Stock market price volatility is back. Following a period of low price volatility levels, prices swung wildly at the end of last month. The S&P 500 index traded at a high of 1965 and as low as 1867 (down 5 percent from the previous close) and closing at 1893 (up 1.4 percent from the day’s low). Over the next four trading days, the S&P 500 high/low daily range averaged a 2.8 percent price swing, per day. This is a very high level as compared to longer-term averages.

Amazingly, by the end of the last week in August, the S&P 500 index had recovered much of the downward move experienced earlier in the week. At its lowest intra-day level, the index had traded down by 5.2 percent in value from the previous Friday’s close. But by the close, the S&P was actually up by 0.8 percent for the week. Is the worst over for this corrective phase? Frankly, we don’t know. The three concerns which ignited the downward push in stock prices are still in existence. Those concerns are:

• Emerging economies are vulnerable to a full-blown economic crisis born in China

• That China’s economy is in deep trouble

• That the long rally in developed world equity markets is over

I believe two of these fears to be either exaggerated or misplaced, and the other to be real. The slowdown in global growth is real, although Chinese officials will deny this assertion. Denials or not, global investors are lowering their expectations of global growth. As these expectations decline, global stock markets will show high levels of price volatility, at times to the downside. Today, I want to discuss these risk factors and how investors may wish to take advantage of upcoming market volatility.

With that being said, considering my view that neither the fundamental worries nor technical considerations are fully discounted, what is an investor to do? While I expect price volatility to remain in place within many asset classes over the next number of weeks/months, investors who enter and maintain positions in the capital markets should be rewarded for their positive determination over the intermediate to long term. I believe current opportunities reside in the developed international markets. These markets are trading cheaply based on historical norms and are still selling at distressed values as compared to earlier this year.

Before I get ahead of myself, let’s take a quick peek at the three worries mentioned above. Which of these are valid concerns and which may be overblown?

Is Chinese Economy in Deep Trouble?

The world’s investors are fixated on the economic slowdown in China. Risk-oriented concerns surrounding China’s economic “black box” appears to be the catalyst which is driving most global equity markets downward. Most non-official indicators are suggesting China’s economic growth rate has contracted to less than 5 percent, a level which, due to the economic sluggishness of the rest of the world, threatens to throw the global economy into a recessionary environment, according to IMF standards.

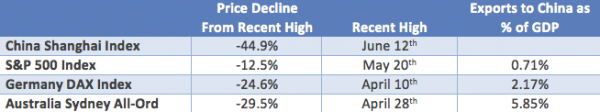

Evidence of China economic growth rates being the issue at hand is apparent in the relative performance of the world’s major stock markets. By and large, the stock markets in countries highly tied to economic trade with China have swooned more than those which don’t have such a direct tie. The world’s investors have expressed this concern with their dollars by driving stock markets downward. Consider the following data of how some of the global stock markets have traded of late.

All data shown are intraday high and low levels which capture the total volatility levels seen over the last few months. It is interesting to see the difference in recent stock market performance for Germany and Australia – two countries where exports to China represent a rather significant portion of overall economic activity. It is also interesting to look at the stock market performance of the United States, where trade with China (exports) is a much smaller portion of economic activity. We could show other examples of this direct tie between stock market price declines and exports to China. For example, China is the No. 1 importer of goods from Brazil (17 percent of Brazilian exports go to China). Brazil’s stock market is now down 32 percent from its recent high level.

Nobody outside of Beijing actually knows how much growth has contracted. Therein lies the rub. The lack of factual, reliable data from Beijing is increasing capital market volatility. But we need to remember that China’s officials are engineering an economic metamorphosis – their goal is to move China away from the economic model which has been present over the last number of decades to a model where consumption spending will be a much larger driver of economic growth. Will they succeed in this endeavor? Perhaps – but in the meantime uncertainty surrounding the economic growth question in China is high. As a side note, it is important to understand that while China’s growth is slowing, at 5 percent growth, China’s additive to overall economic growth would be larger than when the country was growing by 14 percent in 2007.

So, the fear of an extreme growth contraction in China is real and meaningful, but rather unmeasurable.

Emerging Markets Concerns and Ties to China

Exports tend to make up a significant amount of economic activity in many emerging economies. Many of these exports wind up in China. With China’s growth rate slowing, the growth rate of imports will slow. Consider the data below.

