Following the use of unconventional monetary policy tools in response to the 2008 recession, Federal Reserve officials have emphasized the importance of establishing a new set of strategies for normalizing monetary policy, with a focus on reserves management. The Fed formally introduced a list of strategies that could be employed in order to exit unconventional monetary policies at the June 2011 Federal Open Market Committee (FOMC) meeting.

These included a timeline for ending reinvestment of paydowns (principal prepayments the Fed is receiving on its Mortgage-Backed Securities portfolio), forward guidance, and interest rate adjustments on excess reserves adjustments, followed by sales of securities from its balance sheet. Since the last round of quantitative easing and the February 2014 change of guard at the Fed rendered this early set of proposals obsolete, a new blueprint of exit strategies is currently being written.

At the June 2014 FOMC press conference, Chairwoman Yellen indicated that a revised set of exit strategies would be provided later this year. The FOMC minutes provided a deeper look into the mechanics of how the different facilities are expected to be employed. We outline in some detail below what tools exist within the FOMC toolbox and present some potential market implications on the path to normalization.

First, let’s frame the size of the Fed’s balance sheet and the excess reserves created since the start of the global financial crisis. As of July 2014, the Fed’s balance sheet stood at $4.4 trillion, while excess reserves of depository institutions had risen to $2.5 trillion, staggering increases from their pre-crisis levels.

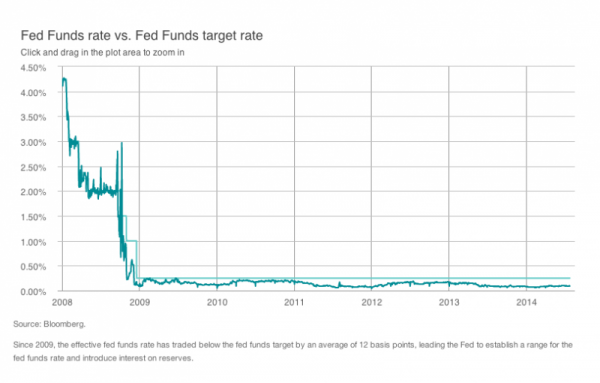

The June 2014 FOMC minutes provided some potential clues on the Fed’s new framework for managing an eventual policy normalization. Members of the Fed believe the effective federal funds rate should continue to play a key role in monetary policy. By managing the spread between the interest rate earned on excess reserves and the reverse repo facility that utilizes the balance sheet, the Fed intends to revive trading in the fed funds market.

Adjustments to the rate of interest on excess reserves (IOER) are expected to affect bank demand for excess liquidity, and are viewed by many as the Fed’s main policy lever. IOER represents the rate that banks earn on cash deposited at the Fed, while rates observed in the money markets (CP, CDs and term deposits) are rates that banks are willing to pay to borrow funds. Since banks are in the business of earning a spread between assets and liabilities, most short-term bank funding markets clear at rates below IOER and banks will continue to be able to enjoy this arbitrage.

Nonbank participants (broker dealers, Government-Sponsored Enterprises (GSEs), money market funds and asset managers) are ineligible to earn IOER. The reverse repo facility (RRF), with an interest rate set below the IOER, opens the Fed’s balance sheet to securities lending to these market participants, and provides a floor under money market rates and a mechanism to extract cash from the system.

Regarding the repo facility, the Fed expressed concern that large usage would dis-intermediate repo traders and pose a risk during times of stress, since market participants with money would bypass the financial and non-financial institutions who are dependent on short term financing and just engage with the Fed, as a preferred counterparty. As a result of these concerns, there could be further design features including constraints on usage either in aggregate or by counterparty, and a relative wide spread between IOER and the rate offered via the repo facility.

In addition, the Fed is looking at other tools like the term deposit facility (TDF) and the term reverse repo facility (TRRP) in order to set term deposit rates, which will also be available to banks. TDF testing has increased lately, however it is unclear how large a role these secondary tools will play. The Fed has emphasized a “simple and clear approach to normalization” and would have to pay an attractive rate to lock up term funds. Moreover, term deposits likely do not qualify as High Quality Liquid Assets, which would disincentivize bank usage given regulatory capital constraints.

The Fed also indicated that the initial exit strategies regarding its portfolio holdings are in the process of being changed. Reinvestment of portfolio paydowns in Agency MBS will likely continue through the first rate hike, and the sale of securities seems to be off the table. Instead Fed officials seem more inclined to use run-off to gradually shrink the Fed’s balance sheet over time. It could take well into the 2020s before the balance sheet falls to a pre-crisis percentage of gross domestic product.

Many questions remain regarding the Fed’s ability to exit unconventional monetary policy as its balance sheet has swelled. The Fed is still in the process of writing this new chapter (of normalized policy) and we look forward to learning more details as we advance through this uncharted territory. The risks that this normalization process could present further highlight the importance of the research intensive, fundamental investment process that we undertake at Delaware Investments. We believe our rigorous security selection process can help us find the best individual securities to make up a portfolio regardless of any potential market turbulence related to the Fed’s actions in the coming years.

The views expressed represent the Manager's assessment of the market environment as of August 2014, and should not be considered a recommendation to buy, hold, or sell any security, and should not be relied on as research or investment advice. Views are subject to change without notice and may not reflect the Manager's views.

Carefully consider the Funds' investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds' prospectuses and their summary prospectuses, which may be obtained by visiting the fund literature page or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

IMPORTANT RISK CONSIDERATIONS

Investing involves risk, including the possible loss of principal.

Past performance does not guarantee future results.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

Ion Dan is a Senior Structured Product Analyst and Trader for Delaware Investments