By Michael Hunstad, Michael De Juan and Jessica K. Hart

As an advisor, you often face the challenge of understanding the risks and bets that are buried within client portfolios. Their assets may be diversified, but what about their risks? This is why you should look at asset allocation through the lens of its underlying risks (you may be surprised). Analyzing portfolios using macro factors is an effective way to do so.

How Factors Help

Factors are the primary drivers of risk and return in asset classes. As everyday meals are a combination of ingredients, every asset class is a combination of underlying risk factors. This means they are useful in explaining how returns or risk vary.

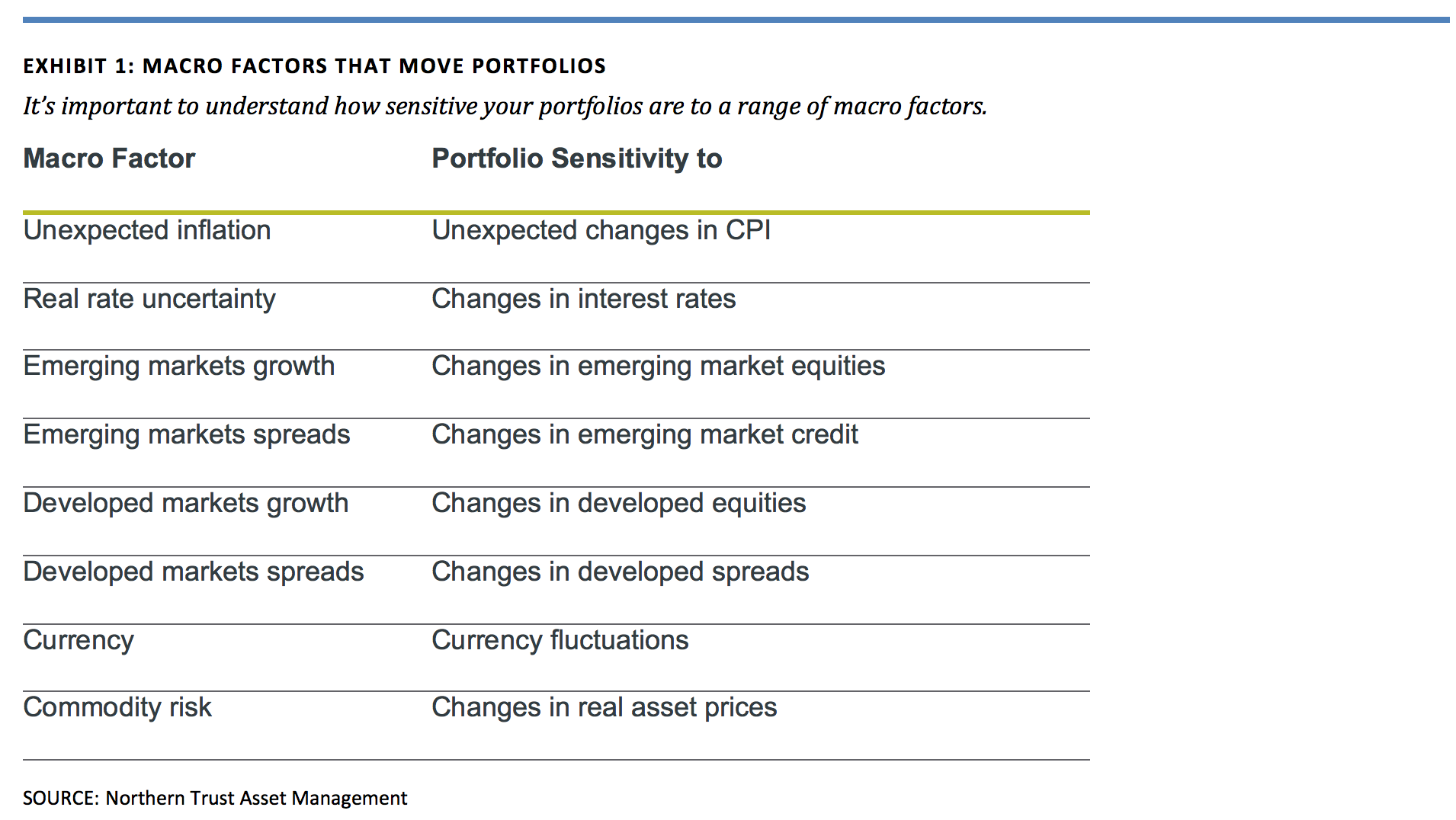

We often talk about style factors that influence individual stocks: value, volatility, momentum, growth or quality. But here, we’re talking about special types of factors that can influence multiple asset classes. These are “macro factors” that represent variables used to measure the state of the economy: inflation, currency, interest rates and others listed in Exhibit 1.

An important step in portfolio design is to understand the macroeconomic risks found within asset classes. As you combine asset classes in a portfolio, you then aggregate (or offset) those risks. For example, a high exposure to the unexpected inflation risk factor implies that your portfolio is more susceptible to unexpected changes in the consumer price index (CPI). Or a high exposure to the currency risk factor exposes your portfolio to fluctuations in exchange rates.

