A greater number of registered investment advisors are creating career paths for client service and operations staff, and the practice is becoming more prevalent among larger firms, according to a recent compensation survey released by Charles Schwab.

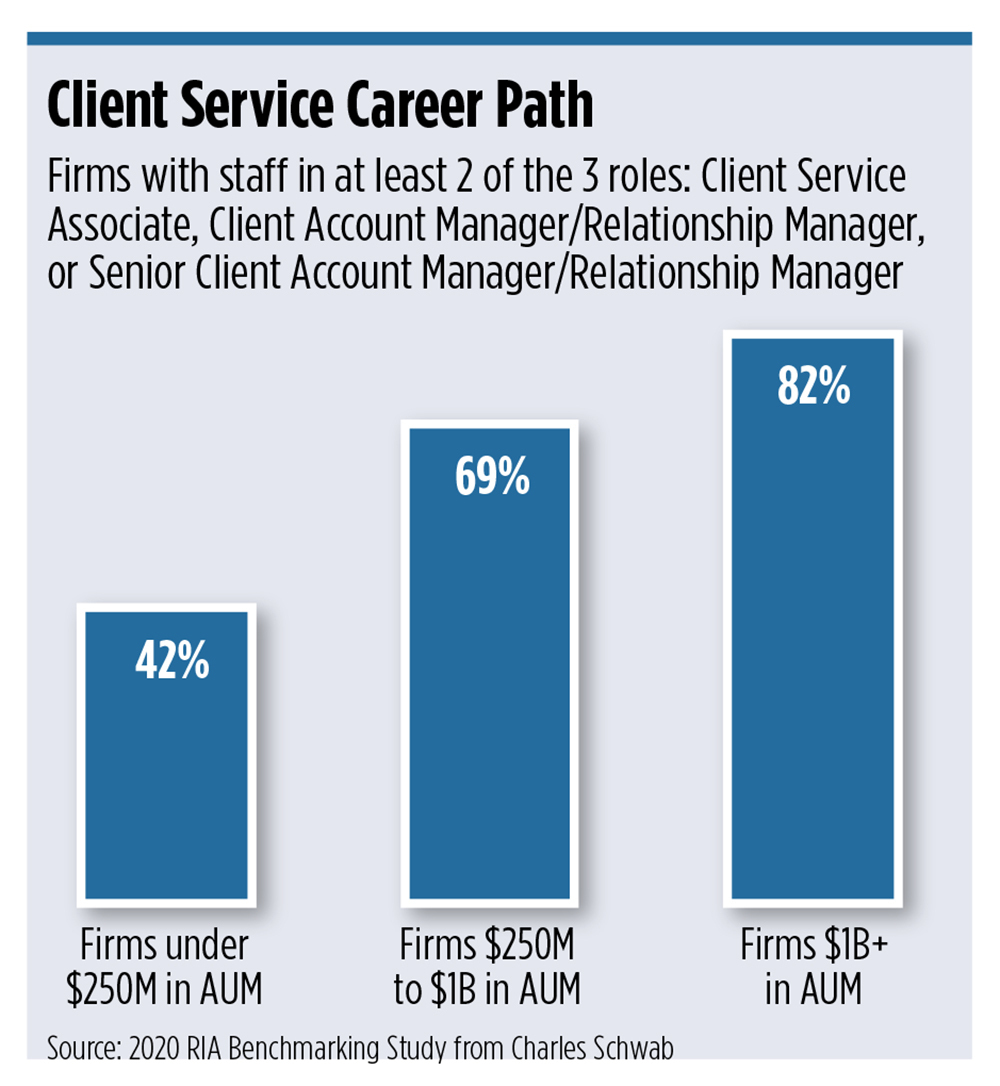

In its survey of 761 RIA firms fielded from January to April 2020, Schwab analyzed firms with staff in at least two of three client-facing roles, including client service associate, client account manager/relationship manager and senior client account manager/relationship manager. It found that 82% of RIAs with $1 billion in client assets or more had staff in at least two of these roles, compared with 69% of RIAs with between $250 million to $1 billion, and 42% of RIAs with under $250 million.

“Firms that truly take the time to develop a career path and write it down really differentiate themselves in the marketplace,” said Lisa Salvi, vice president of business consulting and education at Schwab.

A career path includes things like training and certifications, but some firms look at cultural attributes that they want to instill in their people, Salvi said. They might encourage employees to lead a committee within the firm, do some community outreach or read certain leadership books.

A career path is particularly attractive to university students, she said.

“When they’re thinking and weighing all of those different career paths that they could go down—investment banking, insurance, a wirehouse, independence—they want to know that the firm they’re joining will invest in their development and that they’re going to have opportunities for growth,” Salvi said. “Although a lot of larger firms have done this, it’s a way a mid-sized or smaller firm that is really trying to attract that next generation talent—they can put some of this in writing, they can add this into their employee value proposition during the interviewing process, and really get a lot of mileage out of it.”

Having a career path for operations staff was not as prevalent. That said, 64% of firms with $1 billion-plus had staff in at least two of three operations roles, including operations associate, operating director/manager and chief operating officer. Thirty-eight percent of firms with $250 million to $1 billion had at least two of the three operations roles, compared with just 13% of RIAs with under $250 million.

The survey results also emphasize the need for a compelling compensation strategy in order to be competitive in the marketplace for top talent, Salvi said. Nearly four in 10 firms (39%) said they recruit from other RIAs, compared with 33% who recruit from colleges and universities, 16% from banks or trust companies, 12% from wirehouses and 10% from independent broker/dealers.

