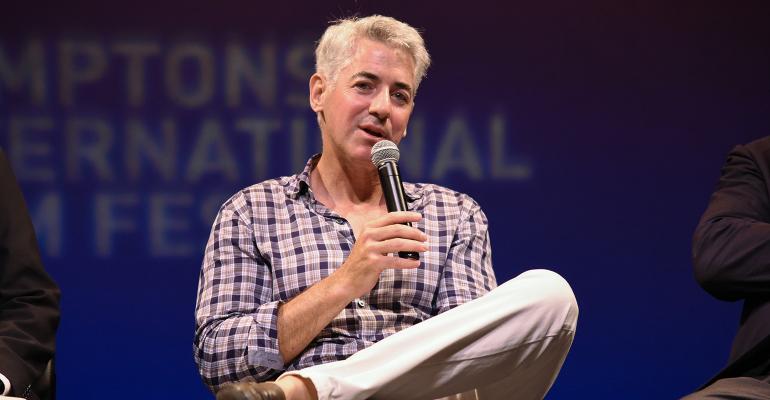

(Bloomberg Opinion) -- Every so often there are news reports of someone generating seemingly impossible returns in the financial markets. Several media outlets reported recently that hedge fund manager Bill Ackman made a 9,530% return in March, turning $27 million into $2.6 billion. So-called tail-risk hedge fund Universa Investments LP posted a 4,144% return that same month.

Most people probably can’t easily process these numbers or relate them to more normal performance like earning 2% on a bond or 9% in an equity mutual fund. It feels like lottery-ticket territory, which breeds doubts that the results are true. This is unfortunate, because there is useful information in the reports, but it’s presented in a highly misleading way.

The best way to think about these gains is that they were essentially insurance payouts divided by a premium payment. For example, suppose you pay $100 per month for homeowner’s insurance on a house valued at $250,000. One day the house burns down and you collect $250,000. Would you call that a 249,900% return on the $100 monthly premium? No, you’d say you recouped 100% of the $250,000 pre-fire value of the house. You weren’t trying to make a good trade with your monthly premium payment, you were trying to protect the value of your housing investment.

In Ackman’s case, later details revealed he had agreed to pay $40 million per month for five years for credit-default swap contracts that paid $2.6 billion when the virus lockdown sent the credit ratings on many corporate bonds to below investment grade, or junk. The $27 million was the amount he paid before the virus crisis hit and he collected on the trade.

The appropriate denominator for the profit is not the one-month or five-year premium, but the value of what Ackman was protecting. The hedge was for his $8 billion Pershing Square Capital Management fund, so he was paying a premium of 0.5% per month of assets for a hedge that paid off an amount equal to 33% of the fund’s assets. A nice trade, especially considering that he didn’t even have to pay a full month’s premium, but not a 9,530% trade.

The Universa situation is similar. The fund recommends allocating 96.67% of assets to the S&P 500 Index and 3.33% to Universa. But this doesn’t mean the client hands over 3.33% of assets at one time and has protection forever. The 3.33% is like an insurance premium, it gets used up. My estimate is that it lasts about 15 months if there is no equity crash. If you want continuous protection from Universa, you have to keep paying the bills.

The meaningful denominator for reporting hedge results is 100% of the client’s portfolio. This gives a 12.8% return, or about five years of premium payments. But Universa’s 4,144% is instead computed on 10% of the 3.33% because that’s apparently the amount typical investors fund at one time. I estimate that as about six weeks’ premium. That 12.8% can be compared to my estimate of 0.22% of portfolio assets investors lose with the recommended 3.33% allocation to Universa in months other than the big crash months of October 2008 and March 2020.

Whether this is a good or bad deal depends on the frequency of big crashes. One like we had in 2008 pays for about 20 years of premiums, while a March 2020 pays for about five years. If you started in 2008, you’re ahead of the game, having paid a bit over 12 years of premiums and collected about 25 years of premiums in two events. But, of course, it’s hard to know whether the next 12 years will have more and bigger crashes, or fewer and smaller.

Universa’s numbers are not completely transparent, so I could be a bit off on my calculations. But the point is that reporting a 12.8% gain in March 2020, versus a 0.22% average monthly loss if there is no crash, is the rational way to think about Universa’s performance. A figure like 4,144% isn’t useful information. Similarly, reporting Ackman’s trade as a 33% gain on a 0.5% average monthly premium is the right way to think about it.

In a better world, any reported return would be accompanied by the disclosure of what denominator is used. Most investors are used to thinking of the capital they put up as the denominator. If you invest $100 in a fund, then a 10% return means a gain of $10. But for hedges, the amount you put up isn’t the point; what you’re trying to protect is. If you pay $1 for protection on a $100 portfolio, a $10 gain should still be a 10% return (versus 1% cost), not a 1,000% return.

To contact the author of this story:

Aaron Brown at [email protected]

To contact the editor responsible for this story:

Robert Burgess at [email protected]