We want to measure a portfolio’s sensitivity to various unexpected macroeconomic events. Through recognizing and understanding factor sensitivities, we can better allocate capital and manage portfolio risks.

An Example: Global Real Estate

Consider real estate, which we consider a hybrid asset class because it possesses equity and fixed income characteristics. One way that advisors can access this asset class is through real estate investment trusts (REITs) which are publicly listed and found in many equity indices.

When we apply a traditional global equity factor model lens, we uncover a large sensitivity to the developed growth factor (global equities) because REIT values are market based and the securities are publicly traded. However, using our macro factor lens, we also find strong risk exposures to inflation, interest rates, emerging markets spreads and currency risk factors. Interest rates make sense because REITs, like bonds, distribute income. We also find currency risk because this is a global asset class.

A 60/40 Portfolio

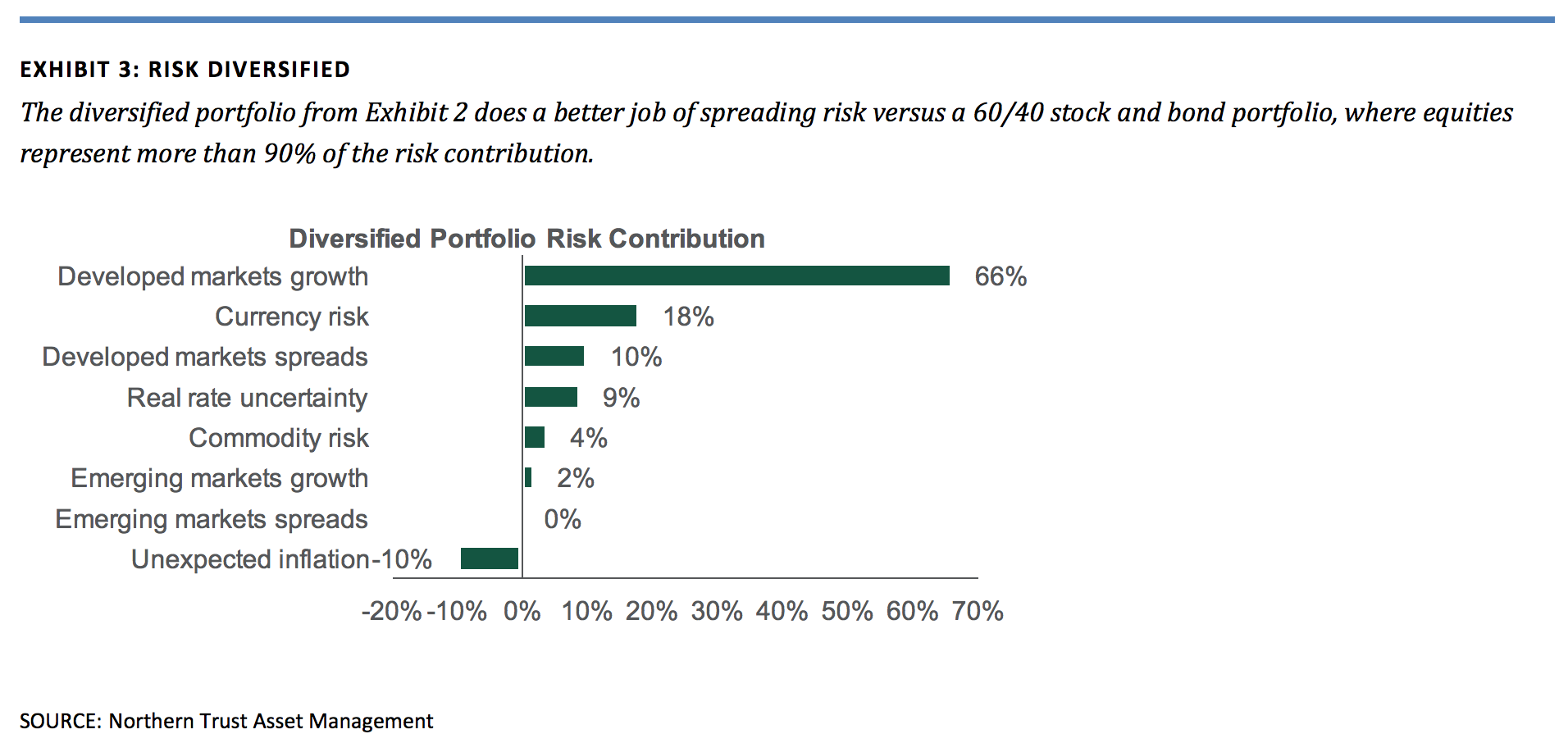

Capital diversification is not the same as risk diversification, and most advisors realize this. It’s the magnitude of the difference in risk that catches advisors by surprise. Take a simple global balanced portfolio with 60% equity and 40% bonds. Even though advisors might believe this portfolio is diversified, the risk contribution is extremely one-sided in favor of equities. This is because the 60% allocation to equities actually drives more than 90% of total portfolio’s risk.

