When I see the growing popularity of SPACs, the blank-check special purpose acquisition companies, I get worried. Not because they are an unhealthy investment (which they are); in fact not because of any misgivings with SPACs themselves (though I have misgivings). I get worried because SPACs have the earmarks of innovations that precede market distress, namely lack of transparency, difficult risk assessment, and moral hazard. That is, SPACs are a canary in the coal mine for market vulnerability.

Innovations like SPACs tend to come during times of rampant positive sentiment, when people are in "house's money" mode. The innovations might be useful but become overstretched, or they might be designed specifically to play on market exuberance. Ones of particular note include the junk bonds in the late 1980s that fueled LBOs and spurred the Savings and Loan Crisis, as the S&Ls borrowed cheaply and securely and invested in the high coupon junk bonds, overleveraging in the process; the creative interpretations of accounting standards in the early 2000s, which coupled with a failure of due diligence led to a succession of high-profile failures, the most notable being Enron, WorldCom, and Tyco; and the collateralized debt obligation complex (CDOs, CDO-squared, synthetic CDOs) that triggered the downward spiral in banks ushering in the 2008 crisis.

These were symptomatic of the excesses that led to the vulnerability. They were prime movers for the various crises, but before things came crashing down they each were symptomatic of a market that was open for play. And once this vulnerability was coupled with a market shock, we had the crisis as a result.

These sorts of innovations tend to have these characteristics:

- They have little to no precedent. They are new instruments or strategies—naturally, or else they would not be called innovations—and so they can take on risk that is not readily recognized, and if recognized not easily measured.

- The risk is not transparent. This can come from complexity like synthetic CDOs, or an informational advantage, as was the case with the accounting issues in the early 2000s.

- They feed off of moral hazard. That is, they have a “heads I win, tails you lose” structure. The too-big-to-fail institutions in the 2008 crisis are the poster child for this. In a market that seems to be going nowhere but up, people forgive the fine print in their structure that leaves someone else holding the bag in a downturn, because, what could go wrong?

- They are built for speed. The quicker out the gate, the more money is there for the taking, and the more time there is before the market wakes up or the regulators react—if they ever do. So the innovations hit the market running, building up exposure very quickly.

Where do SPACs fit into this universe?

