Equity REITs have traded up and down this year largely based on sentiment about interest rates. While in positive territory for the year to date, the FTSE NAREIT U.S. All Equity REIT Index has not kept pace with the broad stock market. Nervous investors seem to have been looking to the Fed, not the fundamentals, for the next move on REITs. One Wall Street analyst told Bloomberg, “This sector is going to woefully underperform in a rising rate environment. History proves that out.”

But does it?

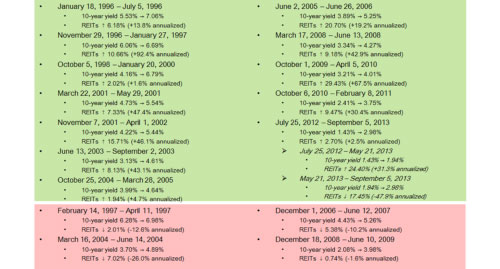

Historical data demonstrate that equity REITs have usually delivered strong, not weak, returns during periods of rising interest rates. An analysis conducted by the National Association of Real Estate Investment Trusts found that equity REITs generated positive returns in 12 out of 16 periods of rising interest rates since the mid-1990s, and double-digit positive returns in 9 of them.

The conditions are in place for a multi-year bull market in commercial real estate. Let’s take a more critical look at the current preoccupation with interest rate sensitivity and what actually drives equity REIT performance. It turns out that a strengthening economy and commercial real estate demand and supply trends offer a better way for investors to assess the outlook for equity REIT cash flows, dividends and total returns.

Fed Fears Roil REITs

Publicly traded equity REITs have delivered higher total returns than stocks and bonds for most periods in the past 40 years. If you had invested $10,000 in the FTSE NAREIT U.S. All Equity REIT Index for the ten years through 2012, it would have grown in value to more than $30,000, compared to slightly less than $20,000 for a similar investment in the S&P 500 Index. The recovery of REITs since the 2008 financial crisis also has been significantly faster and sharper than for the broad stock market.

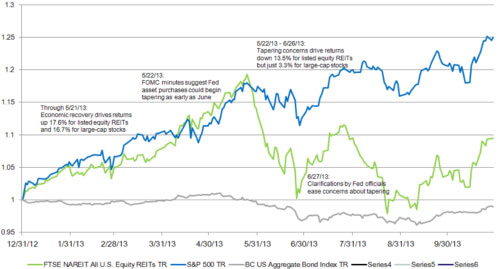

With evidence of a healing economy, 2013 started out strong. Both equity REITs and other stocks rose nearly 18 percent through the middle of May, and bond prices trended up as well. But the market situation changed dramatically on May 22, 2013 with indications by the Federal Reserve Open Market Committee and Chairman Ben Bernanke that the Fed might begin tapering its bond-buying program, a precursor to raising interest rates – if the economy continued to improve.

Bonds tanked, as if on cue. Two weeks earlier, legendary fund manager Bill Gross had tweeted his prediction that the 30-year secular bull market in bonds was at an end.

Curiously, the market seemed to treat equity REITs like bonds, and fears about interest rates drove a 13.5% decline over the next 35 days. In this, equity REIT performance diverged sharply from other equities and the 3.5% decline in the S&P 500. “REITs are highly sensitive to the interest rate environment, they're effectively bond substitutes on the equity side. They are enormous users of capital,” commented one Wall Street analyst speaking to CNBC.

Chart 1: Fed Fears Roil REITs in 2013

Source: NAREIT

Clarification by Fed officials in late June eased market concerns, sparking a partial recovery in equity REIT prices. The unexpected decision by the Fed not to start tapering in mid-September also benefited equity REITs – prompting the Wall Street Journal to warn that if interest rates go up, REITs could swoon once again. “[REITs] are sensitive to rising interest rates because they depend on borrowed money to expand their businesses. As a result, when borrowing costs rise, REITs get dinged twice: their cost of capital goes up, and their dividend payments become less appealing compared with other high-yielding investments.”

Equity REIT Sensitivity to Interest Rates – Urban Legend or Reality?

A discerning investor should ask, “What’s wrong with this picture?’ After all, if rates were to go up due to an improving economy, that should be good for commercial real estate. GDP drives market demand for industrial, retail and office space, for hotel rooms and apartments. Economic growth lifts occupancy rates and gives upward support to rents, increasing equity REIT cash flows, profits and dividends.

