May 2013 marked the beginning of the Great Yield Back Up. Fearing the end of the Federal Reserve’s support for bond markets, the 10-year Treasury Note rose a full percentage point to 2.60% from May 2 to June 25. After a brief retreat, the 10-year yield marched higher still, hitting 2.88% on August 19.

Bond market panic or not, 2.88% is not much of a return. Not that long ago 2.88% was a mediocre savings account rate. Yes, corporate bonds offer investors a higher yielding alternative to Treasuries - a Bloomberg investment grade corporate bond index closed out the month at a 3.5% yield to maturity. But it takes significant assets (and experience) to assemble a high quality diversified corporate bond portfolio. Investing in such a portfolio is not possible or practical for most investors.

Bond funds provide the individual investor an alternative to individual issues, but by buying a fund, the investor forgoes the benefit of a maturity date. (In a portfolio of individual bonds, each maturity enables a large chunk of assets to be reinvested at prevailing interest rates.)

For today’s investors, bonds pose two problems: 1) they generate little income and 2) after a three decade bull market in bonds, higher bond yields are likely in our view. Because bond prices move inversely to interest rates, higher yields can result in capital losses if today’s bond buyer must sell before maturity to pay living expenses.

In fact, bond yields are so low that stocks are a legitimate competitor when it comes to generating income. For example, the S&P 500 boasts a yield of 2.1% (2.0% unweighted), and 93 companies in the index do not offer a trailing 12 month yield. The average unweighted yield of S&P 500 companies actually paying dividend is 2.36%. That is not far from the 2.88% yielding 10-Year Treasury Note.

Further, over several years, a growing stream of dividends has a clear advantage over today’s low-yielding bonds. Not only can the dividends of many high quality companies compete with the yield on high quality bonds, but as dividends grow the income gap between the two asset classes widens.

For example, let’s compare the income generated from a basket of stocks to that of an intermediate term bond. Let’s assume a 2.4% trailing 12 month dividend yield for our stocks (the yield on dividend paying stocks in the S&P 500 mentioned above) and 6% dividend growth rate. That seems reasonable given that dividends on the S&P 500 grew 6.9% annually over the 10 years ending 2012. We assume a 2.9% yield for bonds given that is close to the current yield to maturity on 10-Year Treasuries.

Given this scenario, stocks generate 16% more income over 10 years than the bond, and that’s without assuming any income earned from reinvestment.

But equity investors seeking income can do better. Many high quality equities offer yields of 4%, 5% and even 6%. In our experience, it is possible to assemble a portfolio of high quality companies with these types of yields, even in today’s environment. These higher yielding equities often include those from the following sectors or categories:

Utilities – Utilities have long been considered bond substitutes given their above average yields and slow, but steady dividend growth. But the slower the dividend growth the more the stock is destined to behave like a bond – losing ground when interest rates rise. Further, investors have bid up the prices of utility stocks over the past few years in their quest for yield. While utilities appear a bit more reasonably valued after the recent sell off, these stocks are not cheap and care must be taken to find candidates with good prospects for growth. Without dividend growth, a utility stock is not much better than an intermediate Treasury, and is certainly more risky. In our view some non-US electric utilities offer better prospects for dividend growth than in the US.

MLPs – Master Limited Partnerships are typically natural resource companies that have selected a partnership structure in order to maximize income and limit taxes. Many MLPs own pipelines that earn a fee paid to transport petroleum products. This fee-based arrangement results in little direct commodity price risk. However, MLPs involved in oil and gas production or natural gas processing do have commodity price risk. Typically a portion of MLP distributions are not taxed, but the tax filings can be complex. Some MLPs have grown distributions at an impressive rate, while others have done a poor job of improving payouts to unit holders.

REITs – Real estate investment trusts allow the individual investor the chance to reap the benefits of being a landlord without having to collect rent checks. By law REITs must pay out 90% of their profits to shareholders. REITs run the gamut, not only in terms of properties owned, but also in terms of risk. Some REITs are far more leveraged than others. Rising interest rates or the loss of a major tenant can wreak havoc on the dividends of these riskier REITs.

