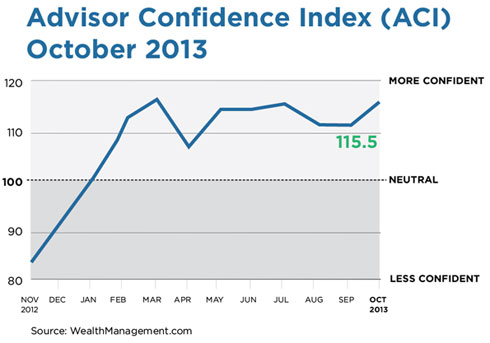

Financial advisors are again increasingly optimistic about the future of the U.S. economy and the stock market. The WealthManagement.com Advisor Confidence Index rose 3.1 percent in October to a level of 115.5. The overall confidence level has risen 14 percent since the beginning of the year.

The Advisor Confidence Index is a monthly poll of some 150 financial advisors asking how optimistic they are over the near-term future of the economy and stock market. A reading over 100 indicates optimism. October reverses the previous two months’ decline in investor optimism, and is the largest one-time gain since May of 2013.

While advisor optimism over the future continues to tick upward, they continue to be less confident about today. Their assessment of the current state of the economy actually fell 3 percent during the month, mostly based on the federal government’s inability to compromise on debt and spending which led to a brief government shut down.

At the same time, their confidence in the near-term future of the stock market increased 10%, a record for the year.

“There is a range of legitimate economic and political concerns that could undermine economic growth. Still, I am cautiously optimistic that we'll be able to navigate these sufficiently and that economic and market growth will continue,” said Kevin Gahagan of Mosaic Financial Partners in San Francisco.

“Despite the overall uncertainty this month, this has been one of least volatile years in market history,” in terms of days where the Dow moves up or down by more than one percent, said Andy Knott from Wintrust Wealth Management. “Since the signing of Dodd-Fank legislation in July 2010, the Dow has withstood a number of crisis, including the US debt downgrade, European sovereign debt downgrades, Obama re-election, sequestration and now the debt ceiling crisis. While the future is unknowable, there is no technical evidence of a major change in the direction of US market benchmarks and for now, they remain positive.”

While advisors confidence in the current state of the economy fell during the month, their optimism over the economy in twelve months rose 4.7 percent compared to the previous month.

“Despite some current political challenges and a modest U.S. GDP in 2013, I believe that the overall U.S. economy is on a positive trajectory trend going forward because of such things as a new Fed Chairwoman in 2014, positive corporate profits, decreasing unemployment numbers,” said James R. Veal from JRV Wealth Management. “The stock market is a leading indicator and has done quite well thus far in 2013.”

Many advisors laid the blame for the current weak economy on the federal government’s inability to come to consensus over spending and debt levels. If it continues, many said, it could be the mitigating factor that will slow down the economy, or possibly lead to another downdraft.

“Positive economy over the next six to 12 months but the stock market is likely to lack direction as there will continue to be indecision in Washington. Fed tapering, new fed chair, and another debt ceiling fight will make things difficult in the short term. Long-term investors should be fine as long as they are able to stay in their seats,” said Nathan Baumann with LVZ Advisors in Michigan.

| Key Stats: |

|---|

| Current state of the economy: -3% |

| Economy in six months: 0.8% |

| Economy in twelve months: 4.7% |

| Markets in six months: 10.2% |

WealthManagment.com’s ACI records the views of a panel of some 150 financial advisors who agreed to participate on a monthly basis, recording their level of confidence across four categories: confidence in the current state of the economy, confidence in the economy in both six months and 12 months, and confidence in the near-term future of the stock market.

About Advisor Confidence Index’s Methodology

The Advisor Confidence Index is a benchmark that gauges advisors’ views on the economy. The ACI captures the views of a panel of 130 financial advisors, all of who agreed to respond to the survey. The survey asks four questions – an advisor’s view on the economy, the economy in six months, the economy in twelve months and the stock market – on a scale from most pessimistic to most optimistic. The cumulative average is calculated for each question and then added for the overall benchmark.

About WealthManagement.com

As the digital resource of REP. and Trusts & Estates, WealthManagement.com provides everything wealth professionals need to know to stay knowledgeable about the industry, build stronger relationships, improve their practice, and grow their business—all from one site. It boasts more than 60 editorial contributors who provide content for the more than 645,000 members of our wealth management community.

About Penton

For millions of business owners and decision-makers, Penton makes the difference every day. We engage our professional users by providing actionable ideas and insights, data and workflow tools, community and networking, both in person and virtually, all with deep relevance to their specific industries. We then activate this engagement by connecting users with tens of thousands of targeted providers of products and services to help drive business growth. Learn more about our company at www.penton.com/.

Penton is a privately held company owned by MidOcean Partners and U.S. Equity Partners II, an investment fund sponsored by Wasserstein & Co., LP.

###

Contact for WealthManagement.com:

David Armstrong

Editor-in-Chief

WealthManagement.com

Phone: (212) 204-4398

Email: [email protected]

Contact for Penton:

Kate Spellman

SVP, Marketing

Penton

Phone: (212) 204-4351

Email: [email protected]