Matt Davis, a senior finance major at Bucknell University, watches the hands going up, one by one, until it’s time for a vote. For the past hour, he’s pitched his fellow students on the merits of adding shares of T-Mobile (TMUS) to the investment portfolio managed by a class of 24 senior finance and accounting students. Like many other schools, Bucknell, a private liberal arts university in Lewisburg, Pa., has a Student Managed Investment Fund (SMIF) where they create and manage real-world investment portfolios—and put real money at risk. The student managers, all finance seniors, are responsible for the active management of Bucknell’s SMIF, a $2.5 million portfolio carved out of the Bucknell endowment.

There is nothing simulated nor pro forma about the presentation. Davis expects his investment thesis to be challenged—and it is. The students consider the equity stake from a variety of risk perspectives and filters. Davis recommended the fund shed its positions in Verizon and A&T in favor of T-Mobile. The students try to knock holes in his analysis. Davis holds his ground, armed with data points and graphs to support the thesis that T-Mobile is both undervalued and the carrier best positioned to roll out 5G technology.

Bucknell’s SMIF, like others, is a highly selective, two-semester experiential course which exposes the most serious finance students to the analytical and practical challenges of running a small investment company. Most SMIFs organize fund managers into committees around sectors—consumer, financial, transportation, technology, etc. At Bucknell, students make all portfolio decisions. As long as the investments are within the guidelines, faculty advisors Frank Schreiner (who came to Bucknell after a 33-year career as an analyst at BlackRock) and finance professor Curtis Nicholls execute the trades.