That discerning investor’s judgment would be justified based on historical data. NAREIT’s analysis of listed equity REIT returns during episodes of rising interest rates demonstrates that in the 16 extended periods of rising interest rates since the mid-1990s, equity REITs delivered negative returns in only four periods. In the 12 other episodes, equity REITs posted increases, and in 9 of these situations, they delivered double-digit gains on an annualized basis. For example, when the Greenspan Federal Reserve began raising interest rates as the economy recovered during the Clinton years, annualized equity REIT returns rose 13.8 percent in the first half of 1996 even as the 10-year yield on U.S. Treasury bonds increased from 5.53 percent to 7.06 percent (see Chart 2).

Chart 2: Equity REIT Returns During Episodes of Rising Interest Rates 1995 -2013

Source: NAREIT

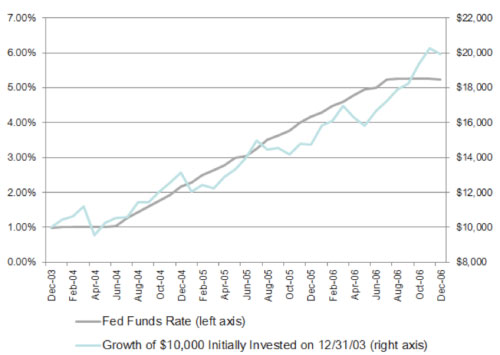

The example of the early 2000s provides an even more dramatic illustration of the muted impact of interest rates. From the end of 2003 through 2006, the Fed Funds Rate increased five-fold from 1.0 percent to 5.25 percent. This was clearly a period when the economy was growing at a strong pace -- GDP increased 6% per year or 19% for the three-year period.

If you thought such a dramatic interest rate rise would decimate equity REITs, think again. Over the same three-year period, an initial $10,000 investment in the FTSENAREIT All Equity REIT Index doubled to nearly $20,000, for an annualized total return of 26 percent with dividends reinvested. Shareholders received dividend increases of 6 percent per year or 18 percent for the period. The strong performance of REITs was underpinned by GDP growth and its positive impact on industry profitability, as equity REIT Funds From Operations (a common industry measure of cash flow) increased 12 percent per year or [41] percent from the fourth quarter of 2003 to the fourth quarter of 2006.

Chart 3: Increase in Fed Funds Rate and Growth of $10,000 Investment in FTSENAREIT All Equity REIT Index from 2003 Q4 to 2006 Q4

Source: NAREIT

REIT Income Is Not Fixed Income!

An investor looking at this year’s market gyrations might also question the divergence between equity REITs and the broader stock market, and comparisons of REITs to bonds. Many investors buy equity REITs for a reliable dividend income stream, but let’s be clear – REIT income is not fixed income.

When interest rates rise, the value of bonds held in investment portfolios falls. Since the income is fixed, the market adjusts the price of the bond downward to make the yield competitive. Equity REIT dividends, however, tend to benefit from economic growth. It’s not that REITs can choose whether to pay more dividends as rental income and profits improve… they are required by law to pay out at least 90 percent of their taxable income, which means that, as increasing rents and occupancy levels drive up taxable income, REIT dividends have to keep pace.

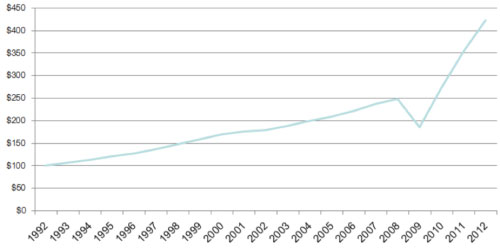

Again, let’s look at the historical data. REITs have delivered a four-fold increase in dividends over the past 20 years. For every $100 of dividends in 1992, REITs paid out $432 in dividends in 2012 – a record year for the industry in which REITs distributed more than $29 billion in dividends to shareholders.

Chart 4: Equity REIT Income Is Not Fixed Income – 20 Years of Strong Dividend Increases

Source: NAREIT

There is another part of this story, too. Those concerned that higher interest rates could increase the cost of capital and constrain REITs’ growth should note that REITs are in a very strong financial position. First, REITs use substantial equity financing and they have successfully raised $128 billion in equity from the capital markets since the beginning of 2011. They operate with moderate leverage, and an average debt to total capital ratio of around 35 percent for listed equity REITs is not considered stretched in the context of real estate investing. Moreover, when rates go up, the existing debt held by REIT borrowers becomes less valuable, reducing the liability side of their balance sheets.