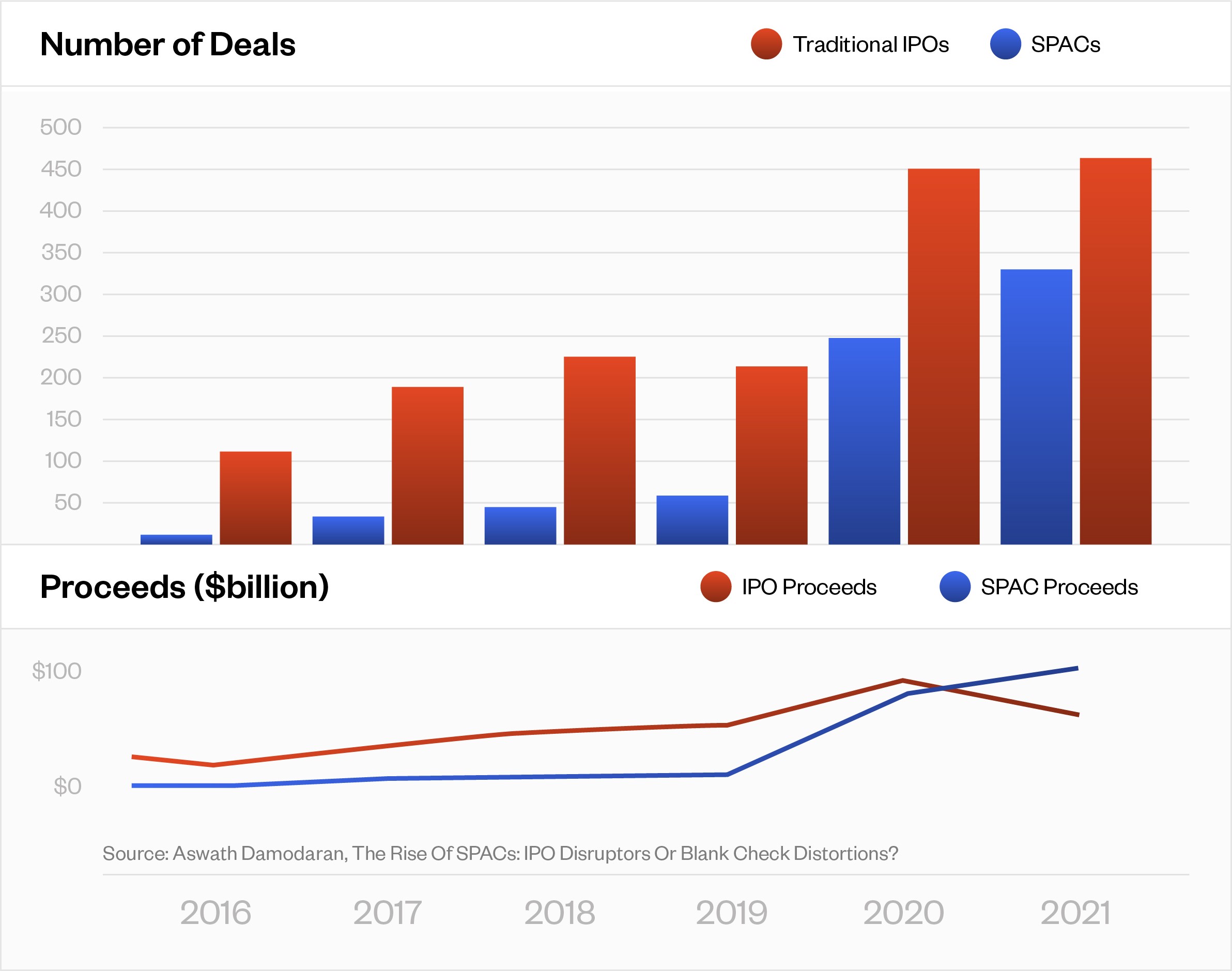

SPACs have become a force over the past two years. In 2020, their dollar proceeds matched those of traditional IPOs, and so far in 2021 they are higher. In the past two years, the number of deals has risen from being less than a quarter of those for traditional IPOs to being four times as many.

Sponsors love SPACs because they collect a fee that can run up to 25% of the deal value. With the 25% to the sponsor coming out of the pocket of the investors, a recent study shows that overall investors have lost money in SPACs. More worrisome than the investor-to-sponsor wealth transfer is the extent to which they check all the boxes previously described for “innovations” that may signal broad market vulnerability

- No precedent: SPACs don't have a long or well-known operating history to know how they might react and how the market interest for them will change in different market conditions.

- Low transparency: In terms of disclosure front, SPACs have more leeway in making projections and "talking their book" than do traditional IPOs. Also, SPAC sponsors do the deal-making role, taking on the due diligence role as well. Small investors, facilitated by new online trading platforms, are active in the market and are on the receiving end of informational asymmetries. Far from performing due diligence or analysis of value, their prime source for SPAC decisions is celebrity appeal, including social media influencers like Chamath Palihapitiya and athletes like Serena Williams.

- Moral hazard: Sponsors receive a significant stake, about 20%, while contributing little or nothing to the capital pool.

- Built for speed: The chart shown above speaks for itself.

The point here is not that SPACs pose a systemic risk for the markets. For all of their popularity, they do not pose the danger of, say, CDOs, which grew to be a huge market and pointed to the heart of the financial system. Rather, the point is that SPACs are a notable instance of innovation, the sort that meets key criteria for pinpointing a period of increased market vulnerability.

Rick Bookstaber is founder and chief risk officer at Fabric RQ. He previously held chief risk officer roles at Morgan Stanley, Solomon Brothers, Bridgewater Associates, and the University of California Regents and served at the U.S. Treasury in the aftermath of the 2008 crisis. He is the author of The End of Theory (Princeton, 2017) and A Demon of Our Own Design. Mr. Bookstaber holds a doctorate in economics from MIT.