In my last blog post I discussed leverage as a tool to outperform in certain market environments. The various investment options we reviewed were all focused on increasing or otherwise shaping the upside potential of structured investments. Now let’s take a look at another aspect of structured investing – the various tools available to protect against downside exposure.

Why Are We Interested?

When including dividends, the S&P 500 has returned roughly 125% over the prior 5 years despite sluggish domestic growth and political infighting in Washington. With the secular bull market now getting a bit long in the tooth by historical standards, investors may be looking for ways to continue participating in equity markets while adding a degree of protection to their investments.

While a number of investment products provide elements of protection (e.g., low vol funds), structured notes are one of the few products that can offer defined outcomes. Let’s analyze the characteristics and costs of some of the more popular protection-themed structured note offerings.

Some Technical Analysis

There are generally three different types of protection offered by structured notes:

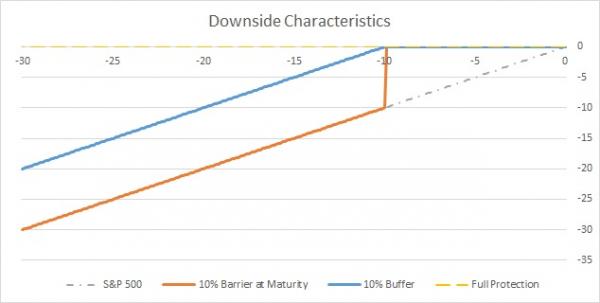

Principal Protection – All or almost all downside risk is eliminated; this degree of protection typically comes at a steep cost in terms of reduced upside.

For those looking to take on a bit more risk in return for better reward characteristics there are two main flavors:

Buffers - provides fixed level of downside protection. A buffer provides protection down to a particular level after which the investor is exposed. For instance, if the reference security declines by 15%, and the buffer is 10%, then the investor will be exposed to a 5% loss at maturity.

(Buffer exposure is similar to selling a put at the strike price of the buffer – e.g., if the buffer is 10%, then selling a put with a strike that is 10% below the current market would be synonymous to that component of the note.)

Barriers - provide a contingent level of downside protection. A barrier provides protection down to a particular level after which the investor is exposed to risk as if they did not have protection at all. For instance, if the reference security declines by 5% and the barrier is 10%, the investor is fully protected. However, a decline of 15% would result in no protection level and exposure to a 15% loss at maturity.

(Barrier exposure is similar to selling put as in the Buffer with the additional step of selling a digital put with the same strike price as the put option. If the market finishes above the strike price, the digital expires worthless. However, if the market finishes below the strike price, the digital is now “in the money” and must be paid out. The payoff amount is set to wipe out the original protection offered by the barrier, thus leading to an “all or nothing” type of protection.)

Below is a graph illustrating the downside characteristics of the protection examples cited above as relates to the S&P 500.

So how does the protection level selected affect the potential upside of a note?

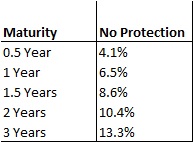

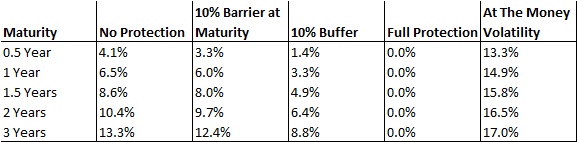

In a no protection scenario linked to the S&P 500, the structured note introduces downside exposure in the note through selling at the money puts. The money earned from the sale of the put is used to purchase upside; using prices as of July 30, 2014[i], the money earned from the sale of that put would be:

The seller of that put (i.e., the structured note holder) is thus taking on the complete downside risk of the market moving down in exchange for the payments outlined above, which will be used to purchase upside performance.

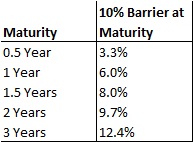

As we reduce the amount of risk the structured note holder is taking on, he or she will earn less money which can be used to purchase upside. In the case of a 10% barrier note, the seller of the put + digital would earn:

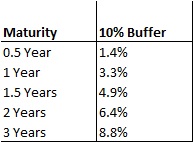

Since the noteholder is selling less valuable protection, there is less capital available to purchase upside. If the note offers a 10% buffer, the note holder earns even less to spend on upside:

And of course if the structured note sells no puts at all (i.e., no downside exposure to the noteholder), there will be no extra proceeds which can be used to enhance returns.

Cost of the Protection Levels, .5 - 3 Years

I illustrate below how increasing levels of protection reduce the potential upside a note can offer. For both examples below, I am focused on a 2 year product. I will assume a total yield of 2% (roughly 1% yield to maturity) which is in line with what one can expect from corporate bonds with a 2 year duration at the time of this posting. It is worth noting that some banks will have a yield that should be above this and some will be below based on their credit quality. I will also add a 2% fee to my estimates.

For more information on the construction of a note click here.

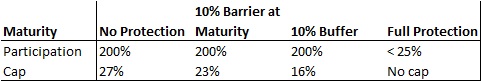

Capped Product - Participation/Leverage Level Given Downside Characteristics

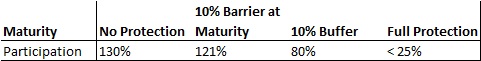

No Cap Product - Participation Level/Leverage Given Downside Characteristics

As a sanity check on our internally calculated numbers, here are some recent examples in the marketplace which are similar:

- 10% barrier at maturity on the S&P 500 with a 2.5 year duration provided 200% participation to a 22.5% cap[i][ii].

- 10% buffer on the S&P 500 with a 2 year duration provided 140% participation to a 21.35% cap. Note that the downside participation is leveraged at 111.11% meaning a 20% loss for the S&P 500 would result in an 11.11% loss for the note.

- 100% protected note on the S&P 500 with a 2.25 year duration provided 23% participation with no cap[iii].

(I would ideally have relied entirely on market examples in creating the tables above, but the market is too bespoke and disparate to effectively present in that fashion. For example, it is hard to find the varying downside characteristics with the same duration on the same product. Furthermore, in the few examples that are close, the fees associated also ranged dramatically, which would ruin the comparison.)

Conclusion

This blog and the prior one analyze three important elements to structured investing – the use of the leverage/changing participation levels, caps on upside, and the amount of protection provided. Of course, there is no free lunch – as the characteristics of one of these dimensions improves, the characteristics a note can offer for the other two worsens.

A structured note investment can provide investors considerable upside while providing a meaningful level of downside protection. It is up to the investor to decide what type and level of protection best matches their objective.

In most cases, a successful investment experience is defined as outperforming in down markets and participating in good markets. That being the case, most investors will find a suitable balance between downside protection and lost upside potential, rather than going extreme in one direction.

[i] Of the protection features discussed above, barriers are the most complex and hardest to hedge for the banks. As a result, we can assume banks take a larger spread when pricing barrier products.

[ii] Investors should read the fine print before purchasing a barrier product. It is important to be aware and fully understand the implications of the barrier level and therefore be prepared to lose the full level of protection.

[iii] As illustrated, there is not much upside participation for a fully protected product. With yields at all-time lows, investors need to commit to very long duration notes to capture any meaningful upside if they seek full principal protection.

[i] With the recent volatility of the market, these values are higher as of the publication of this blog.

Joe Halpern is the CEO of Exceed Investments, an investment company focused on developing next-generation structured investments.