It is highly likely that financial advisors have been flooded with client questions regarding cryptocurrencies, and rightfully so, as digital currencies have taken the investment world by storm over the past few years. Whether you are a longtime skeptic like me, or a true Bitcoin believer, you can no longer punt the question.

But answering the crypto questions that come your way is not easy, as one must not only know the potential risk and reward for investing in Bitcoin or other crypto coins, but also have workable knowledge of blockchain and how cryptocurrencies work.

This article is not a Crypto 101 introduction nor my thoughts on Bitcoin’s staying power and chance to unseat the U.S. dollar as the world’s reserve currency. Rather it is intended to help you understand the risks and rewards of implementing digital currencies in your client portfolios, and the potential portfolio strategies that one can implement.

Full disclosure: I’m a skeptic and neither I nor my immediate family members own cryptocurrencies. However, the following analysis opened my eyes to the benefits of including crypto/Bitcoin in investment portfolios.

Not only is investing in cryptocurrencies immensely popular within the retail crowd, institutions have also jumped into the digital world. Firms like MassMutual have purchased large amounts, you can transact using Bitcoin on PayPal, and on apps such as Square and Robinhood, while brokerages like Morgan Stanley say investors should incorporate Bitcoin into their portfolios.

And while investing in cryptocurrencies is not as easy as buying a stock or mutual fund, that hurdle is diminishing. Fidelity added Bitcoin trading to their platforms while other brokerages like Morgan Stanley and JPMorgan are following suit. Exposure to cryptocurrencies can be achieved through separately managed accounts or publicly traded trusts like Grayscale Bitcoin Trust. For those looking for a more traditional vehicle, a number of asset managers, including Fidelity, have petitioned the Securities and Exchange Commission to offer a Bitcoin ETF.

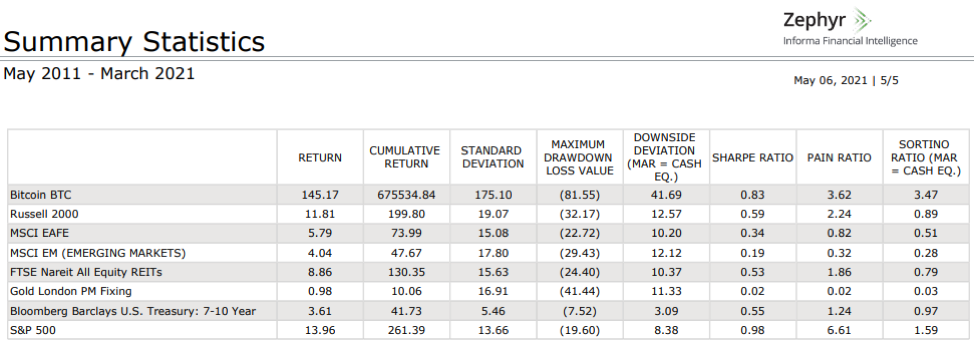

As for the analysis of Bitcoin as an investment, we turn to quantitative analytics (Figure 1). It is no secret that Bitcoin is a risky asset regardless of what risk measure you choose. It is in a class of its own. What is more surprising is the attractive risk-adjusted performance. The “to-the-moon” returns help offset the huge risk, which results in strong risk-adjusted performance regardless of what measure you use.

It is worth mentioning that the time frame used in this analysis starts in June 2011, when the return stream for Bitcoin starts. If I shorten the time frame to say, five or three years, the risk-adjusted scores for Bitcoin only improve and are the highest among the other asset classes listed. As you will see shortly, the strong Sharpe ratio makes it a very attractive option within portfolios created by leveraging an efficient frontier and modern portfolio theories.

Bitcoin Returns Source - Koyfin Analytics

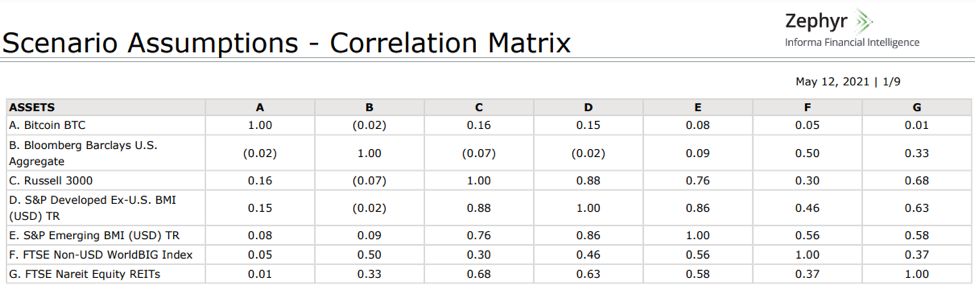

The next step is to see how Bitcoin impacts investment portfolios. One of the three building blocks to building an investment portfolio is incorporating assets that behave differently, which benefits Bitcoin, due to its low correlations to other major asset classes (Figure 2).

