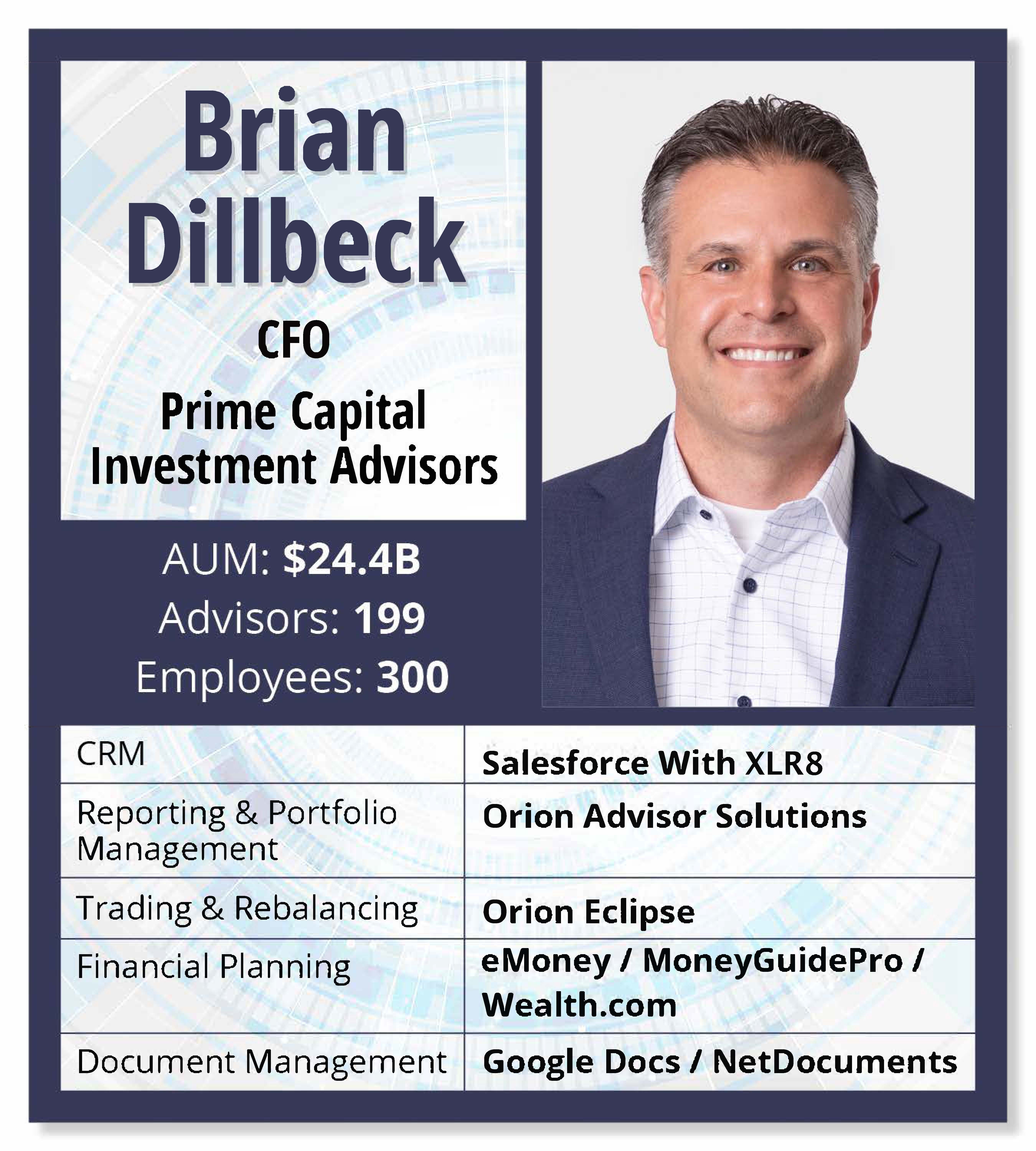

I’ve been a financial executive for about 25 years now. I started at American Century’s retirement planning services. Soon after I started, JPMorgan Chase purchased it, and I created the divisional accounting department there. I’ve had other roles in different companies in retail, manufacturing and consumer package goods. I came to Prime Capital Investment Advisors in January 2020, shortly after they had taken some private equity money and needed a CFO. So, I came back to financial services after all these years.

CRM: XLR8 Overlay for Salesforce

We use the XLR8 overlay for Salesforce (from Concenter Services). That’s cheaper for us, but we can still accomplish everything we need to through our CRM. Before I came here, they had used different overlays, including Sycamore, but they had just moved back to XLR8 when I started. We’ve been building off that over the last four years.

That’s been our mantra the whole time we were building this: We want to use systems that can share data back and forth, whether they have an API or our business intelligence team can create one. For example, we’ve had to do that with our Salesforce to push the data we want. Whether we must build it ourselves or use theirs, we want to be able to share that between the systems. We have everything completely integrated. Salesforce is the hub. We want to say that if it’s not in Salesforce, it didn’t happen. We try to tag everything in Salesforce. All the data converges there.

That’s been our mantra the whole time we were building this: We want to use systems that can share data back and forth, whether they have an API or our business intelligence team can create one. For example, we’ve had to do that with our Salesforce to push the data we want. Whether we must build it ourselves or use theirs, we want to be able to share that between the systems. We have everything completely integrated. Salesforce is the hub. We want to say that if it’s not in Salesforce, it didn’t happen. We try to tag everything in Salesforce. All the data converges there.

Reporting, Portfolio Management, Trading & Rebalancing: Orion Advisor Solutions with Amazon Redshift / Orion Eclipse

We use Orion. When I arrived, they were using the SS&C Black Diamond Wealth Platform. There were some issues with how the firm implemented the SS&C Black Diamond Wealth Platform. It was not a tool that would have taken us into the future. It doesn’t share data as easily as Orion does.

We’re also using Amazon Redshift with Orion. That gives us our own Amazon database directly to the data. Amazon Redshift allows our business intelligence team to run queries and pull that data into our data lake more easily.

Financial Planning: eMoney / MoneyGuidePro / Wealth.com

We’re open. We use eMoney and MoneyGuidePro mostly. We leave what they’re comfortable using up to the advisor. We also use Wealth.com for estate planning and trusts.

Before that, they didn’t have anything. Around two and a half years ago, we created a central financial planning department to help our advisors create financial plans for their clients. They now submit requests to our financial planning department, which allows them to build financial plans in eMoney or MoneyGuidePro.

Document Management: Google Docs / NetDocuments

For internal document management, we will use Google Docs for the most part. However, for the repository of custodial forms, client agreements and other types of documents, we use a product called NetDocuments.

Marketing: HubSpot / SmartAsset / WiserAdvisor

We use HubSpot, which is integrated with Salesforce for marketing outreach, campaigns, and the like. Certain advisors have subscriptions to SmartAsset and WiserAdvisor. We also have our internal department and marketing department that does a lot of Google ads.

AI Data Extraction: Amazon Textract

We’ve dabbled with AI, mainly on the advisor level. If they’re trying to create communications with clients or emails, that’s where that’s been helpful. Internally, we haven’t relied on that in terms of marketing campaigns or disseminating workflows within Salesforce.

We do use Amazon Textract to read the paperwork. It’s an optical character reader that pushes information into our databases.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].