Real-World Opportunity

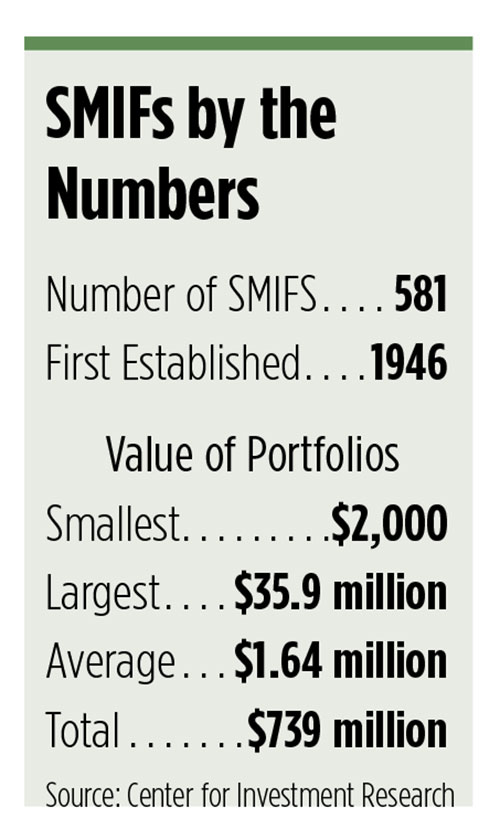

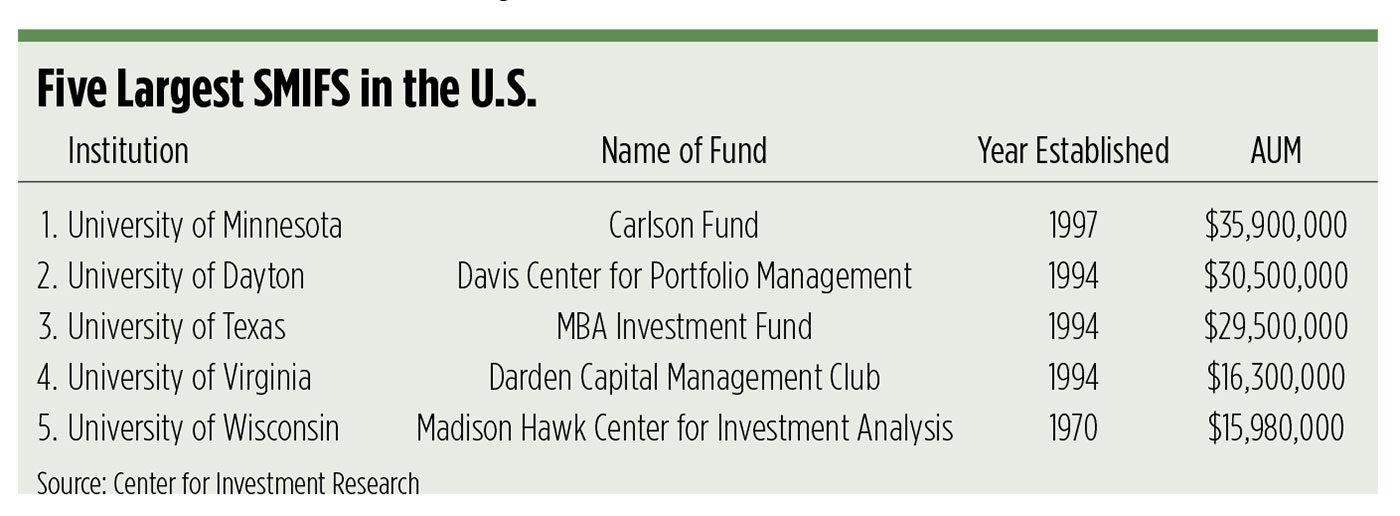

More than 500 U.S. colleges and universities have created SMIF programs. They all share two core features: First, the stakes are real; the programs put real dollars, sometimes tens of millions of dollars, at risk. Two, SMIFs are for-credit capstone courses offered to seniors and MBA students who have distinguished themselves in previous coursework. Student managers are selected through a rigorous application process, including a formal interview and a written research report. Managers act as security analysts and portfolio managers. Students learn to read analyst reports and use Bloomberg terminals to support their theses. Most SMIF programs supplement classroom work with field trips and internships with working market professionals.

SMIF programs do impose some limits. The SMIF at The University of Richmond, for example, invests about $740,000 between a growth fund and a value fund. The funds are in long positions only. Students may not invest in shorts, options, fixed income or derivatives. The program is organized as a student club, which reports to an advisory board. Student managers can pitch stocks, but they must get a majority vote of the other managers to be added to the portfolio.

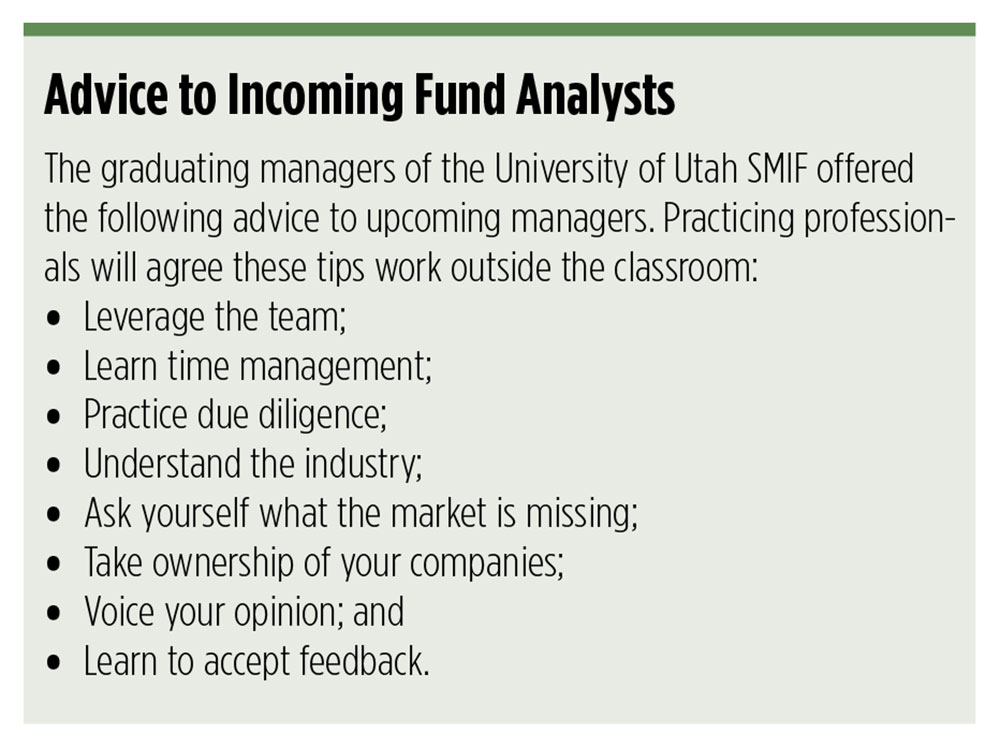

SMIF participants find easier paths to high-paying jobs in the finance sector. Claire Griffiths, general manager/president of the University of Richmond SMIF, is a business administration manager with concentrations in finance, economics and international business. After she graduates in May, she will join Barclays Investment Bank on the sales and trading side. The skills she developed working the SMIF process—team leadership, quickly analyzing a company, constructing a diversified portfolio and proficiency in Excel—helped her land the job.

Griffiths understands the benefits of passive investing but argues there’s still a place for active stock pickers. “We’ve been in the longest bull market in the history of the U.S.,” she notes, adding that the students learn that during bull markets, passive management looks especially good. “It’s in the inevitable down market when active stock management perhaps helps clients lose less,” Griffiths says. “With the collective insights of 18 well-trained finance students, we believe that active management can result in positive alpha.”

