Between regulatory pressure and new competition from low-cost digital startups, advisors are increasingly turning to protect their profitability. The promise of wealth management technology is that it can automate labor-intensive workflows to help a firm increase scale while decreasing errors and cost.

One area where wealthtech has made significant strides is in performance reporting. Algorithms can automatically collect the necessary data and produce timely, easily digestible reports much more quickly than a human and with much less risk of error.

However, the technology hasn't necessarily brought cost savings to advisors. According to a white paper by Panoramix, a technology firm developed by Sapphire Software Services, some firms are paying hundreds of thousands of dollars annually on performance reporting technology.

Why is it still so expensive?

Panoramix says the transactional data in investors’ portfolios is at the heart of the issue. Advisors can’t just take the values of the portfolio at two points in time and make a linear calculation; they have to include the transactions and money flows, both in and out, that occurred during a report period. A performance report also has to account for rebalancing, fees, dividends, expenses and corporate actions in order to be accurate.

The computing methods needed to handle all of these variables are difficult, and expensive, to set up. Additionally, a performance reporting technology has to reconcile, another complex and time-consuming process.

The complexity and cost only increase for firms using multiple custodians because each one formats data and categorizes transactions differently.

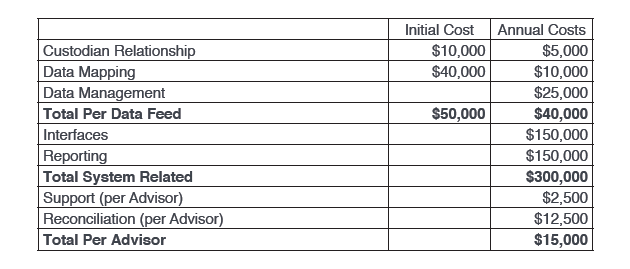

Each data feed costs an average $50,000 to set up, plus $40,000 per year to maintain. If that system supports 1,000 advisors, that’s an annual $2,500 cost to advisors. Add in support and reconciliation, and an advisory firm with 500 accounts and $100 million in AUM is looking at shelling out $17,500 annually for performance reporting, and that’s before even factoring in sales staff, operations, and additional product features like CRM integration and billing.

Performance reporting is so important to wealth management, and the process so labor intensive, that many firms are willing to pay for it. But Panoramix argues that it doesn’t have to be this way for small advisory firms looking to keep costs in line.

According to Panoramix CEO Chris Hastings, most smaller firms only draw from one or two data feeds. Instead of building a system for hundreds of data feeds, Panoramix presents a more “à la carte” solution by only charging for the data feeds that smaller firms need.

“By focusing on the largest custodians with clean feeds (Schwab, TD, Fidelity), and incorporating the aggregators like DST and DAZL, as well as Quovo and Aqumulate (and ByAllAccounts if someone were to request it), we can keep our costs down and pass that on to advisors,” Hastings told WealthManagement.com via email. The Panoramix system can also automatically reconcile.

Altogether, Hastings claims that this approach cut down initial setup costs by $10,000 per data feed, and cut annual costs for an advisory firm with 500 accounts and $100 million in AUM from $17,500 to $3,150.

“Thus, while billion-dollar firms may need additional data interfaces, the majority of the industry does not,” the white paper concludes. “Most advisors can solve for the 99 percent of their clients who work with the top custodians, and enjoy tremendous cost savings.”