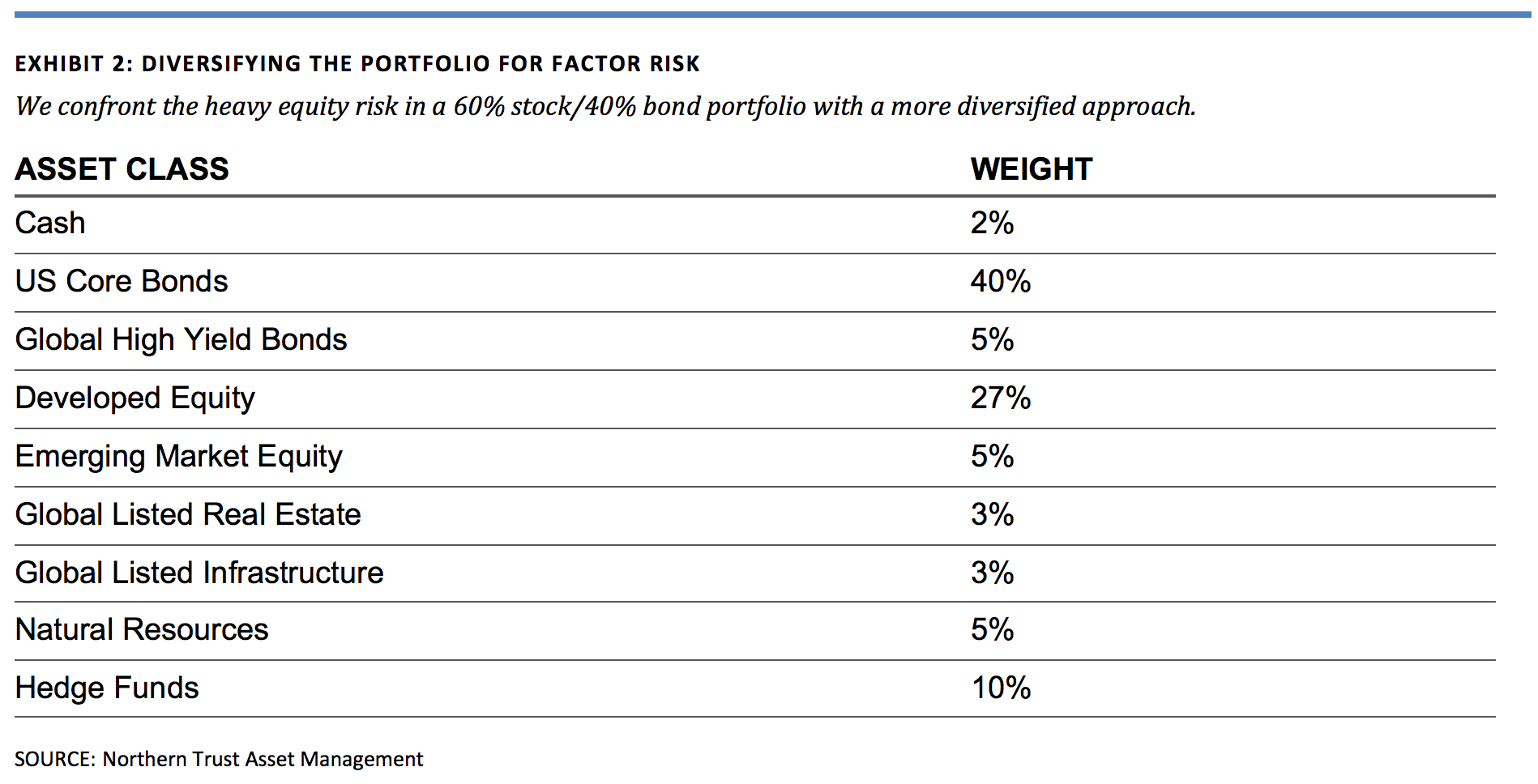

You can confront this problem with a more diversified, multi-asset class portfolio with risk exposure top of mind. In Exhibit 2, we have added high yield fixed income, global real estate, global infrastructure, natural resources, and hedge funds to our portfolio allocation. By using our macro factor lens, we can see many risk contributors to our diversified portfolio in Exhibit 3, with dramatically different results from the 60/40 portfolio.

Further, the thoughtful addition of other asset classes has dramatically reduced the risk contribution of the developed growth factor and spread it among various other factors. We can also measure beta sensitivities to the various risk factors. For example, observing a beta of 0.1 to the emerging markets growth factor implies that the portfolio would capture 10% of the return of the MSCI Emerging Markets Equity Index.

A Critial Component

Macro factor analysis is a critical component of portfolio construction. We use macroeconomic factors to better understand the risks, drivers and sensitivities of complex portfolios. Advisors can use this tool to make more informed decisions about asset allocation to meet their unique risk tolerances.

Michael Hunstad, Ph.D., is the head of quantitative strategies, Michael De Juan is the director of portfolio strategy and Jessica Hart is Retirement Practice Lead at Northern Trust Asset Management