Mortgage REITs – These REITs own paper rather than buildings. MREITs make loans or own mortgage backed securities and profit by earning a higher rate on their investments than the interest rate paid on borrowed money. MREITs vary widely in the degree of leverage undertaken, and a poorly managed, over-leveraged MREIT is a ticking time bomb in a rising rate environment. MREITs offer big yields, but investors must tread carefully in this sector.

BDCs – Business development companies borrow money and lend it to upstart companies in hopes of turning a profit on the spread. Like REITs, BDCs must pay out 90% of their profits to shareholders. Investors should know if the BDC loans to a wide range of companies or concentrates on a specific industry. Many BDC’s emerged only recently to take advantage of the historically low interest rates, so evaluating management is critical when investing in these leveraged players.

Telecom – Telecom stocks generally offer above average yields given the utility-like nature of their business models. But competition is increasingly fierce in this sector, with cable, internet and phone providers battling for the same customers. Companies with failed growth-through-acquisition strategies slashed dividends in recent years.

Foreign stocks – Dividend paying practices vary by country. Companies in Australia, for example, tend to pay out more of their profits in dividends than is the case in the US. Also, lower stock market valuations in other countries compared to US markets can result is higher yields overseas.

Domestic stocks in special situations – Often quality US companies can be purchased with well above average yields. These may include long-time dividend paying stocks that fall out of favor. Or, as is the case with some tech stocks of late, the company may dramatically boost the dividend while continuing to offer attractive growth prospects.

Perpetual Immaturity

Unlike bonds, stocks do not promise a return of principal upon maturity. This is a deal killer for investors who absolutely require a return of their investment on a certain date. Still, some conservative investors do own an asset that pays them regularly that they have no intention of selling – an annuity. While annuities can be dressed up with all manner of options, the basic idea is that the investor trades assets to an insurance company in exchange for an income stream for life.

A properly constructed portfolio of high yielding equities can provide an “annuity-like” stream of income. By “annuity-like” we mean the dividends are expected to generate income indefinitely. Of course dividend cuts are a real risk, but this can be mitigated by diversification and an emphasis on high quality companies. In fact, a well-managed equity portfolio is expected to generate a growing income stream, ideally one that outruns inflation. Given these attributes, higher yielding stocks may well be an attractive asset class for conservative, income-oriented investors.

And if an investor must sell? The risk, of course, is that a forced sale for living expenses will result in a loss. But growing dividends can reduce the risk of loss. For example, a $100 dollar stock with a $5 dividend has a 5% yield. If that dividend grows to $9 over 10 years, and the yield remains 5%, the stock would have a value of $180 in Year 10. ($9/5%)

But what about rising interest rates? Wouldn’t higher bond yields push up yields on stocks, thereby lowering prices?

Certainly, higher bond yields can pressure stock prices. We need look no further than the recent sell-off in utilities, REITs and MREITs for evidence. But over several years, the price of a higher yielding stock is influenced not only by the level of interest rates, but also by how fast the dividend grows and the relationship between bond yields and the yield of a particular stock. The reason interest rates are rising can also effect the relationship between bond yields and stock valuations.

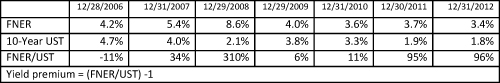

The performance of REITs over the last several years illustrates the lack of a straight forward relationship between interest rates and higher yielding stocks. The table below compares the yield on a popular REIT index to the yield to maturity on the 10-Year Treasury. At year-end 2006 REITs actually traded for a lower yield than Treasuries. But at very low bond yields, REITs traded at a significant premium:

Even if the market places a higher yield on a stock some years down the road, all is not lost. A growing dividend can partially offset the impact of a lower valuation (higher yield).

