The release this week of the minutes from the Federal Reserve’s Jan. 28 meeting sparked a frantic hunt for fresh clues about the timing and pacing of a federal funds rate hike. The question no one seems to be asking is once the Fed commences down the road of raising rates, how far will they ultimately go? Based on research we’ve conducted on the impact of higher rates on the U.S. debt burden, it appears the terminal value for the fed funds rate—the point at which the Fed stops tightening in a cycle—is around 2.5 to 3 percent, a lot lower than many people expect.

In the near-term, the stage is clearly set for the Fed to begin what it has been referring to as “policy normalization.” While consensus may be growing that the first of the coming rate increases will commence in June, I think the Fed will likely be more cautious and begin its “liftoff” in September. After that, the Fed is likely to raise rates by 25 basis points every other meeting. Practically, this means the overnight rate should be in the 50- to 75-basis-point range by the start of 2016.

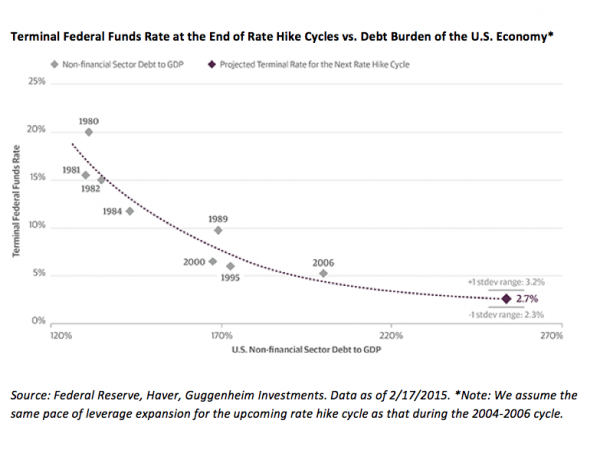

Longer term, the Fed will likely continue to tighten at a steady pace until it nears the terminal rate in the cycle, which I believe will occur toward the end of 2017 or early 2018 in the range of 2.5 to 3 percent. Supporting such a ceiling on the fed funds rate is research that shows a close historical relationship between the debt-to-GDP ratio in the economy and the terminal fed funds rate.

At 233 percent, the amount of debt as a share of GDP, excluding the financial sector, is among the highest since data became available in 1947. Given this level of debt in the economy today, and assuming the same pace of leverage expansion for the upcoming rate hike cycle as that during the 2004-2006 cycle, a terminal rate around 2.5 percent is where the economy is likely to begin to slow to an extent that forces an end to the tightening cycle. Knowing that policymakers typically overshoot, 3 percent would be in the cards as a possible terminal fed funds rate, which is within the standard error of estimate for the model. A recession typically occurs about a year after we reach the terminal rate, so if this tightening cycle plays out as I suspect, the U.S. economy won’t face its next recession until 2018 or 2019.

Why is the end of a Fed tightening cycle a concern today? Well, the yield curve generally flattens substantially by the end of a tightening cycle. In other words, 10-year Treasuries typically trade very close to the overnight rate (maybe 25 basis points higher). Therefore, understanding the economic constraints and terminal rate value of the upcoming “normalization” process can provide long-term investors with insights into the potential ceiling on 10-year Treasury yields, as well. In this case, if our view of the terminal fed funds rate is correct at 2.5 to 3 percent, then the end of the cycle in 2017 or early 2018 could see a ceiling for the 10-year note around 2.75 to 3.25 percent—a level much lower than many investors may be anticipating.

Terminal Fed Funds Rate Falls as Debt Burden Rises

The amount of debt as a share of GDP, excluding the financial sector, is among the highest since data became available in 1947. The expanding leverage of the economy suggests that economic growth is increasingly sensitive to rising borrowing costs, as evidenced by the strong inverse relationship between the historical terminal fed funds rate and the leverage ratio of the U.S. economy at the end of each rate hike cycle, indicating that the terminal rate for the upcoming rate hike cycle should fall in the 2.5 to 3 percent range.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2015, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Scott Minerd is Chairman of Investments and Global Chief Investment Officer at Guggenheim Partners.