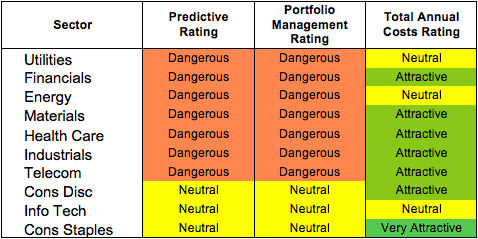

For the first quarter of 2014, only three sectors manage to even earn a Neutral rating. My sector ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each sector.

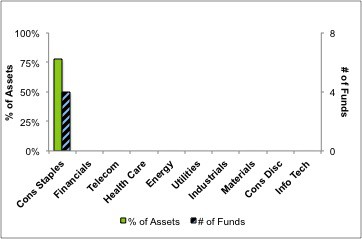

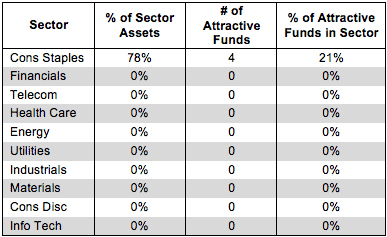

Investors looking for sector funds that hold quality stocks should look no further than the Consumer Staples sector. Only this sector houses Attractive-or-better rated funds. Figures 6 and 7 provide details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs

Note that the Attractive-or-better Predictive ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) low fees can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by sector. See my free ETF & mutual fund screenerfor rankings, ratings and free reports on 7000+ mutual funds and 400+ ETFs. My fund rating methodology is detailed here.

All of my reports on the best & worst ETFs and mutual funds in every sector and investment style are available here.

Figure 1: Ratings For All Sectors

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only four sector ETFs and mutual funds meet these requirements, which is only 0.5% of all sector ETFs and mutual funds.

State Street Consumer Staples Select Sector SPDR (XLP) is my top Consumer Staples ETF. It earns my Attractive rating by allocating over 39% of its value to Attractive-or-better-rated stocks.

The Coca-Cola Company (KO) is one of my favorite stocks held by XLP. KO earns my Attractive rating. KO has grown itseconomic earnings by 10% compounded annually over the past decade. The soft drink maker has earned a double-digit return on invested capital (ROIC) in every year of our model going back to 1998. Usually one has to pay a premium for a blue chip stock like KO, but it’s currently valued fairly modestly. At its current valuation of ~$40/share, KO has a market-implied growth appreciation period (GAP) of only five years. A more reasonable GAP for a Consumer Staples company would be between 15 and 20 years. If we give KO credit for 15 years of growth at a long-term rate of 6.5%, the stock is worth over $55/share today.

Rydex Series Funds: Utilities Fund (RYUTX) is my worst Utilities mutual fund. It gets my Very Dangerous rating by allocating over 91% of its value to Neutral-or-worse-rated stocks, and to make matters worse, charges investors total annual costs of 4.79%.

Duke Energy Corp (DUK) is one of my least favorite stocks held by RYUTX. DUK gets my Dangerous rating. DUK’s 2012 acquisition of Progress Energy helped it to grow revenue by $5 billion, but it added very little in shareholder value as DUK’s ROIC only increased by one-tenth of a percentage point to 3.6%. Unfortunately, the acquisition also helped balloon DUK’s debt from $21 billion to $42 billion. Add in DUK’s deferred tax liabilities and underfunded pensions and it has over $54 billion (112% of market cap) in long-term liabilities.

DUK’s current valuation of ~$68/share implies that the company will grow after-tax operating profit (NOPAT) by 8% compounded annually for ten years. In the ten years prior to the Progress Energy acquisition, DUK’s NOPAT actually declined slightly. Prospects don’t look good for DUK to justify its valuation.

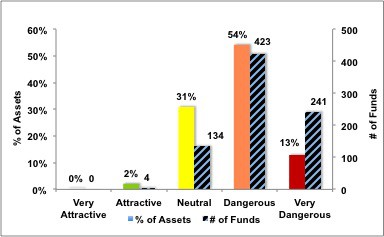

Figure 2 shows the distribution of our Predictive Ratings for all sector ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

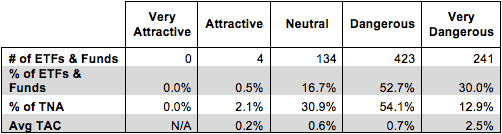

Figure 3 offers additional details on the quality of the sector funds. Note that the average Total Annual Cost of Very Dangerous funds is almost 13 times that of Attractive funds.

Figure 3: Predictive Rating Distribution Stats

* Avg TAC = Weighted Average Total Annual Costs

* Avg TAC = Weighted Average Total Annual Costs

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors deserve to have the best of both and we are here to give it to them.

