CLS Investments and Riskalyze teamed up Thursday to launch an automated asset management platform to help financial advisors scale their services for lower-end clients.

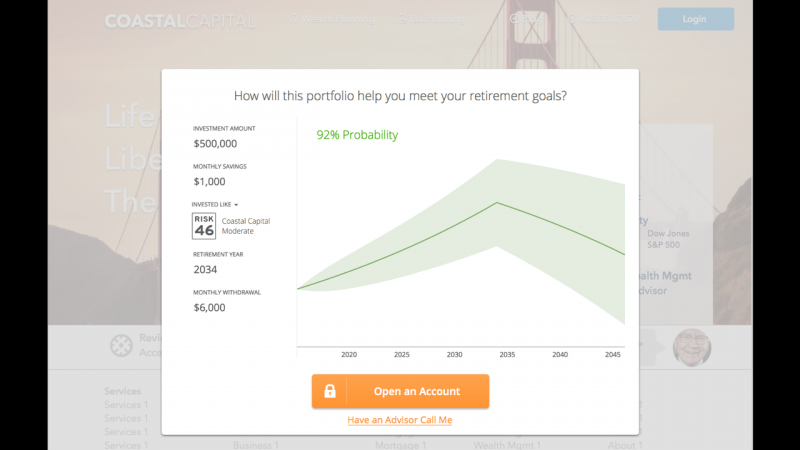

Advisors can plug the new platform, called AutoPilot, right into their websites. The tool will then allow online clients to access the Riskalyze software to determine risk tolerance, sync outside assets, open a new account, and e-sign all necessary documents.

Once a client account is opened, CLS is instantly added as the co-advisor and acts as the asset manager, trading the portfolio, handling all the account transfers, rebalancing the account and providing a service team to answer client phone calls.

“Advisors are spending way too much time trying to figure out how to out-robo the robo-advisors,” says Riskalyze CEO Aaron Klein. “Traditional advisors need to seize on their strengths, which is the ability to put a face with a name of the management of that client’s dream.”

AutoPilot aims to be a low-cost, low impact solution for advisors looking to foster relationships with smaller clients not yet ready for full-service pricing levels. The platform—which will be available exclusively to financial advisory firms and can be white-labeled to the firm’s branding—will roll out to advisors nationwide in early April.

“Advisors need to use technology to leverage that advantage that they have, even for clients with small account sizes. Because the problem is if you totally cede the marketplace for all the clients with small account sizes, guess what, you’re not going to have the relationships ready when those clients grow and they’re ready to become full-service clients,” Klein says.

Last Fall, Riskalyze and Orion Advisor partnered to create a precursor to AutoPilot, now called AutoPilot Select, where clients could plug into a self-service platform and integrate Orion’s account opening software, but the advisor was still in charge of selecting the investments, doing all of the trading and rebalancing, and all of the asset management. That option is still available for existing Riskalyze clients looking for greater investment management oversight for a "small software fee," Klein says. The new Autopilot has no upfront fee for any advisor, currently on Riskalyze or not, and plans start at 25 basis points.

"It's going to allow advisors to segment their businesses and grow their future generation of full-service clients," Klein says. "AutoPilot is going to handle all of those client service calls for the little operational details like withdrawing money and such—we're taking all that work off of them so now advisors can do a lower tier of service."

Thursday’s announcement from Riskalyze and CLS follows a similar path tread by advisory firm Ritholtz Wealth Management last October. The firm—run by Josh Brown and Barry Ritholtz—announced they were working with Upside, a year-old tech company which developed an automated, online financial planning and investment platform to be white-labeled by financial planners who want to compete with the likes of Wealthfront, Betterment or Futureadvisor.

Called Liftoff, the RWM platform takes investors through a handful of risk-tolerance questions, then asks if clients are looking to create a retirement plan, a financial goal plan or are looking just to invest. The securities underlying the plans are a combination of ETFs, with, according to the site, a “regimented rebalancing strategy” built in.

But Klein says that while RIAs may have a number of similar options available, registered reps at broker/dealers haven't had this kind of technology solution avialable before. Riskalyze already has solicitor agreements in place with 250 broker/dealers like Securities America, LPL Financial and AIG Advisor Group, which could allow their advisors to leverage the platform starting on day one.