Favorable monetary policy and improving economic growth have remained steady, but investors appeared to focus on some of the negatives last week. Sentiment seemed to sour due to the rising turmoil in Iraq (and subsequent rise in oil prices), as well as House Majority Leader Eric Cantor’s primary defeat, which served to highlight a more partisan environment before the November elections. For the week, the S&P 500 Index declined 0.6%. (1) Cyclical stocks are an area we tend to prefer, but performance there was mixed, with airlines and machinery companies losing ground while semiconductors and Internet stocks rose. (1)

“Stocks may be vulnerable to a pullback, but the long-term case for equities remains solid.”

The Economy is Looking a Bit Healthier Than the U.S. Stock Market

U.S. equities have come quite a long way in recent months. Prices are up 5 percent since the April low and 10 percent since the February low. (1) Last week’s decline may be a case of “buying on the rumor and selling on the news,” with investors moving out of positions following some solid economic data and easing by the European Central Bank. But to some extent, the market does seem to be tired. We do not believe we’re nearing the end of the bull market, but for the first time since the Great Recession, we feel better about the state of the economy than the state of equities.

Weekly Top Themes

- Rising oil prices may present a risk. As a point of comparison, when oil prices spiked during the 2011 Arab Spring (contributing to a sharp decline in consumer confidence, a slowdown in the economy and a difficult market environment) prices rose from $90 to $125. (2) With current prices around $113, oil certainly bears watching. (2)

- Retail sales for May were a bit disappointing, rising only 0.3 percent, compared to expectations of 0.5 percent. (3)

- The World Bank’s downgrade of U.S. and global economic growth appears mostly due to the weak first quarter. This doesn’t change the overall positive forward outlook from the World Bank, however. (4)

- Chinese growth is slowing, but we don’t anticipate a hard landing. While most Chinese economic data appear to be trending downward, we believe this is primarily a slowdown engineered by policymakers.

- We expect the U.S. dollar to strengthen in the coming months. A combination of improving U.S. growth, continued tapering by the Federal Reserve and easing by other global central banks should be a positive for the dollar.

The Big Picture: Risks Remain, But the Bull Market Is Still Intact

In our view, the U.S. economy should continue to accelerate after a rough first quarter. Employment growth has been uneven at best, and despite solid earnings, corporations have been reluctant to engage in widespread hiring plans. We do expect this phenomenon to slowly start changing, which should help the labor market and act as a tailwind for the broader economy.

Despite improving growth, however, many investors remain skeptical about the prospects for equities and doubt the sustainability of the current bull market. This skepticism has actually been in place since the bull market began over five years ago. We agree that valuations may be starting to look a bit stretched and stocks may be vulnerable to a setback. Nevertheless, we continue to believe the long-term case for equities remains intact. In fact, should a pullback occur, it could create more attractive market values.

Currently, the pro-cyclical industrial and technology sectors appear especially attractive to us. These sectors tend to outperform when businesses are ramping up capital spending plans. With strong corporate balance sheets and improving economic growth, we expect to see higher levels of capital expenditures, which should be a positive for industrials and technology companies.

1 Source: Morningstar Direct, as of 6/13/14. 2 Source: Bloomberg, as of 6/13/14. Represented by West Texas Intermediate (WTI). 3 Source: U.S. Census Bureau http://www.census.gov/retail/ 4 Source: World Bank http://www.worldbank.org/en/news/press-release/2014/06/10/wb-lowers-projections-global-economic-outlook-developing-countries-domestic-reforms

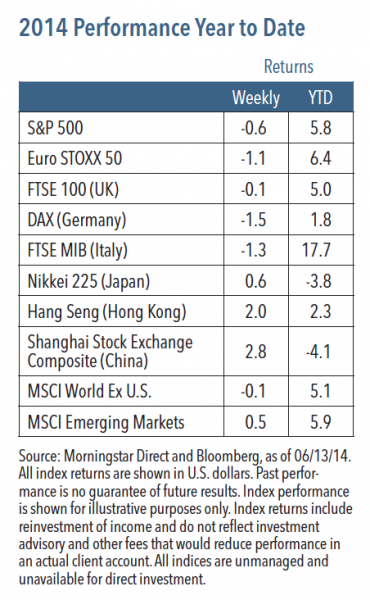

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy. Euro STOXX 50 Index is Europe’s leading Blue-chip index for the Eurozone and covers 50 stocks from 12 Eurozone countries. FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. Deutsche Borse AG German Stock Index (DAX Index) is a total return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. FTSE MIB Index is an index of the 40 most liquid and capitalized stocks listed on the Borsa Italiana. Nikkei 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. Hong Kong Hang Seng Index is a free-float capitalization-weighted index of selection of companies from the Stock Exchange of Hong Kong. Shanghai Stock Exchange Composite is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The MSCI World Index ex-U.S. is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets minus the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

RISKS AND OTHER IMPORTANT CONSIDERATIONS

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. Equity investments are subject to market risk or the risk that stocks will decline in response to such factors as adverse company news or industry developments or a general economic decline. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Non-investment-grade bonds involve heightened credit risk, liquidity risk, and potential for default. Foreign investing involves additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. Past performance is no guarantee of future results.

Nuveen Asset Management, LLC is a registered investment adviser and an affiliate of Nuveen Investments, Inc.

©2014 Nuveen Investments, Inc. All rights reserved.

Robert C. Doll, CFA is Chief Equity Strategist and Senior Portfolio Manager for Nuveen Asset Management. Follow @BobDollNuveen on Twitter.