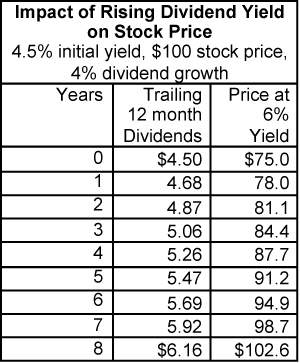

The accompanying table illustrates the impact of a substantial increase in dividend yield on the value of a hypothetical $100 stock. We assume the initial trailing 12 month yield is 4.5% for a dividend of $4.50. If the day after the stock is purchased the market values the stock at a 6% yield, then the price of the stock will suddenly fall to $75. But if the dividend grows just 4% annually, by year 8, the company will pay out not $4.50, but $6.16. A 6% yield on that $6.16 dividend equates to a $103 stock price ($6.16/6%). In other words, if we assume bond yields rose and our the yield on our dividend paying stock followed bond yields higher by jumping from 4.5% to 6%, the growing dividend has the effect of gradually moving the stock price higher, even with modest dividend growth.

In this instance the stock has performed like a bond – only better. The stock provided regular income payments, but unlike a bond, these payments rose each year rather than remaining flat. And, in this example anyway, the stock provided an opportunity for the investor to exit the investment without a loss.

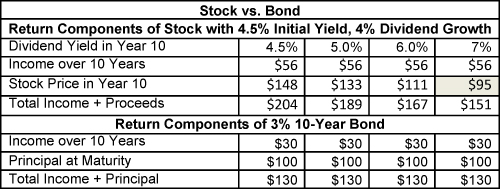

We can expand upon this comparison by comparing our 4.5% stock to a, say, 3% 10-Year bond under different scenarios.

Again, assume our stock with the 4.5% yield grows dividends 4% each year. Over the course of 10 years, the stock will generate total dividends of $54. We won’t assume any of the dividends were reinvested to earn additional income. (We assume the investor is in the distribution phase.)

Then let’s determine the stock price 10 years out given various dividend yields in that year. If we assume we have to sell our stock in Year 10, we can compare the income received over the period plus the proceeds from the stock sale against the income generated by a bond plus the principal returned at maturity.

Note, the 3% coupon is above the current yield to maturity on the 10-year Treasury. We assume coupons and dividends pay annually to keeps things simple. We assume both the stock and bond were purchased for $100.

While there is no guarantee that stock yields will rise in concert with bond yields, the stock investor in the above scenario would not incur a loss in Year 10 until the dividend yield hit 7%. Even so, the proceeds from the stock sale, plus the income received over the period, make the stock a better deal than the bond given the assumptions.

Equities in Retirement

Many advisors have long argued retirees should include some stocks in their asset mix given longer life expectancies and to help mitigate inflation risk. We would add that carefully selected high yielding equities can serve a dual role for investors headed for retirement and even those already there. Given today’s low yielding bond alternatives, higher yielding equities may generate more income than intermediate term Treasuries while providing the potential for capital gains as dividends grow.

Unfortunately no single market segment can provide investors with a portfolio of high quality equities with above market yields and prospects for solid dividend growth. However, the universe of higher yielding possibilities is large, and careful selection within this asset class can significantly boost income while delivering a lower risk profile than many investors may expect.

Jeff Middleswart is a Senior Analyst for Ranger International. The views set forth in this essay are solely those of Mr. Middleswart, and do not necessarily represent the views of Ranger International as a firm, nor any other member of the portfolio management team. As such, views set forth in this essay may be inconsistent with Ranger International’s portfolio positions or objectives.

Data from third party sources may have been used in the preparation of this commentary and neither Mr. Middleswart nor Ranger International has independently verified, validated or audited such data. As such, neither Mr. Middleswart nor Ranger International can guarantee its accuracy. In addition, neither Mr. Middleswart nor Ranger International accepts any liability whatsoever for any loss arising from use of this essay or any information, view, opinion or estimate herein.

The views expressed herein do not constitute research, investment advice or the recommendation for the purchase or sale of any security. Past performance of the asset classes discussed in this article do not guarantee future results.