Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com

Citigroup (C) is in the Danger Zone this week and earns my Dangerous rating. Citigroup’s stock has posted an impressive 20% rise thus far in 2013, but the stock’s current price is simply out of touch with reality. As the market bulls continue to look to rising interest rates as a sign of future strength for Citi, they ignore the fundamentals of the market and of Citi’s weak profit history.

Dangerous Fundamentals

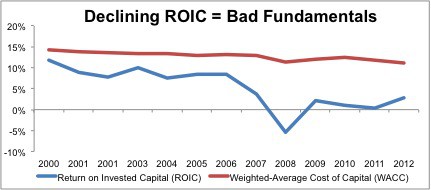

Even before the financial crisis, Citi struggled to create value for investors. Figure 1 shows that Citi’s return on invested capital (ROIC) has been below its weighted average cost of capital (WACC) in every year since 2000, which means Citi has not had positive economic earnings any year in this century. Citi is the only one of the Big Four financial institutions with this ignominious distinction.

Since 2000, Citi’s after tax profits (NOPAT) have declined by 4% compounded annually. During this time, its return on invested capital (ROIC) has fallen from 12% to under 3% in 2012, putting it in the bottom quintile of all companies I cover.

Figure 1: Return on Invested Capital vs. Weighted Average Cost of Capital

The main issue is that despite its weak history, Citigroup continues to be highly overvalued by investors. Investors and analysts are missing red flags in the footnotes and making mistaken assumptions about future profitability. The end result is that Citi’s valuation is out of sync with its fundamentals.

Hidden in the Footnotes

Taking a closer look at the financial footnotes reveals management failure to create value for investors. Specifically, in 2012 Citi recorded $6.4 billion in asset write-downs in 2012 alone, and over $17 billion total in write-downs over the past few years.

In fact, Citi posted the greatest net amount of asset write downs of any company in 2012, equal to almost 10% of its revenue. The fact that Citi is a leader in destroying shareholder value should be a red flag for investors.

Rising Interest Rates Does Not Mean Rising Margins

Per my article on why I’m bullish and we are not in a bubble, I believe the economy is improving, albeit slowly but surely. The Fed seems to agree and has signaled it will taper quantitative easing in the foreseeable future.

Of course, QE tapering means rising interest rates, which usually imply rising net interest margins and profit growth for lending institutions.

However, I do not believe Citi will benefit from rising rates as much as the market expects. For Citi’s net interest margin to rise, the firm needs to add a substantial amount of higher-margin loans to its book. To achieve that profitable growth, demand for new loans needs to be high. And I do not think demand for debt is or will be very high again anytime soon.

There is no pent up appetite for debt. Those hungry for additional cash have already been sated at ultra-low rates and will have no need for debt when interest rates rise.

Key to the Fed’s strategy to keep interest rates low for the past several years is to incentivize borrowing and lending. That strategy has worked as many people and firms, even those that do not need to borrow, have taken on debt to take advantage of low rates.

Even Apple (AAPL) with over $100 billion in cash on their balance sheet took on debt to pay its shareholder dividends, taking advantage of low rates while they persist. The cash will stay on their balance sheet, but these interest rates are a temporary luxury.

The more rates rise in the future, the slower borrowing will be. For example, how much mortgage refinancing should we expect after mortgage rates rise? Most anyone who needed or wanted to refi has likely done so by now, perhaps multiple times. The same is true for most other types of borrowing.

Some have touted Citi’s global presence as a key asset as other more domestic-oriented corporations work to catch up to Citi’s reach. This may be true, but as long as economic weakness persists in Europe (i.e. Euro debacle) and Asia (i.e. Japan, the world’s #3 economy) there is not much opportunity for Citi to generate profits. Moreover, as long as interest rates in Europe and Asia remain near rock bottom, Citi’s net interest margins will continue to remain low and its earnings will continue on the same track. I think Citi may have sucked all the blood out of the international turnip.

No Easy Way Up

Even if Citi were to streamline its business, dump all bad debt and focus only on the most profitable portions of its business, it still has a long way to go to justify the expectations in its stock’s current valuation. To be specific: assuming Citigroup can maintain the huge NOPAT margin increase it achieved in 2012 (from 1.4% to 13.7%), it still needs to grow after-tax profit (NOPAT) by nearly 12% compounded annually for 15 years to justify its current stock price of ~$50/share.

A look at Citi’s history makes such a growth expectation seem unlikely. For the past 14 years, Citi has grown NOPAT by 1% compounded annually, with an average margin of under 13%. To meet the market’s expectations, Citi would need a return to its growth rate and margins from mid-2000’s. which were rather unusual times. With tightened financial regulation, the market rally slowing down, and no asset bubbles in sight, it’s hard to see how 2013 Citi can match the profitability of 2005 Citi.

Watch Out for the ETFs and Mutual Funds that Hold C

Investors should avoid the following ETFs and mutual funds due to their Dangerous or worse rating and their significant (4% or more) allocation to C:

1. Vanguard Financials Index Fund Admiral Shares (VFAIX)

2. Rydex Series Banking Funds (RYBKX, RYKCX, RYKAX, RYKIX)

3. Saratoga Advantage Trust Financial Services Portfolio (SFPAX, SFPBX, SFPCX)

4. RevenueShares Financials Sector Fund (RWW)

5. Vanguard Financials ETF (VFH)

André Rouillard and Sam McBride contributed to this article.

Disclosure: David Trainer, Sam McBride and André Rouillard receive no compensation to write about any specific stock, sector or theme.