Ever had a truly risk-averse client, somebody who has to be coaxed to take even modest steps to protect their portfolio and build it up gradually over time? I call such clients “Protectors” and they are the most risk-averse type of client I ever have to deal with.

Protectors tend to approach the stock market with nervousness. Unlike other types of clients, who are willing to take calculated risks to increase the size of their nest egg, and who embrace new ideas for growing their portfolios, protectors often see threats all around them, even when the market is steady. They may cling to longtime family stock holdings bequeathed to them decades ago, own lots of bonds, and be way underinvested in equities. All this to avoid what they view as potentially enormous downside risks if the market should ever turn south.

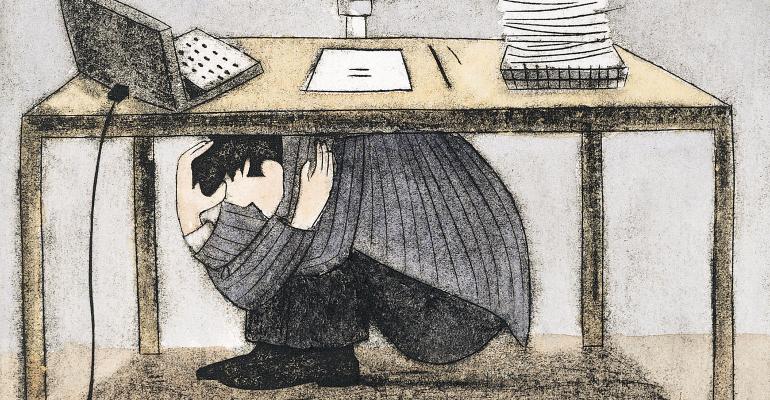

And when the market does become turbulent, watch out! The Protector investor may panic, feel like a victim of circumstances beyond their control, and be inclined to sell everything to avoid taking a big financial hit.

At such moments, you, as their advisor, need to soothe their concerns, help them take charge of their situation, explore options, and plot courses of action to help them ride out conditions of extreme market volatility.

So, where does the Protector investor’s deep-rooted risk aversion come from? Unlike other types of investors, Protectors believe they have very little control over their financial circumstances, and thus opt to avoid risk altogether, if they can. In this respect, they often feel very disempowered when it comes to their finances.

It can be difficult for Protector clients to learn to trust advisors, because of their degree of risk aversion. In reality, the only time you really can develop a relationship of trust with protector investors is when the stock market is extremely steady, and economic prospects on the horizon look sunny.

Protectors are also risk averse because they tend to think of their wealth as being less for themselves and more for others. Indeed, more than other investor types, Protectors tend to assume guardian and stewardship roles as investors. Think of John Beresford Tipton, the fictional benefactor in the 1960s TV show The Millionaire, who gave out $1 million checks each week to people he’d never even met. Or of that indulgent aunt or generous uncle of yours. Or the doting, cheek-squeezing grandmother you had as a kid. All of these are stereotypes of individuals who are Protectors.

So, what’s the best way to deal with a client who is very risk averse? Here are six suggestions:

1. Protectors are anxious about the preservation of wealth. So, as an advisor, be sensitive to this and reassure them, as needed. Protectors notice immediately when markets become volatile, when balances in a portfolio fall below certain levels, when funds drop in checking and savings accounts, and when dividend checks don’t arrive on time. When economic uncertainty prevails, Protectors can begin to feel like victims and become vengeful, even toward you, their advisor. Be prepared for this if you are counseling a Protector investor through market downswings.

2. Because Protectors are highly risk averse, they can be a challenge for advisors to deal with one on one. As noted, Protectors can be overly sensitive to market risks and thus reluctant to embrace reasonable, moderate-risk options to grow their portfolio. In such cases, reassure them that you’ve done background research to ensure the investment options and plans you’re proposing are well considered and prudent.

3. When working with Protector clients, use their commitment to others (spouses, partners, children and grandchildren) as a core premise in constructing investment or estate plans. These commitments to other people provide a natural framework for handling matters of asset allocation, risk tolerance, bequests, charitable contributions and multigeneration wealth transfer. Put today’s volatility in the context of a decade- or generation-long time frame so the Protector sees it in perspective.

4. Look for opportunities to empower Protector clients. Protectors tend to discount any personal ability to direct their lives or to impact the success of their investment and wealth management efforts. Instead, they see themselves as vulnerable to forces “out there” in the markets. Be aware of this and offer Protectors ways to take active control of the wealth management process. For example, by: (a) crafting a vision and mission for their wealth; (b) committing to charitable giving; (c) funding education for beneficiaries; (d) starting or investing in a small business; or (e) taking other steps to avoid becoming a victim of circumstances.

5. Remember, when market conditions become turbulent, Protector clients can go, as I sometimes put it, “to the dark side.” In such cases, they feel powerless, unable to control the situation, and resentful of those around them who seem to be adjusting better to the challenges at hand than they are. If situations become very “high stakes,” the Protector may lash out and even seek revenge against you, as their advisor, or others close to them. In such cases, it’s important to “talk the client down” and to assure them that actionable options exist to help them minimize their financial exposure in rough markets.

Finally:

6. The tendency of Protectors to shield and protect others can be a great asset when you’re working with a client couple or family, where others are prone to rash risk-taking or to entertaining overly idealistic and impractical investment options. In many cases, the Protector client helps put the brakes on when a spouse or family member is inclined to adopt high-risk investment approaches in designing wealth management plans. They’re good at anticipating problems, so their tendency to be anxious can be a very useful tool. Protectors can also help spouses or family members adopt realistic, levelheaded investment plans and approaches, rather than those that are impractical, unrealistic or overly idealistic.

Chris White (www.chriswhiteauthor.com) is a longtime wealth advisor and author of Working with the Emotional Investor: Financial Psychology for Wealth Managers (Praeger, 2016).