Wealthfront announced Wednesday that it would extend its tax-loss harvesting feature to all taxable accounts, not just those with at least $100,000 invested.

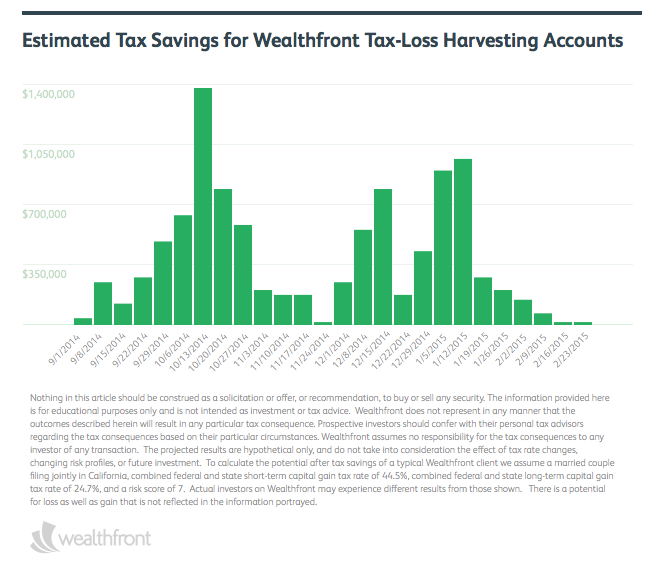

The Silicon Valley company first added the feature to its automated investment service in 2012, and has since added intelligent recovery, optimized harvesting triggers, predictive deposits and tax-sensitive withdrawals. In the last six months, accounts with tax-loss harvesting have realized over $23 million in tax losses, potentially saving them over $9.8 million in taxes, said CEO Adam Nash on the company blog.

“There was only one problem with it. It wasn’t available to all Wealthfront clients,” Nash said. “At Wealthfront we believe everyone deserves sophisticated financial advice, and this brings us one step closer to that that goal.”

The feature will be included in Wealthfront’s standard advisory fee of 25 basis points.

“We know this will make our competitors uncomfortable. But their comfort isn’t out concern, nor is their bottom line,” Nash said.

Charles Schwab recently released a competing robo-advisor, Schwab Intelligent Portfolios, which doesn’t charge advisory fees and offers tax-loss harvesting for accounts over $50,000. In the blog post, Nash referenced “gimmicks and ‘gotcha’-based pricing” used by the investment industry and linked to an article he penned criticizing Schwab.