“Compensation is not the whole story for people—that’s not what gets them out of bed in the morning,” Salvi said. “But it certainly is a factor in making sure that that’s transparent, competitive, that you have a strategy.”

Equity ownership is increasingly becoming more important, she said. Almost three-fourths of the firms that hire from other RIAs have an equity program in place. Salvi said she heard from a lot of advisors in 2020 who said that despite the fact that these firms didn’t have formal job openings, they were receiving cold calls from employees at other firms.

“The employees really want to see that there’s a path to partnership,” she said. “Not necessarily that, ‘I think I should get equity Day 1 if I joined your firm,’ but knowing that they’re part of something where there’s clear factors and opportunities that have been shared with other people and that it’s a possibility.”

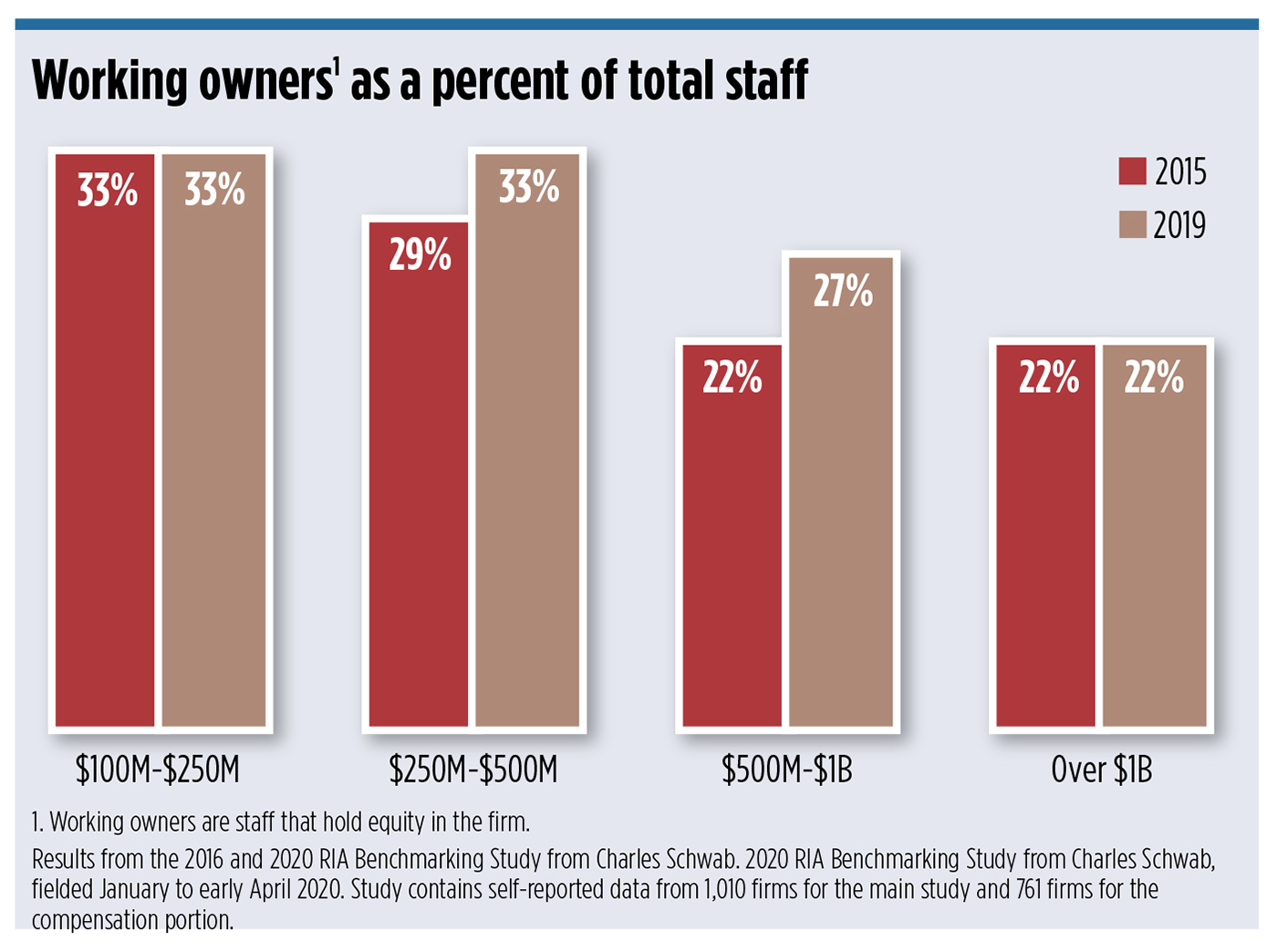

The portion of equity owners hasn’t changed much from 2015 to 2019 for firms with $100 million to $250 million and those with over $1 billion. But there was a bump in equity owners over that time period among firms with $250 million to $500 million and $500 million to $1 billion in assets. (See chart, below.)

“It gives people the opportunity to participate in future growth, and for firm owners, it just creates so many more options for them over the long-term,” Salvi said.

Firms are also realizing equity ownership is important to recruiting and retaining talent.

“Part of the equity ownership story that we’re seeing in those bumps are reflective of the realization that firms at that level have that, going back to scale, we have to develop people for the long-term,” said Jerry Cobb, senior business management consultant at Schwab. “We have to create that path, and we have to show them the rewards that accrue to people who progress down that path.”