Your LinkedIn brand is a precious commodity. Think about it. A good client recommends you to their colleague. The knee-jerk reaction of that colleague is to “Google” you. What do they see? Does your LinkedIn profile appear? Your website? What’s their first impression? These are all concrete questions that most advisors have wobbly answers to.

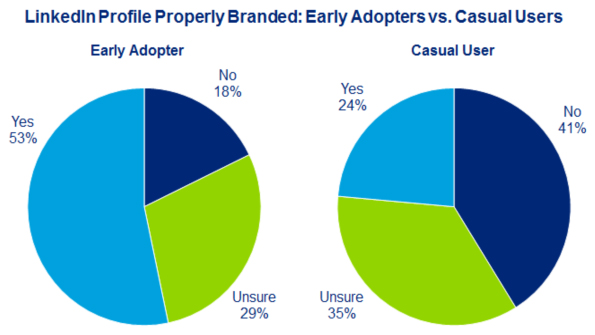

In our latest social media research project, we divided our participants into Early Adopters and Casual Users. Early Adopters are advisors who use social media daily to acquired new business, research clients and prospects, and integrate social media into their overall marketing strategy. Casual Users – are just what their name implies.

Our results indicate that Early Adopters have invested more time and energy into building out their profiles than Casual Users. Still, with only 53 percent of Early Adopters reporting that they are comfortable with their LinkedIn branding, there is professional branding work to be done. It seems as though all advisors could benefit from guidance on the do’s and don’ts of social media branding, as more investors conduct due diligence searches online.

We must also consider that these low confidence responses may be a result of advisors not feeling that their firm’s compliance guidelines allow them to properly brand themselves. Sometimes this is a fair critique, but usually not. Most online branding consists of having a polished profile and having the right connections.

Here are a few profile tips….

· Take two hours to further develop your LinkedIn profile. Update your career history, education, skills, and headline. These are all “keyword” areas. Select one keyword such as “investment manager” and scatter it throughout those areas to increase your visibility in search.

· Select a professional photo. Here are some suggestions on the wrong and right photo styles. (http://www.youtube.com/watch?v=TP8mfHM54Ts&feature=plcp)

· Don’t ask for LinkedIn recommendations pertaining to your position as a financial advisor as this can be a SEC, FINRA, or compliance violation.

· When building connections, think quality over quantity.

Kevin Nichols is a thought-leader with The Oechsli Institute, a firm that specializes in research and training for the financial services industry. Follow him on twitter @KevinANichols www.Oechsil.com