The alternative investments universe generally consists of investments outside of publicly traded real estate, equity and debt. It includes investments ranging from private commercial real estate, hedge funds and managed futures, liquid alternatives to illiquid private equity funds, and real asset and natural resource partnerships. Moreover, the alternative investments industry is rapidly evolving – expanding and increasing its ability to provide durable investment strategies, and therefore is attracting interest from a growing number of individual investors. These programs are continuing to increase in popularity among the investment community because, when added to an otherwise well-balanced, fully diversified portfolio, they have the potential to provide greater risk-adjusted return, while also adding diversity and flexibility for advisors/investors seeking to construct a durable income-producing portfolio.

This paper will provide an overview of several examples of alternative investments. Advisors can use this information to determine which, if any, of these investment solutions might be appropriate for their clients’ specific investment goals, given their existing portfolio of holdings and their unique tolerance for risk.

Characteristics

Alternative investment programs are generally not required to register under the Investment Company Act of 1940. When offered as public, non-traded investment funds, they are not listed on an exchange, placing limits on the investors eligible to access them. Until recently, these private alternative investment programs were largely available only to high net worth and institutional investors (though now they continue to make up an increasingly larger part of the average investor’s portfolio).

A distinct feature of alternative investments is their absolute performance objective. In other words, they do not merely seek to outperform a benchmark but rather aspire to produce positive returns under varying market conditions. In order to achieve their absolute performance objective, alternative investment solutions tend to use leverage to increase returns as well as depend upon on investing skill rather than just market exposure to create value. Historically, alternative investments have exhibited relatively low correlation with traditional financial market indices over long periods of time. Typically they also exhibit reduced liquidity relative to traditional investments, with monthly to multi-year lock-ups. Alternative program managers typically charge higher fees, which may include performance fees.

We believe that in order to act in their client’s best interest, advisors should consider taking the large dispersion of performance across program sponsors into account, in addition to evaluating the degree of each program’s performance persistence. Therefore, even more so than for traditional investments, program manager selection is of critical importance.

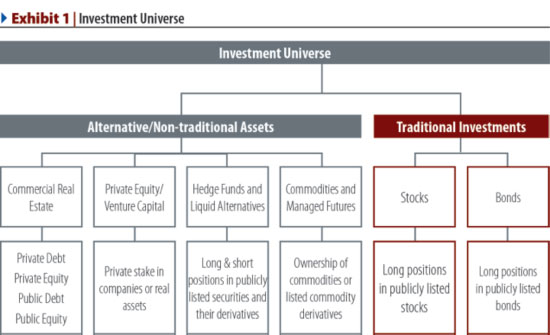

Alternative investments tend to fall into four broad subtypes – commercial real estate, private equity, hedge funds (with a variant liquid alternatives/ alternative mutual funds), and managed futures - all of which differ from traditional investments in a variety of ways.

Please be sure to check back in the coming weeks, as I will dive deeper into these durable income-producing investments.