The wirehouses may still have the biggest share of the assets, but the independents are right on their heels. In the first quarter of this year, long-term mutual fund assets grew at a faster pace at the independent broker/dealers, regionals and RIAs than at the wirehouses, according to new research by Access Data, a Broadridge company, and Strategic Insight, an Asset International company.

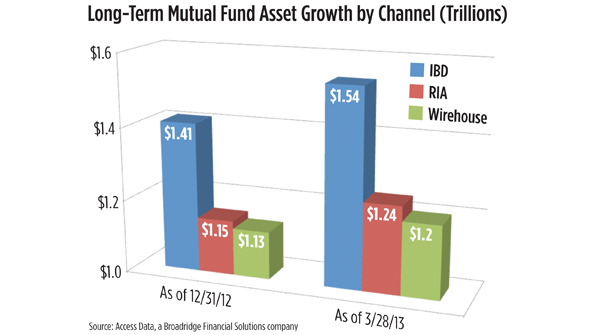

First quarter mutual fund assets grew by 9 percent at the IBDs and by 8 percent in the RIA channel from the end of 2012. Meanwhile, mutual fund assets at the wirehouses was up 6.5 percent from last year. And if you look at all of 2012, total mutual fund and ETF assets at the IBDs and RIAs grew at twice the rate as the wirehouse channel.

“One of the things we think is definitely driving this is the interest of investors to have independent advisors that manage a portfolio for them, as opposed to just buying products on commission,” said Frank Polefrone, senior vice president of Access Data.

In addition, while mutual fund firms have traditionally focused their distribution efforts on the big four wirehouses, they’ve started to expand beyond those firms, to address the independent advisor market and take advantage of the growth in that channel, said Dennis Bowden, senior research analyst at Strategic Insight.

A key driver of that, Bowden said, is the evolution of fee-for-advice culture in the U.S. Both investors and advisors are seeking fee-based portfolio management, as opposed to the traditional transactional approach of buying one fund at a time.

Many fund managers who, 10 to 15 years ago, primarily reached mutual fund investors through direct platforms, such as Charles Schwab, are now going through advisors, Bowden said. That could also be driving the growth at the independents.

“Those traditionally direct-sold firms more and more are seeing a lot of their growth come through advisor-sold channels.”