Bitcoin Returns Source - Koyfin Analytics, Date Range 6/2011 - 3/2021

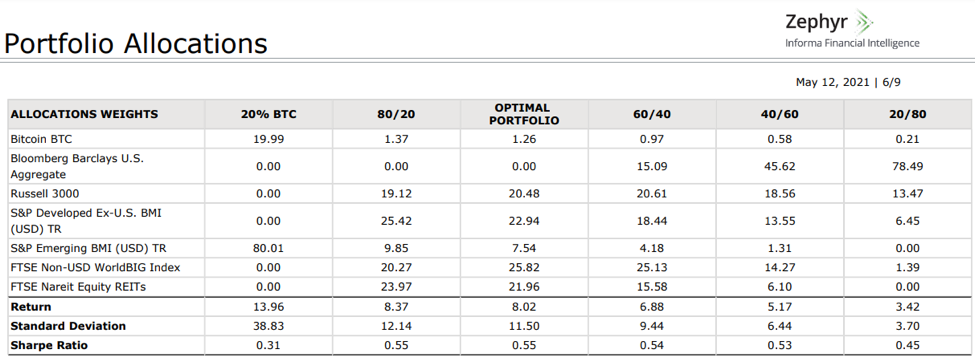

The solid diversification and risk-adjusted metrics make it an attractive addition to investment portfolios, which we see when building an efficient frontier. There are three items that jumped out at me when comparing an efficient frontier with Bitcoin and one without when all other inputs and assets are equal. First, there is minimal differences between the efficient frontier that includes Bitcoin and the one that does not. In fact, they nearly overlap each other.

Second, nearly every portfolio along the efficient frontier includes an allocation to Bitcoin; even a conservative 20/80 portfolio calls for a 0.20% allocation. Last, the most efficient/optimal portfolio (highest Sharpe ratio) along the efficient frontier includes a 1.26% allocation to Bitcoin. If you shorten the time frame to five years from the common start date (June 2011) used in the optimization, the allocation to Bitcoin in the most optimal portfolio jumps to 6.75% and the portfolio Sharpe ratio increases to 0.55.

It is worth noting that the efficient frontier is skewed to the upper-right corner due to Bitcoin’s large return and risk levels. As a result of that skewing, many of the portfolios right of 40% standard deviation have a huge allocation to Bitcoin, which are not prudent portfolios for most of your clients.

In Figure 3, you can see the portfolio allocations with the corresponding returns, standard deviations and Sharpe ratios for the portfolios. Again, notice the allocation to Bitcoin across all portfolios, albeit small in the 20/80 portfolio.

Bitcoin Returns Source - Koyfin Analytics

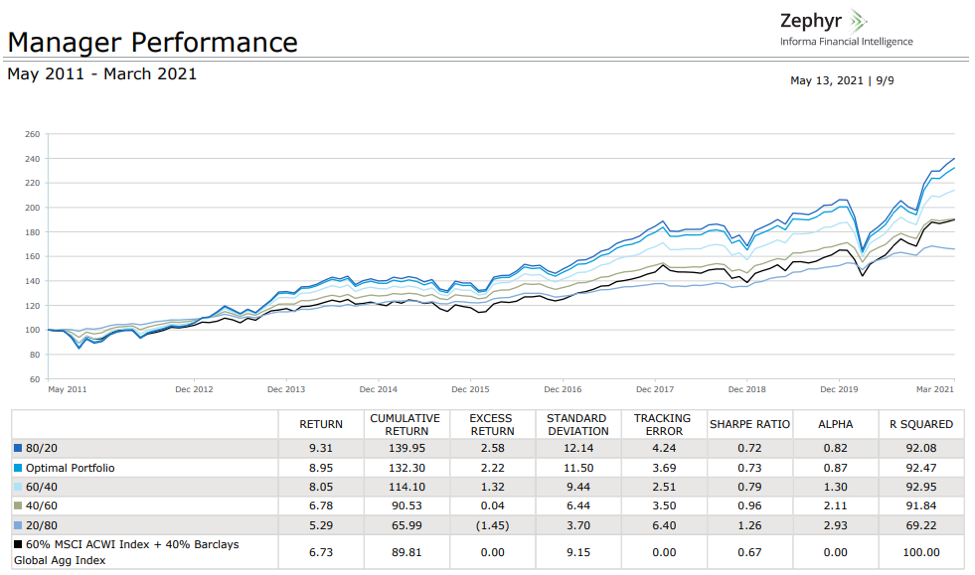

Finally, when backtesting these portfolios from the common date (June 2011–March 2021) you can see that all the portfolios had strong performance (Figure 4). Interestingly, all five portfolios had better Sharpe ratios than the blended benchmark of 60% MSCI ACWI/40% Barclays Global Aggregate.

The most conservative portfolios exhibited the best risk-adjusted returns, while the 80/20 portfolio with a 1.37% allocation to Bitcoin had the best absolute return figures—in fact it was very comparable on a risk-adjusted basis to the optimal portfolio.

Bitcoin Returns Source - Koyfin Analytics, back tested analytics based on portfolio allocations created above.

Cryptocurrencies have gained in popularity in large part due to their eye-popping returns and investors’ fear of missing out. Institutions have taken notice and started to implement crypto strategies that have increased the accessibility but also the questions that financial advisors must answer. After digging deep into the investment analytics behind Bitcoin, this longtime crypto skeptic uncovered answers and some positive impacts of including Bitcoin in globally diversified investment portfolios.

Ryan Nauman is a market strategist at Informa Financial Intelligence’s Zephyr. Both Informa Financial Intelligence and Wealthmanagement.com are owned by Informa Plc.