Early Stages of Multi-year Real Estate Cycle

Investors looking for an entry point to increase their holdings of equity REITs should keep in mind five key drivers that are likely to support long-term performance.

- An improving economy and real estate market trumps higher interest rates

- Rents and occupancy rates are solid and supply of new properties is limited

- Market conditions support equity REIT rental income, cash flow and dividend growth

- Higher property values enable equity REITs to monetize and generate capital gains

- The commercial real estate market is in the early stages of a multi-year cycle

This last point is crucial for investors with longer-term horizons. Commercial real estate is a long-term business. It takes years to plan and develop a property, and landlords must have confidence that there will be sufficient market demand from tenants in order to justify the investment.

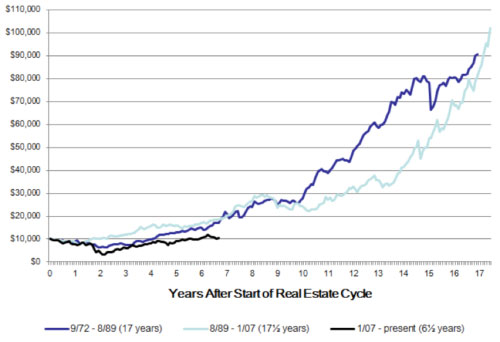

Commercial real estate cycles are approximately18 years on average from peak to peak, a pattern that was noticed all the way back in 1930. Looking at more recent history:

- During the 17-year real estate cycle from 1972-1989, an initial $10,000 investment in the FTSENAREIT All Equity REIT Index grew to more than $90,000

- During the 17 ½ year real estate cycle from 1989-2007, an initial $10,000 investment in the FTSENAREIT All Equity REIT Index grew to more than $100,000

You could say we are now in the third or fourth inning of the current cycle. The commercial real estate market is about 4½ years into its recovery – and it is off to a slower start than has been characteristic of prior recoveries. Developers have been hesitant to commit to new real estate projects, and are cautious about adding new supply given the fragile state of economic recovery and muted investment by businesses.

Chart 5: Value of $10,000 Invested at Start of Multi-Year Commercial Real Estate Cycles

Source: NAREIT

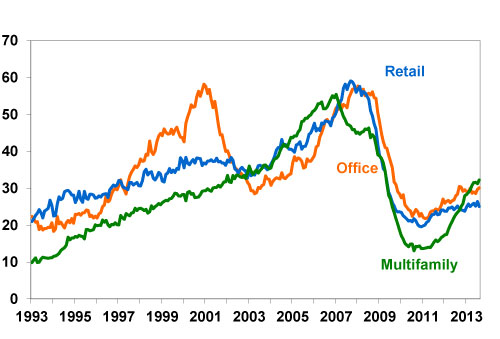

As a result, the supply of new commercial real estate space has grown at the slowest pace of any economic recovery on record. During the liquidity crisis, construction of office and retail properties collapsed more than 60 percent, and apartment construction fell more than 75 percent, to levels that we last saw in the early to mid-1990s. More recently construction activity has rebounded. Office and retail construction are up 30 to 40 percent from their trough, and apartment construction is up 150 percent. Despite this rise, however, nominal construction spending remains 25 percent to 40 below its pace in 2006-2006, and is in line with levels that we last saw in the late 1990s. It’s no surprise that rents in many cities have registered significant increases, given rising occupancy rates and tight supply of new properties. These fundamentals should continue to support equity REITs in generating shareholder returns.

Chart 6 : New Supply is Near Decades-Low Levels

Source: Haver Analytics, U.S. Census Bureau

Conclusion

The hypothesis of equity REIT sensitivity to rising interest rates is not justified given the historical data on equity REIT returns and the fundamentals in place for a multi-year commercial real estate cycle. Equity REITs and their shareholders are positioned to benefit if the economy continues to recover, even once the Fed does begin to taper or eventually raises rates in response to economic strengthening.

Commercial real estate is a distinct asset class that should be held in every portfolio due to its relatively low correlation to stocks and bonds. Equity REITs deliver their own unique set of investment attributes. Simply put, they offer the best of both stocks and bonds – and the power of diversification. A meaningful allocation to equity REITs can reduce risk and increase long-term returns.

Brad Case, Ph.D., CFA, CAIA, is Senior Vice President, Research & Industry Information at the National Association of Real Estate Investment Trusts.