Attribution Models and Alphas

SMIF students practice pitching stocks, running attribution models and presenting their arguments. Adjusting the portfolio over time requires constant diligence, says faculty advisor Professor John Earl. “The students tend to do a better job of buying than selling,” he notes, echoing a refrain heard from other SMIF organizers.

According to Griffiths, the students who succeed at SMIF display a combination of hard and soft skills. “The hard skills are a lot easier to learn,” she notes. “The soft skills—a willingness to learn quickly, to know when to defend a pitch and when to back off, the ability to extrapolate and make insights—those often predict the best outcomes.”

As the stakes go up, so do the guardrails. At Michigan State University (MSU), finance students help manage a $6 million portfolio on behalf of the MSU Foundation. MSU students participate in the Student Investment Fund (SIF) program as members of the college’s Security Analysis class.

Student managers make recommendations to the MSU Foundation to buy or sell securities, though the decision to pull the trigger on the recommendation are made by the faculty advisor. “The buck has to stop with someone,” says professor Stephen Schiestel. “We wanted to get closer to the industry standard where the portfolio manager has the final say.”

The policy also gives the MSU Foundation confidence that the Student Investment Fund (SIF) will be monitored during the summer months, when similar programs at other institutions tend to be under-managed.

Students at MSU focus on a small-cap value investment style, finding stocks selling at a discount to intrinsic value. The three-credit course is the only one in the finance department that students can take twice. Doing so provides some continuity from semester to semester. The students are graded primarily on two stock pitches they make. The first pitch—focusing on a stock already in the portfolio—advocates whether the position should be held, added to, trimmed or removed; the second pitch must involve a stock new to the portfolio.

SMIF Open to Accredited Investors

The MBA Investment Fund at the University of Texas at Austin is the only SMIF that allows students to manage, under the guidance of faculty members, investments not only on behalf of the university but also for accredited investors. Organized as a limited liability corporation, the MBA Investment Fund at the McCombs School of Business lets students work with fee-paying clients and oversees about $30 million.

The managers of the Fund are divided into industry sectors and collectively manage both a growth and value strategy. The Growth Fund pursues a top-down investment philosophy following an economic forecast generated by the fund economist—also a student.

Even with the rise of passive investing, professor Clemens Sialm believes the skills required for active portfolio management will continue to be valuable. “The general trend toward passive investing actually opens up opportunities for active investment because if everyone relied on passive investment styles, it would create significant opportunities for mispricing,” he adds.

ESG and Social Good

Students at every SMIF are lobbying their institutions to add ESG funds to the mix. New York University’s SMIF recently replaced one of its small-cap funds with an ESG fund to better reflect the interests of students passionate about the environment and other social causes. The Michael Price Student Investment Fund (MPSIF) is a family of funds, managed directly by MBA students at the NYU Stern School of Business, which was launched in 1999 through a gift from Michael Price, managing partner of MFP Investors. The Fund pays an annual 5% dividend to support students at The University of Oklahoma Price School of Business to attend summer classes at Stern. Since its inception in 2000, the Fund has distributed more than $1 million and has earned a cumulative return (after trading costs) of 5.2% per year, about the same as an equally weighted blend of its market benchmarks. The fund currently has assets of more than $2.2 million.

Other SMIFs are explicitly organized to perform social good. The SMIF at the University of North Dakota is organized as a 501(c)(3) charitable organization and began with $600,000 in seed capital donated by four alumni. Its bylaws require that each year the SMIF distribute 4% of the funds; 1.9% goes to the UND Foundation and 2.1% goes to reimburse expenses incurred by SMIF members. The University of Florida at Gainesville calls its $500,000 fund program “The Gator Student Investment Fund” and divides its members into two groups: Risk management and research, each of which is led by a chief investment officer. The Fund makes annual distributions equal to 3% to charity and 1% to the school.

Back at Bucknell University, An Phan, an accounting major from Hanoi, Vietnam, who will head to Deloitte as an audit analyst after graduation, is one of 23 students to raise her hand in favor of Matt Davis’ proposal to add TMUS to the portfolio. “Matt successfully presented T-Mobile’s competitive advantage having the lead in nationwide 5G and how its strategic merger with Sprint will combine both companies’ products to create more appealing offerings for customers and put the new T-Mobile far ahead in the competition when 5G rolls out,” she says.

The vote is unanimous. The administrative committee instructs the faculty advisors to make the trade. Matt Davis takes his seat to a round of applause from the class. Upon graduation he will begin his career as a private equity placement analyst at Mercury Capital Advisors.