While not exhaustive, the data above indicates the average emerging economy is almost twice as reliant on export activity for economic growth as the average developed economy. Additionally, of the emerging countries shown, China is a dominant importer of products from many of those countries. So, China’s economic growth matters much more to the emerging space than the developed markets.

This economic risk is well appreciated by the financial markets. From an intra-day high reached on April 28, 2015, to the low on August 24, 2015, the iShare Emerging Market ETF (EEM) declined by 32.1 percent in value. Since that low, EEM rebounded by 12.6 percent as of Aug. 28 close. The emerging market space is facing other risks besides the growth slowdown in China (Fed increasing interest rates for example), but the China question is weighing heavily on these markets.

What action plan should investors consider with the emerging markets? We need to see further indications of China’s true growth rate prior to making additional commitments to this space. As demonstrated, the “China Question” weighs heavily on the emerging market investor. Additionally, the Fed is expected to start raising interest rates by the end of this year. Historically, the emerging equity markets have been very sensitive to rising U.S. interest rates, as external financing is necessary for many of these economies to thrive. While this risk may be overstated as compared to historical standard, there are enough uncertainties to the emerging equity markets to keep us from bottom fishing in this class.

Remember, the emerging markets should continue to economically outperform the developed market space for the next couple of years. Eventually, additions to the emerging market area may make more sense when apparent risks become more measurable.

Developed Economies Worries

In my opinion, the developed world (Europe, United States and Japan) has the least to fear from China’s growth slowdown. Exports to China represent only 0.7 percent of overall U.S. economic activity. Some other developed countries are more closely tied to China’s economy – Germany, for example. While trade with China represents 2.2 percent of overall German economic activity, the German stock market recently corrected by almost 25 percent in value prior to rallying. Additionally, the DAX Index (Frankfurt stock index) is selling at less than 17x trailing earnings, a 9 percent discount from the last 20-year average valuation level. Many of the world’s developed equity markets appear to be largely discounting the China problem as prices have retreated by meaningful levels from recent highs.

Taking Advantage of Volatility

As stated earlier, I believe opportunities exist for fresh investment in the global developed markets – particularly those overseas. These markets are among the world’s most mature markets with stable banking environments and low interest rates. Two of the larger foreign markets (by market capitalization) are Japan and Germany. Following the recent sell off in price, both the German and the Japanese markets are attractively valued and have accelerating expected earnings growth rates. Consider the following data:

The P/E ratio (on average) of Germany’s and Japan’s markets is 14.0x earnings – about 14 percent cheaper than the U.S. market. Additionally, the expected earnings growth rate is slightly higher than the U.S. expectation. In addition, the expected earnings gain over the next 12 months for these major markets is 11.5 percent, on average, as compared to 6.5 percent for the United States.

Finally, the average of the Germany/Japan combination has sold down by 12.6 percent from the high (average of the two markets) compared to a 6.7 percent sell-off for the United States. Don’t get me wrong, I like the U.S. market for many reasons, but if you’re looking for a fresh idea to take advantage of the recent decline, investment in the developed foreign markets may make sense.

Getting Technical

Technically speaking, is the market washed out? As compared to past periods of 10 - 20 percent market declines, the recent price retreat was not accompanied by price increases in safe harbor assets (U.S. Treasury bond and gold prices didn’t rise during the last stock market swoon, which is typical of a wash out process). True, the VIX index (dubbed the “fear” index) spiked from 15 to above 50 and investor bullish sentiment declined to 38 percent, historically, a low reading. Nonetheless, I would like to see a flight to safe asset classes prior to concluding that global equity markets have bottomed. Let’s take a quick peek at some details of these opportunistic markets.

Summary

The world is wrestling with a slowdown in the growth engine that has primarily powered global growth over the last eight years. China is moving from an industrial/export driven growth model to a more balanced model, which includes growth in consumption. During major economic changes such as these, we should expect to see shocks to the system. We received one such shock recently.

I suspect equity price volatility will remain in place for a period of time. Rather than run from the volatility, I suggest embracing it and looking for new opportunities. I continue to believe the world’s equity markets are experiencing the fourth secular bull phase since the year 1900. If history is any guide, this bull market has a ways to run. In the meantime, fasten your seatbelts as the ride may continue to be bumpy.

The information contained herein is not intended to be personal legal or investment advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

William B. Greiner, CFA, is Chief Investment Strategist at Mariner Holdings.