Even the best advisors can trip up over Social Security. And with Baby Boomers charging into retirement, how to maximize the benefit is high on their lists of questions and concerns. Online sites and apps can help make the calculations a lot simpler. Some are calculators advisors embed on their sites. Others double as prospecting tools. They are all easy to use.

“Because Social Security is such a confusing and complicated topic, the easier and quicker it is to put in numbers to figure out the best solution for a client, the better,” says Martha Shedden, a certified retirement planning counselor with ClientFirst Financial, who trains advisors on how to wrap Social Security into a broader retirement plan. “It’s a great way to get new clients and work with prospects.”

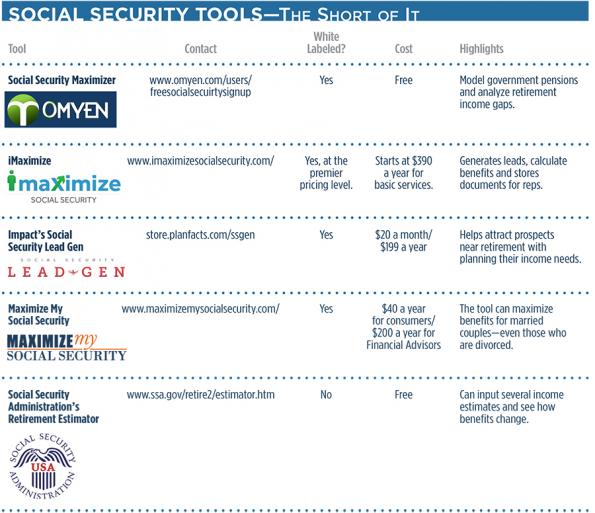

Consider Impact’s Social Security Lead Gen, a tool that can be white labeled for reps. It lets prospects build Social Security projections for free. An advisor can then offer to optimize the scenarios for the client—a far more nuanced service than applying for a standard benefit. The objective, Shedden says, should be to build the maximum benefit for a surviving spouse; the tool helps calculate the best outcome.

Maximization is also the goal of Omyen’s Social Security Maximizer. Dinesh Sharma, Omyen’s CEO, says that the app can be white labeled for a firm’s web site and mobile platforms, and includes educational slides to fold into presentations.

To Sharma the best tools here help advisors attract new clients nearing retirement.

“Social Security is extremely complex, and advisors were avoiding it because they had tools that were not easy to use,” says Sharma. “But there are a lot more tools, ours included, that help clients save money without having to do too much. Advisors who want to do a good job on the retirement income side will have to understand all kinds of income—portfolio and Social Security.”