Ratings by Sector

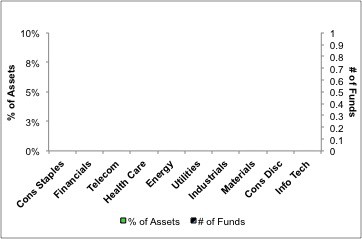

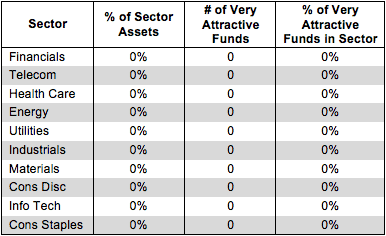

Figure 4 presents a mapping of Very Attractive funds by sector. The chart shows the number of Very Attractive funds in each sector and the percentage of assets in each sector allocated to funds that are rated Very Attractive.

No sector funds earn my Very Attractive rating.

Figure 4: Very Attractive ETFs & Mutual Funds by Sector

Figure 5 presents the data charted in Figure 4

Figure 5: Very Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Source: New Constructs, LLC and company filings

Figure 6 presents a mapping of Attractive funds by sector. The chart shows the number of Attractive funds in each sector and the percentage of assets allocated to Attractive-rated funds in each sector.

Note that the Consumer Staples sector is the only sector that houses Attractive-rated funds. Over 75% of investor assets in the Consumer Staples sector are in Attractive-rated funds. Investors are putting their money in the right places when it comes to Consumer Staples funds.

Figure 6: Attractive ETFs & Mutual Funds by Sector

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Sector

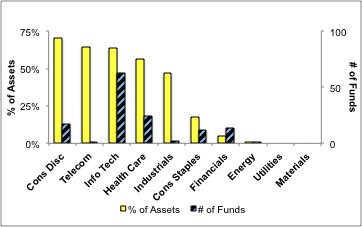

Figure 8 presents a mapping of Neutral funds by sector. The chart shows the number of Neutral funds in each sector and the percentage of assets allocated to Neutral-rated funds in each sector.

Figure 8: Neutral ETFs & Mutual Funds by Sector

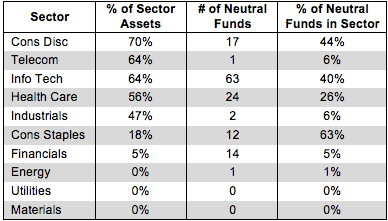

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Sector

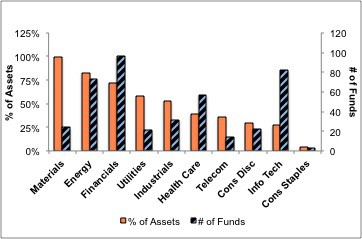

Figure 10 presents a mapping of Dangerous funds by fund sector. The chart shows the number of Dangerous funds in each sector and the percentage of assets allocated to Dangerous-rated funds in each sector.

Note that even the highest rated sectors have some Dangerous funds. Even in a good sector, investors have to beware of the bad funds. To avoid owning a fund that blows up, you have to do your diligence.

Figure 10: Dangerous ETFs & Mutual Funds by Sector

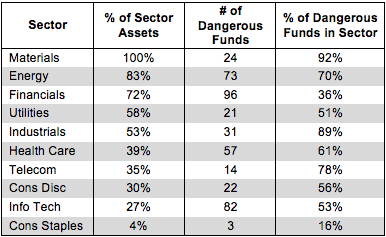

Figure 11 presents the data charted in Figure 10.

Figure 11: Dangerous ETFs & Mutual Funds by Sector

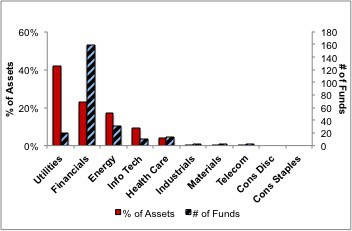

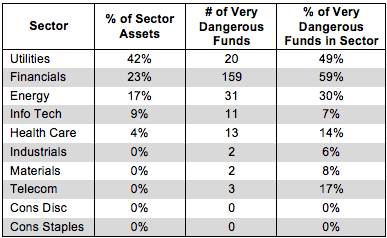

Figure 12 presents a mapping of Very Dangerous funds by fund sector. The chart shows the number of Very Dangerous funds in each sector and the percentage of assets in each sector allocated to funds that are rated Very Dangerous.

There are almost 160 Very Dangerous rated Financials ETFs and mutual funds. These funds exist only to make money for the managers and the fund company, not for investors. Fund providers put out these low-quality, high-fee funds and rake in the cash from those naïve enough to buy in. Investors don’t need 160 Financial funds, and they certainly don’t need 160 Very Dangerous ones.

Figure 12: Very Dangerous ETFs & Mutual Funds by Sector

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Dangerous ETFs & Mutual Funds by Sector

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector or theme.