got from a dad in Los Angeles that is relevant to this subject:

My youngest is a high school sophomore and we're starting to make plans for her. I've noticed that based on her intended major, interests, and selectivity, many of the colleges making the cut are weaker financially.

I hate to eliminate good choices from her list solely based on finances, but I also don't want to get into the situation of a college merger, closure, or program elimination.

Is there a single good source to determine a college's financial health?

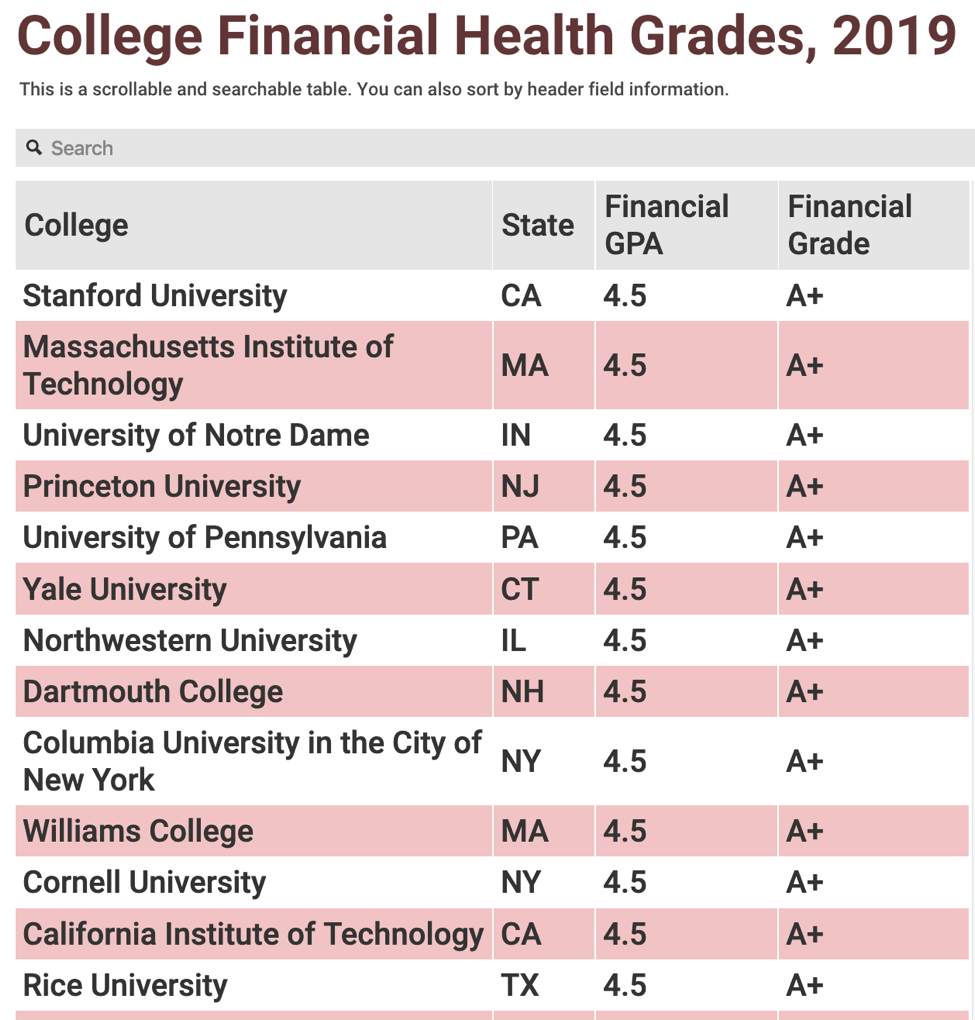

A valuable tool to evaluate a college's financial strength can be found in a yearly report that Forbes produces called the College Financial Health Grades.

You can use the built-in search function in the online report to discover the financial grade of 933 colleges and universities. The best grade is an A+, and D is the worst.

The report covers only private, nonprofit institutions and not public ones. While these public institutions experience financial difficulty, they will have the state aid—even if woefully inadequate—to prop them up.

Below is a screenshot of the Forbes search function and the universities that fared the very best in the evaluation. When you are on the site, type in the school that interests you in the gray bar right below the heading.

Some elite liberal arts colleges also got high marks, including Grinnell College in Iowa, which previously had Warren Buffett, when he was a trustee, investing its endowment assets. Others with high marks include:

- Barnard College

- Bates College

- Carleton College

- Claremont McKenna College

- Davidson College

- Grinnell College

- Hamilton College

- Harvey Mudd College

- Pomona College

- Washington and Lee University

- Wellesley College

What you might find surprising are some of the schools that did extremely well on Forbes financial stress test. The schools on the list below drive home the message that you can’t automatically make assumptions about an individual college’s financial health.

- Brigham Young University

- Brigham Young University—Hawaii

- Berea College

- Berry College

- College of Idaho

- College of the Ozarks

- Hillsdale College

- Kansas City Art Institute

- New England Conservatory of Music

Forbes uses nine factors to evaluate each institution’s financial health, including:

- Core operating margin.

- Tuition as a percentage of core revenues.

- Admission yield.

- Percent of freshmen getting institutional grants.

- Endowment assets per full-time student.

- Primary reserve ratio.

- Viability ratio.

- Return on assets.

- Admission yield.

- Instruction expenses per full-time student.

With the pandemic ravaging all aspects of society, including the higher-ed world, it is crucial to check the financial stability of any school on a teenager’s list.

Lynn O’Shaughnessy, a nationally recognized college expert, offers an online course—Savvy College Planning—exclusively for financial advisors. Click here to get Lynn’s guide, Finding the Most Generous Colleges.